Shorting gold when it rose to a record $1,895 per ounce on September 6, 2011 would have been a great trade, with the benefit of hindsight. It is down to $1,305 currently, with most of the decline occurring last year after the bulls lost their confidence in the precious metal when it didn’t soar after ECB President Mario Draghi’s whatever-it-takes speech and on the introduction of Abenomics.

A few contrarians I know are turning bullish on gold. They note that both the price of gold and the price of silver seem to be finding support at their 2013 lows. Silver is back at that low. However, it settled at its highest level in a month on Wednesday, buoyed by a report that said physical demand for the metal rose to a record last year. Gold rose back over $1,300 an ounce yesterday.

If the precious metals head higher, it will be either because of rising geopolitical tensions or rising inflation, say the contrarians. The former scenario seems like a more likely one than the latter, in my opinion.

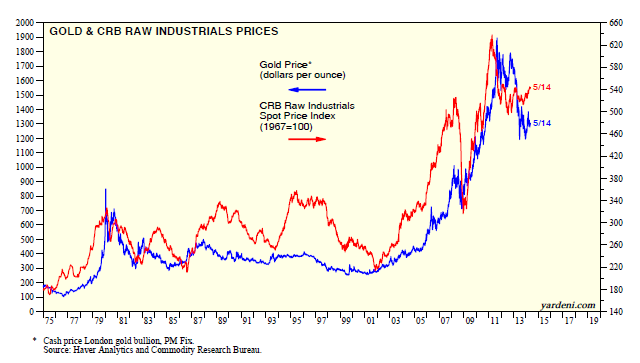

I believe that the price of gold is a good indicator of the underlying trend in industrial commodity prices, which I expect will remain on the flat side for a while longer. So if the price of gold takes off, I will have to reassess my outlook for commodities.

Today's Morning Briefing: The Contrarians. (1) Favoring the out-of-favor. (2) A review of the most recent hits. (3) Greek yield drops from 44% to 6%. (4) Betting that China will have to do something. (5) Could US bond yields go lower? (6) Will precious metals become more precious? (7) Global boom would be a contrary bet leading to higher commodity prices, rising EM stock prices, and a weaker dollar.