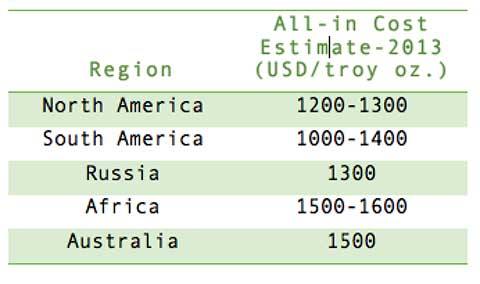

As producers endeavor to cut costs, they are likely to halt, downscale or offload operations in South Africa, Australia and Papua New Guinea.

This means it could be a long time before projects like the Golpu mine in Papua New Guinea and the Pebble gold mine in Alaska, among many others, could see commencement of production operations.

Although South America is currently the lowest-cost region for gold mining, the Pascua Lama project belonging to Barrick Gold Corp. may not see the start of mining operations before 2016 unless environmental safeguards are met by the company.

Which Gold Miners Will Remain Profitable?

With gold price trapped in the region of US $1,200-1,400 per troy ounce, not one of the top 15 gold producers earned positive cash flows during the second quarter of 2013.

Gold mining stocks have lost nearly 50% of their value this year as industry-wide non-profitability became evident among investors. Only Gold Fields Ltd., among the global top five gold miners, reported a positive net margin for the first half of 2013, despite having major operations in high-cost regions like South Africa, Ghana and Australia.

Among top gold producers, Canada-based Yamana Gold Inc. and Agnico Eagles Mines Ltd., China-based Zijin Mining Group, and South America-based Cia de Minas Buenaventura are expected to be better placed than their peers at the current gold price environment, thanks to the concentration of their operations in low-cost regions like China and South America.

by Moonmoon Basu

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Which Gold Miners Will Remain Profitable?

Published 12/24/2013, 04:21 AM

Updated 07/09/2023, 06:31 AM

Which Gold Miners Will Remain Profitable?

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.