As most FX traders know by now, the negotiations over Greece’s debt took a sharp turn for the worse over the weekend, culminating in the Greek government’s decision to call a public referendum on its creditors’ proposal on this coming Sunday. Early opinion polls suggest that the Greek populace is leaning toward voting “yes” (i.e. accepting the proposals in order to secure more bailout funds), but emerging market FX traders are likely to remain on edge throughout this entire week regardless.

Of course, most EM currencies do not have direct financial links to Greece’s relatively small economy, but traders are worried about the potential for contagion to the Eurozone economy as a whole. In other words, a Grexit-induced European financial calamity could spook traders across the world, leading to an outflow from EM currencies on the whole. If the Greece debt drama metastasizes, the most vulnerable EM currencies could be the usual suspects with large current deficits and external debts, including the South African rand, Turkish lira, and Hungarian forint.

As of writing, the market’s reaction to the so-called “Greferendum” has been relatively limited. Most major EM currencies are trading down by just 1.0% against the US dollar , with EM equities down similarly and EM government bond yields ticking up slightly.

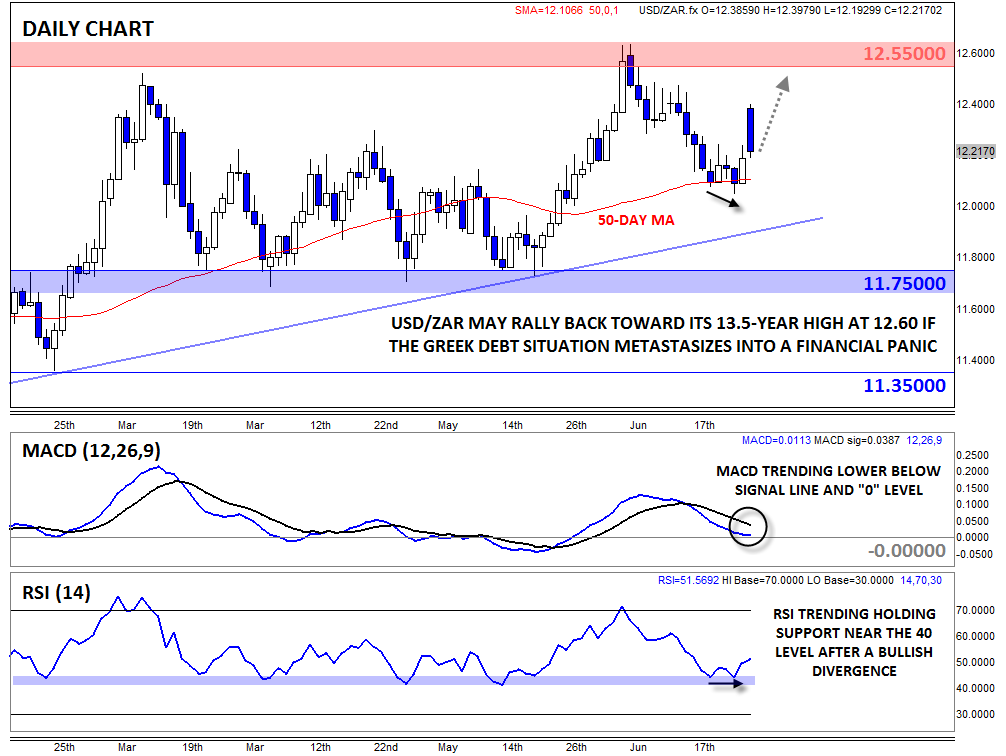

Technical View: USDZAR

Of the most vulnerable currencies mentioned above, yesterday’s price action in the South African rand is perhaps the most interesting. USDZAR predictably gapped sharply higher before falling nearly 2,000 pips back down to fill the gap near 12.20 as of writing. With the gap now filled, bulls are hoping that the medium-term uptrend will resume.

So far, the pair has managed to hold its 50-day MA at 12.10, and the secondary indicators are also still constructive, with the MACD holding above the “0” level and the RSI bottoming near previous support near 40. Astute traders will even note the small bullish divergence in the 14-day RSI, suggesting that the selling pressure dissipated throughout last week.

Therefore, a bounce is favored as long as USDZAR holds above support in the 12.00 area, with a move back toward last month’s 13.5-year high still in play. On the other hand, a break below 12.00 could open up previous support levels at 11.75 and 11.35 next.