In the market Friday, there was a monster short squeeze as Japan's central bank took a big step in the easing direction to the surprise of the entire planet. While it smacks of desperation, it was absolutely necessary that it be done as the world's alliance of central banks continue to take turns in the joint effort to keep the global stock markets propped up, especially the US stock market.

Many investors wonder just when the central banks know unequivocally that they must execute an intervention. If you follow all the key moving averages on the SPDR S&P 500 (N:SPY) and NASDAQ Composite you can see that some moving averages have down crossed and some have bounced without a consistent pattern lending to the argument that you cannot predict when a central bank market intervention is imminent. This belief is simply not true. Market interventions are actually timed off a key pair of moving averages on the NASDAQ 100 ETF, the PowerShares QQQ Trust Series 1 (O:QQQ). The QQQ is the designated market manipulation workhorse. These two QQQ moving averages are shown in the charts below.

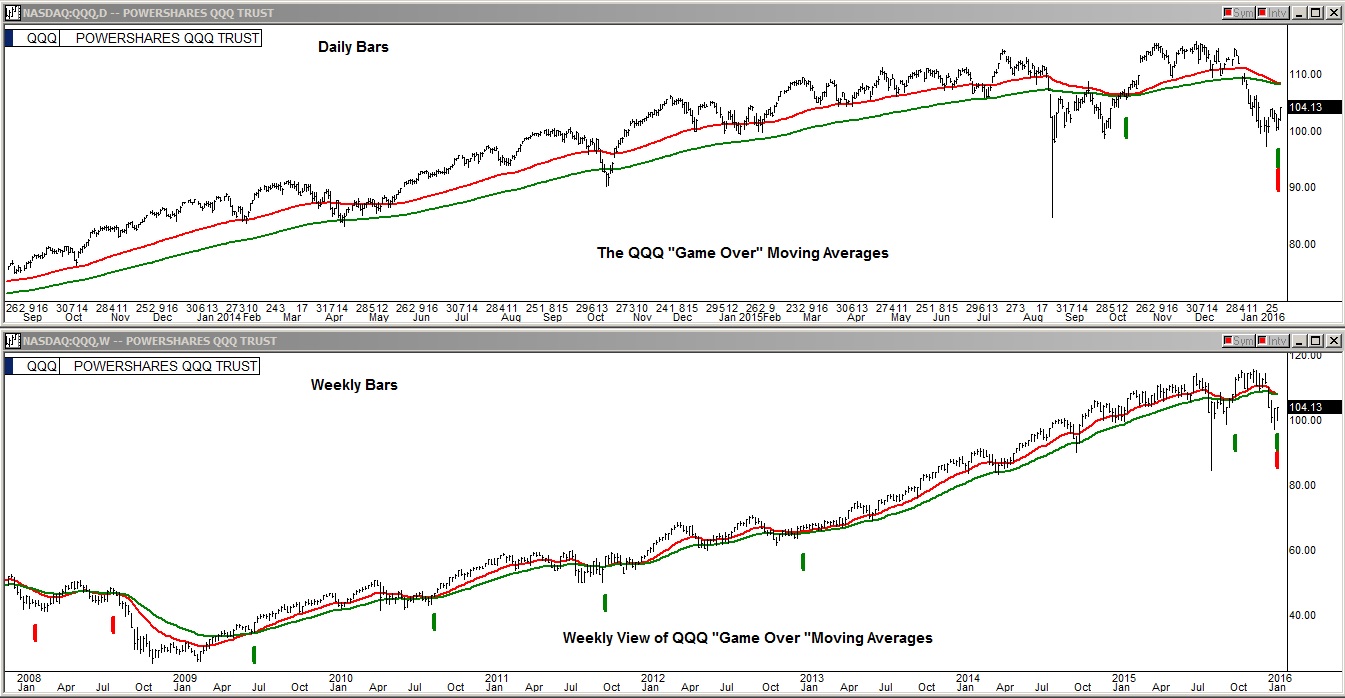

The top is a two year chart showing the key moving averages in daily bars and the bottom shows the equivalent of these two moving averages in weekly bars so a long term view can be seen. Notice that in 2008 the smaller red moving average down crossed through the larger green moving average and the stock market collapsed. In mid 2009 the red line up crossed through the green and the game was on once again. Looking at the lower weekly chart, you see that every time the market was in trouble bringing the red line to the green for a possible down cross and sudden game over there was a central bank intervention either directly or verbally to stop the down cross.

Looking at the top chart where we can focus in on the last time the two moving averages merged in October, we once again had a central bank intervention to prevent the down cross. Two days ago, the two lines merged once again on Fed speak day putting the world's central banks on high alert that an immediate intervention was necessary. First Yellen retreated on her hawkish rhetoric, then Japan's central bank did a shock and awe easing early Friday and then the mighty short squeeze engine was turned on and was very effective as Fridays are always thinly traded and easily manipulated. The result was a monstrous short squeeze.

If you look at the top chart closely it is easy to see that if we had not had an intervention Friday that the QQQ would likely have had its first down cross in the entire seven and a half year bull market, the game over down cross. I must say they do like to wait until they can see the whites of the bear's eyes.

This is a big gift for the bulls but they must step up and buy big on Monday and Tuesday to produce follow through. If they don't and we have a big down day Monday, the tip of the red line could still turn and begin a down cross. The odds are in the bulls favor as historically when the first trading day of a new month falls on a Monday there is virtually always a rally.