Mark Twain once said, “Whenever you find yourself on the side of the majority, it’s time to pause and reflect.” For stock market investors, the time to pause and reflect is now.

Everywhere you look (except in these pages), you’ll find individual investors and institutions bullish on key stock indices. It’s like they believe they can only continue going in one direction—up. Not much attention is being paid to the fundamentals that suggest a market sell-off is nearing.

In January and February, investors bought $43.29 billion worth of long-term stock mutual funds. While March’s money flows into mutual funds are not available, looking at the weekly data, it suggests investors continued to buy the key stock indices. (Source: Investment Company Institute, last accessed April 2014.)

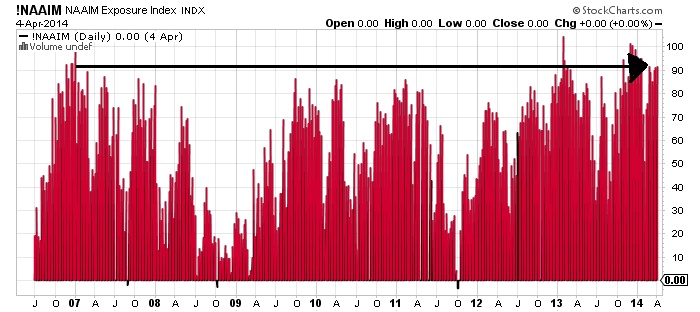

Please look at the chart below of the National Association of Active Investment Managers (NAAIM) Exposure Index. This index looks at how exposed managers are to the key stock indices.

Chart courtesy of www.StockCharts.com

This chart says fund managers are heavily exposed to key stock indices, with 90% of their portfolios invested in stocks. The exposure to the key stock indices has been high since the beginning of 2014, but at the same time, stock prices have been coming down.

Sadly, this isn’t all. Pension funds, the so-called conservative investors, have increased their exposure to key stock indices as well. Take the New York State Teachers’ Retirement System, for example. It is one of the biggest in the U.S. In 2013, the net assets of the fund increased to $95.4 billion. Its exposure to the equity market was $39.87 billion—roughly 41% of all assets were in U.S. stocks. (Source: New York State Teachers’ Retirement System web site, last accessed April 7, 2014.) This fund is taking the retirement money of school teachers and investing almost half of it in the stock market. Isn’t that risky?

When I see all this, I can’t help but think back to 2007. Back then, the underlying fundamentals of the economy were also ignored, but we heard a significant amount of “noise” that stated key stock indices would go higher. Instead, we witnessed one of the worst stock market sell-offs in history.

Over the past few weeks there has been a broad sell-off in high-tech stocks. With that said, I suggest you look at the charts of Amazon.com, Inc. (NASDAQ:AMZN), Facebook, Inc (NASDAQ:FB), and Netflix, Inc. (NASDAQ:NFLX); they all have seen massive sell-offs and are down 20% or more from their peaks in mid-March. The biotechnology sector is also plunging lower. This is an ominous sign.

Dear reader, each passing day, the stock market is getting riskier…the chances of a total collapse in stock prices are increasing. Now is a good time to preserve capital, rather than expose your portfolio to key stock indices just like pension funds, active fund managers, and other individuals are doing. Many indicators we follow suggest a market sell-off is closer than many anticipate.

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and analysis. The opinions in this e-newsletter are just that, opinions of the authors. Information contained herein, while believed to be correct, is not guaranteed as accurate. Warning: Investing often involves high risks and you can lose a lot of money. Please do not invest with money you cannot afford to lose.