The escalating Greek crisis has raised new questions about the timing of the Federal Reserve’s plans for the first US rate hike since 2006. But by some accounts, it’s still mostly noise on this side the Atlantic. “This isn’t a ‘watch Greece’ situation,” says Roberto Perli, a former Fed staffer who’s now at Cornerstone Macro. “While we have chaos in Greece, there are no signs of dramatic contagion yet, and that’s why it doesn’t change the Fed’s tone.”

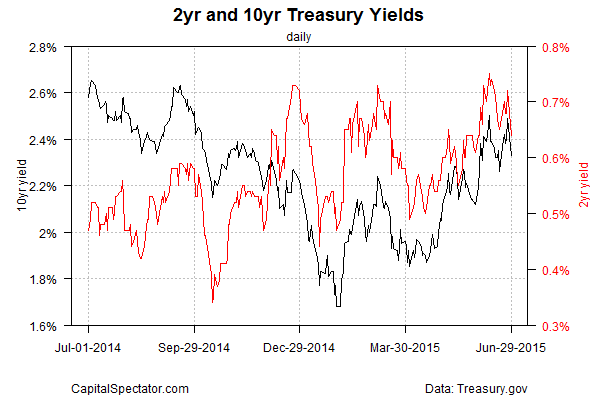

Maybe so, but investors rushed into Treasuries yesterday as a precautionary move, sending the benchmark 10-year yield down a hefty 16 basis points to 2.33% – the lowest since June 19. The 2-year yield — considered the most sensitive spot on the yield curve for rate expectations – also retreated substantially, dipping to 0.64%, which marks the return to the lowest level of the month, based on Treasury.gov data.

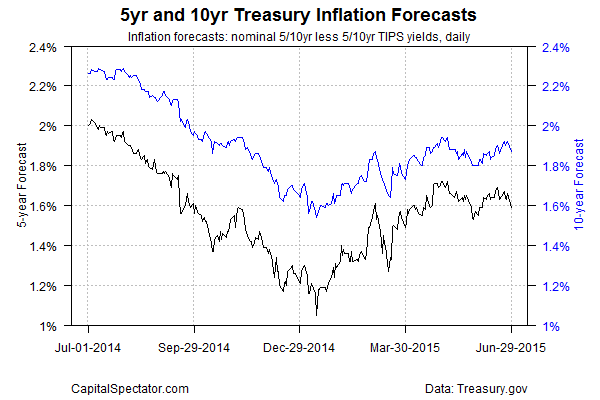

The market’s implied inflation forecast eased as well, based on the yield spread on the nominal 10-year Note less its inflation-indexed counterpart. The crowd’s prediction by this yardstick ticked down to 1.87%, the lowest since June 15.

But this is all about the Greek drama rather than any reversal of macro fortunes in the US. Indeed, yesterday’s numbers on pending home sales — seen as a leading indicator of housing activity — rose to a nine-year high in May. “The steady pace of solid job creation seen now for over a year has given the housing market a boost this spring,” said Lawrence Yun, chief economist at the National Association of Realtors. The upbeat figures follow last week’s buoyant reports on sales of existing and newly built houses and a revival in consumer spending in May.

Nonetheless, optimism remains subject to stress testing with each new data point in the current climate, and this week’s hurdle is the Labor Department’s employment report that’s due for release on Thursday (July 2). For the moment, the outlook remains encouraging, with private payrolls on track to rise by a solid 225,000 in June, based on Econoday.com’s consensus forecast. In that case, we’ll have another data point to support the view that moderate growth for the US will prevail.

The big-picture outlook is hardly stellar in terms of the expected pace overall, but the trend is moving in the right direction. The Atlanta Fed’s GDPNow estimate for GDP growth in the second quarter has recently ticked up to 2.1% (as of June 25). That’s a modest rise, but it’s the highest reading for Q2 to date for this widely followed model and additional gains can’t be ruled out before the official estimate is published on July 30.

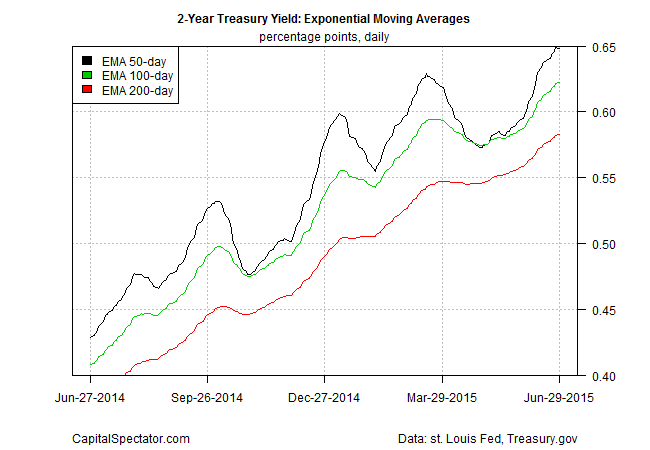

Perhaps, then, it’s no surprise that the upside momentum in Treasury yields remains intact. Although yesterday’s yields fell, the dip looks like noise when measured with exponential moving averages for recent history. The 2-year yield is still trending higher by that standard, although it’s wobbled slightly in recent days.

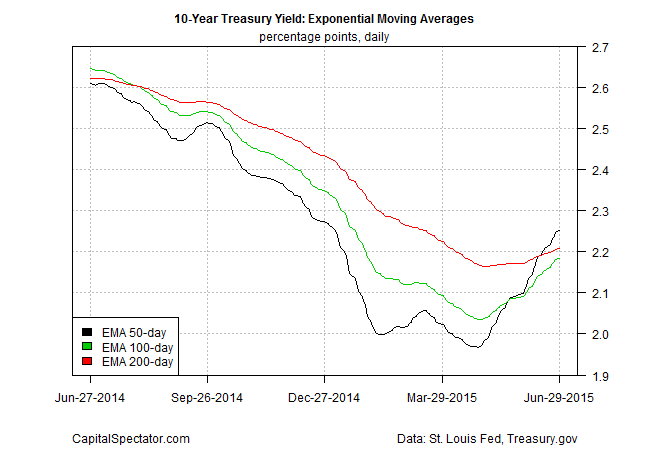

Meanwhile, the 10-year yield’s trend signals continue to reflect an upside breakout of late.

A series of setbacks for US economic numbers in the weeks ahead would likely raise the worry that the economy is taking flak from the fallout linked to Greece. But for the moment, it’s not obvious that the Eurozone’s problems pose a serious threat to the positive macro momentum that’s been building in the US lately. But with the prospect of a Greek euro exit lurking, the days ahead may continue to shake confidence in markets around the world. Even so, the odds are low that a Grexit will derail the US economy.

But low odds aren’t the same as zero. As Fed governor Jerome Powell told The Wall Street Journal last week, “if global growth weakens, or remains weak, and we get into a trend of that, then yes, that will be a big headwind for the United States economy.”

Once we have more clarity on how Europe will deal with Greece, one way or the other, I’m expecting that US yields will resume their upward trend. In the interim, however, getting from here to there could be a rough ride. As a result, the Fed may be inclined to delay the start of rate hikes. But the current macro profile for the US still suggests that we’re a long way from high odds of a derailment.