The blogosphere is full of comments about the Cypriot bailout on the weekend (for examples, see How to start a banking crisis, Cyprus edition and The Cyprus conspiracy II). Instead of writing about Cyprus, a topic that I have no special expertise in, I thought that it would be timely to write an update to my post of February 19 about the resource-based sectors (see Time to buy gold and commodity stocks?).

Since I wrote that post, the metals and mining stocks have begun to stage a turnaround. To recap, the mining group is showing signs of being overly beaten up and washed out. This chart of the SPDR mining ETF (XME), against the market shows that it is trading at or near investor capitulation levels relative to its long-term history.

Take a look at the shorter term one-year relative chart of XME vs. SPY. The miners are starting to show some positive relative strength against the S&P 500 SPDR (SPY). Is that the sign of a nascent recovery?

Similarly, gold stocks are highly unloved against bullion. I have not been a big fan of buying gold stocks for gold bulls (see Where is the leverage to gold?), but in this case a long gold stock/short bullion position is likely to have much better risk/return profile than any time in the recent past.

Shorter term, however, my inner trader is still watching this pair of a relative turnaround as the HUI/Gold pair remains in a relative downtrend.

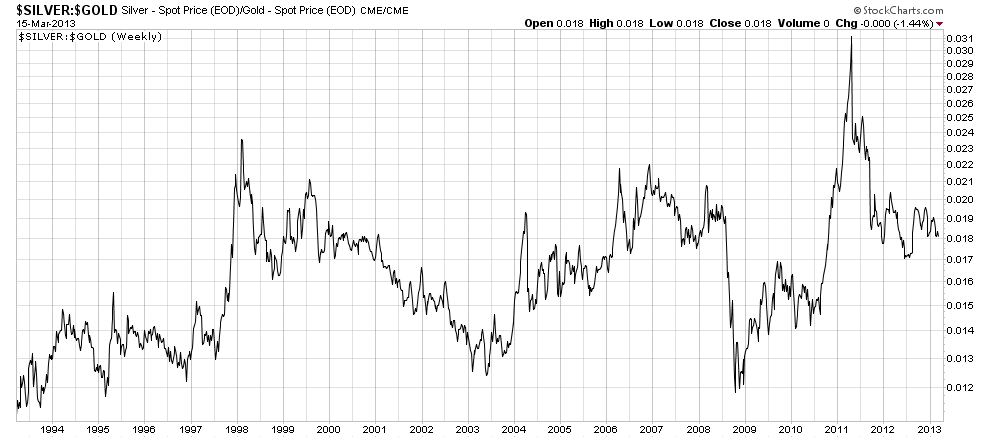

On the other hand, I can't say I am overly bullish on gold itself. The silver/gold ratio, which is a measure of the speculative interest in precious metals, is stuck in the middle of its historical band, indicating neither excessive bullishness nor excessive bearishness on the PM complex.

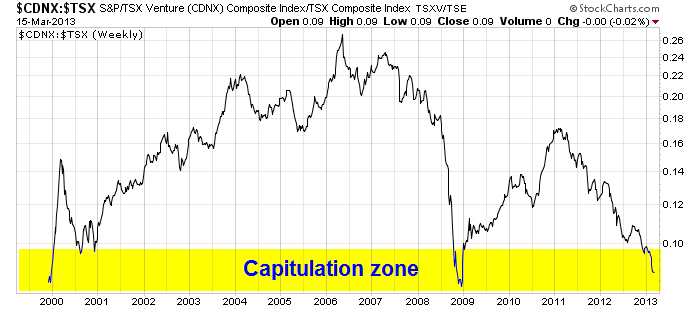

Nevertheless, I am seeing signs of a capitulation, or washout, in investor sentiment. Here in Canada, the chart of the junior Venture Exchange Index against the more senior TSX Index shows that the ratio is at or near levels indicating investor capitulation in the juniors, which are mostly junior resource companies.

Not enough energy in Energy?

In my last post on this topic, I was more constructive on the energy sector as the sector was showing signs of a relative strength turnaround. Since then, the sector remains range-bound against the market and appears to be consolidating sideways on a relative basis.

The price of Brent crude confirms my observation about the range bound, or sideways consolidation pattern shown by energy stocks.

At this point in time, the energy sector may not have enough energy, or momentum, to present itself as the new emerging leadership sector.

As I write these words, the markets have a risk-off reaction over the Cyprus news. The EUR is plummeting against all currencies and against JPY in particular; USD is up: ES is falling and gold is up marginally but a base metal like copper is down. While the initial market reaction isn't necessary the sustainable reaction, the Cypriot event may serve as a catalyst for the resource sectors (and the metals in particular) to stage a turnaround and present themselves as the new market leadership.

It will also prove to be an important market test for the price of gold (and the gold bugs), to see whether investors flock to USD assets or to gold in this instance of an unexpected eurozone confiscation tax of banking depositor assets.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Will Cyprus Spark A Turnaround In Metals And Mining?

Published 03/18/2013, 06:09 AM

Updated 07/09/2023, 06:31 AM

Will Cyprus Spark A Turnaround In Metals And Mining?

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.