Everyone knows that Iraq is an important oil producing country. But Iraq is more than just important, it is critical.

Iraq is so important that in October of 2012 the International Energy Agency (IEA) released a report called “World Energy Special Outlook On Iraq”.

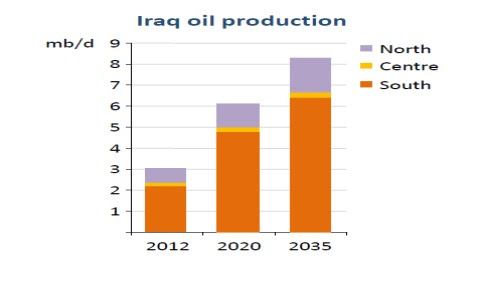

In that report the IEA concluded that in 2035, oil prices would be $215 if Iraq could increase its oil production by 266% from 3 million barrels per day to 8 million barrels per day. (Could–not couldn’t)

Source of image: IEA – World Energy Special Outlook On Iraq

Drink that in for a moment.

$215 per barrel is the IEA’s scenario if everything goes swimmingly well in Iraq over the next 20 years. Given the long history of instability here, the IEA’s vision seems like a very optimistic one.

Last week’s violence in Iraq, the IEA scenario seems almost absurd. If oil is expected to be $215 per barrel in 2035 if Iraq thrives, what will the oil price be if Iraq falls apart or just keeps production steady?

It won’t be pretty, especially for poorer countries.

Now, I’m the first to say any prognostication that goes 20 years into the future is as useful as screen doors on a submarine. But let’s look at the two main reasons why the IEA says the world needs a lot more oil production by 2035.The first great call on new oil production comes from the relentless thirst for oil that belongs to the emerging middle class of the billions of people in emerging countries. China and India lead this group that also includes all of Africa, Southeast Asia and Latin/South America. The people in this part of the world use, on a per capita basis, a tiny fraction of the oil that Westerners do, and every day they are fighting to live a more Western lifestyle.

The second great call on new oil production is that currently producing oil fields across the globe produce less and less oil every month. All in, these fields decline in production at 6% per year, which means that the world will require an additional 40 million barrels of new production to just replace those declines by 2035. To put that in context, it means the world needs to bring on new oil production equal to that of four Saudi Arabias.

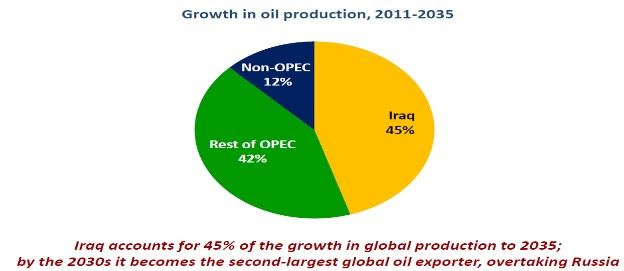

How important the IEA believes Iraq’s contribution towards meeting global oil demand needs to be is shocking. The Agency has earmarked Iraq to provide 45% of the global growth in oil production by 2035.

Source of image: IEA – World Energy Special Outlook On Iraq

Yes, Iraq, a country that has been in a state of chaos for virtually its entire existence, is the key piece in the energy supply puzzle for the future of the entire globe. Alice, pass me the gravol.

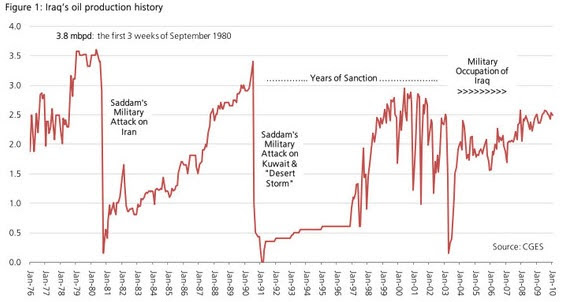

Historical Iraqi oil production won’t calm your stomach either. Recent Iraq oil production has been bouncing back and forth between 3.3 million and 3.5 million barrels per day. That level is the highest production has been in 30 years dating back to 1976.

As you can see in the graph above, that 3.5 million barrel per day figure has been approached a couple of times in the past 30 years—but never stays there for long. The world needs a lot more than for Iraq to just deliver 3.5 million barrels per day consistently. The world needs Iraq to more than double that all time high level of production and then grow some more from there.

There is nothing in the history of this country to lead us to believe that a long sustained run of big—unprecedented even—production growth is possible. And the news coming out of the country certainly provides no reason to believe the future would be any different.

The Good News – Most Of Iraq’s Oil Production is Not Currently In Harm’s Way

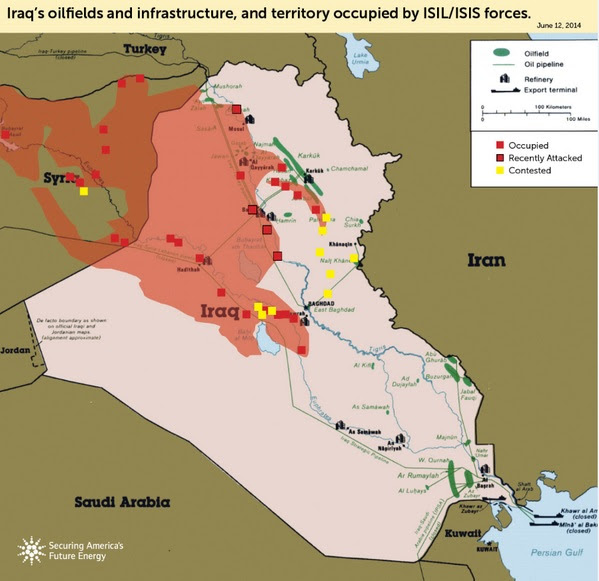

The IEA’s vision for Iraq production growth is certainly questionable. The good news is that the group calling themselves the Iraq/Syria Islamic State (ISIS) is actually not likely to materially disrupt Iraq oil production in the near term.

ISIS is an extreme Sunni group that is small in number (Iraqi officials estimate the group has 6,000 soldiers) and that doesn’t have much popular support. The headlines the group has been making by gaining control of cities have been in regions divided by religion like Mosul and Tikrit that were extremely unstable to begin with.

These are not regions with significant oil production.

The great majority of Iraq’s production is found away from current hostilities either in the south of the country within the borders of the Shiite majority or in the Kurdish region in the north.

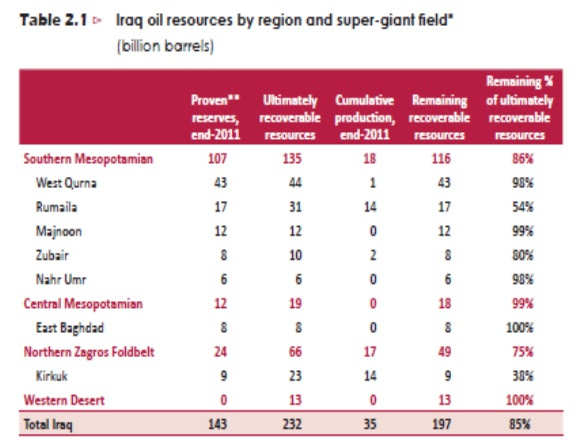

Source: Source of image: Securing America’s Energy Future

Iraq’s historical production has been dominated by just two super giant oil fields. There is the Rumaila field that has produced over 14 billion barrels since the 1950s in the Shiite south and the Kirkuk field which has produced a similar amount since the 1920s in the northern Kurdish region.

A third super-giant field called The West Qurna is also located in the Shiite south and with 44 billion barrels of recoverable oil is the second largest oil field in the world. West Qurna is targeted to be the primary driver of Iraq production growth.

Iraqi oil production is now split roughly 75/25 between the Shiite south and the Kurdish north.

The fighting has however already impacted some of Iraq’s key oil infrastructure, most notably a pipeline that can deliver 600,000 barrels of oil per day from Kirkuk to the city of Ceyhan in Turkey which is damaged and offline.

What the fighting also does is make Western oil companies hesitant to invest capital in Iraq. The IEA estimates that more than $15 billion needs to be invested every year in Iraq in order to generate the anticipated level of production growth. Without at least the appearance of the country moving closer to stability, it seems hard to believe companies will be willing to risk that kind of money.

Reality May Be Setting In

The actual near term threat to oil production from ISIS is likely not as significant as the frightening headlines make it seem. What the headlines may be doing however is waking the world up to the fact that Iraq’s success as a growing oil producer is critical to the entire world and also to the fact that the country is in no better shape than it has been over the last 30 years when production has sputtered.

The Sad Truth is that one has to wonder if Iraq isn’t in worse shape than it has ever been. And that isn’t good considering what the IEA says regarding its importance to global energy security.

BY Keith Schaefer