It has been almost three weeks since CyberArk Software, Ltd. (NASDAQ:CYBR) reported third-quarter 2016 results. Following the release, the stock has been on the rise. To some investors, choosing the stock may appear to be a no-brainer because right after an earnings release, a company is almost always on investors’ radar. While better-than-expected results make the stock a good pick, lower-than-expected results dampen investors’ spirit. So, the period following earnings releases is often marked by high market activity.

Shares Marching Higher

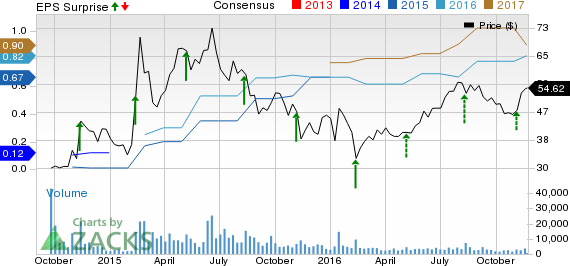

CyberArk reported its quarterly numbers on Nov 3 before the market opened, following which its shares have gained approximately 22% so far. For the third quarter, the company reported adjusted earnings per share (excluding amortization of intangible assets and other one-time items buts including stock-based compensation) on a proportionate tax basis of 22 cents per share, which came ahead of the Zacks Consensus Estimate of 18 cents per share. Adjusted earnings however were flat year over year.

CyberArk’s revenues grew 37.2% year over year to $54.9 million and surpassed the Zacks Consensus Estimate of $52 million. The year over year increase was mainly driven by better-than-expected demand for its privileged account security platform.

Notably, during the third quarter, CyberArk signed a large deal with a major European manufacturing company. The company also inked deals with a stock exchange, manufacturing companies, banks, a born-in-the-cloud e-tailer, two airlines, security software companies, universities, hospitals, law firms and a casino among others.

The growing percentage of large deals in the mix is a positive as it increases deferred revenues and visibility. CyberArk ended the September quarter with a huge customer base of over 2,800 (which includes 45% of the Fortune 100 companies and 25% of the global 2000 companies).

An upbeat guidance for revenues and non-GAAP operating income and earnings per share for 2016 also helped in boosting investors’ confidence about the company’s future prospects.

Upward Estimate Revisions

In the last 30 days, the Zacks Consensus Estimate for the fourth quarter and full-year 2016 witnessed upward revisions. The two analysts covering the stock revised their estimates upward for both the aforementioned periods.

For the fourth quarter, the Zacks Consensus Estimate is currently pegged at 25 cents per share, which is higher than earnings of 23 cents projected 30 days ago. Similarly, the Zacks Consensus Estimate for 2016 is currently pegged at 82 cents per share compared with 78 cents projected 30 days ago.

Growth Initiatives

We are optimistic about CyberArk given a healthy security market, strong product lineup, deal wins and investment plans, which should boost results in the long run. Furthermore, CyberArk’s strategy of growing through acquisitions is encouraging. Last year, the company made two important acquisitions of Cybertinel and Viewfinity. Apart from this, it also acquired certain assets from Agata Ltd.

We expect its sustained focus on new product launches and acquisitions to contribute significantly to this Zacks Rank #3 (Hold) stock’s overall growth.

Stocks to Consider

Some better-ranked stocks in the broader technology sector worth considering are FireEye Inc. (NASDAQ:FEYE) , Amber Road Inc. (NYSE:AMBR) and Juniper Networks Inc. (NYSE:JNPR) , all of which carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

FireEye has witnessed upward estimate revisions in the last 30 days and has surpassed the Zacks Consensus Estimate in the trailing four quarters with an average positive surprise of 14.51%.

Amber has witnessed upward estimate revisions in the last 30 days and has surpassed the Zacks Consensus Estimate in the trailing four quarters with an average positive surprise of 29.95%.

Juniper has witnessed upward estimate revisions in the last 30 days and has surpassed the Zacks Consensus Estimate thrice in the trailing four quarters with an average positive surprise of 3.09%.

The Best Place to Start Your Stock Search

Today, you are invited to download the full list of 220 Zacks Rank #1 ""Strong Buy"" stocks – absolutely free of charge. Since 1988, Zacks Rank #1 stocks have nearly tripled the market, with average gains of +26% per year. Plus, you can access the list of portfolio-killing Zacks Rank #5 ""Strong Sells"" and other private research. See these stocks free >>

CYBER-ARK SFTWR (CYBR): Free Stock Analysis Report

JUNIPER NETWRKS (JNPR): Free Stock Analysis Report

FIREEYE INC (FEYE): Free Stock Analysis Report

AMBER ROAD INC (AMBR): Free Stock Analysis Report

Original post

Zacks Investment Research