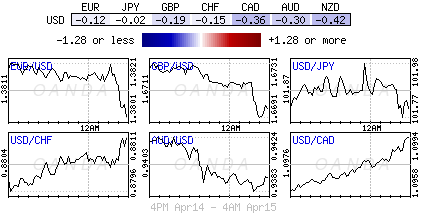

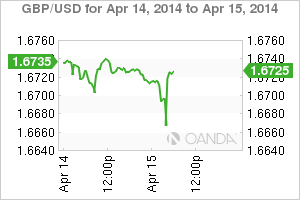

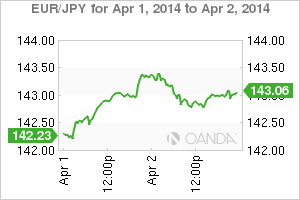

With the 18-member single currency sitting high and mighty all Draghi has been capable of doing so far is basically re-open the "verbal intervention playbook" -- buying time in the hope that an improvement will soon be seen in the Euro-zone inflation front. So far, all the single currency has managed to do is skulk away from its recent key high values -- north of €1.3900. For the ECB to get more "bang for the buck" they need to be proactive and aggressive, perhaps introduce a little "shock and awe" therapy. Using verbal massaging is limiting and makes Euro policy makers look weak. The continued strengthening of the EUR has, according to policy makers, reduced -0.5% off regional inflation numbers over the past 18-months. Its no wonder that Draghi over the past weekend mentioned that the Euro-zone situation requires "further monetary policy accommodation."

Obviously the EUR bears are happy, however, they have been down the pro-rhetoric road before and this type of policy maker's talk is always considered cheap. This time, and only if they are serious, Draghi and company will be required to send an aggressive message to capital markets - no 'fly by night,' but a 'shock and awe' solution. Whether is a combination of interest rate cuts coupled with negative deposits rates or the removal of SMP sterilization (securities markets program) would be an effective way of providing stimulus and buys the ECB time to work out logistics of other measures. The market would also see suspension of the SMP sterilization as a powerful signal that the ECB could engage in outright asset purchases if inflation continues to fall. By using the sterilization policy, the debate on the decision to use private or sovereign bonds in QE, would be delayed even further. That is very much the Euro way -- different cultures, economies and diversifying politics make member uniformity difficult.

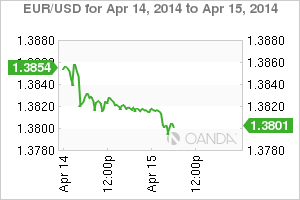

UK data continues to keep policy makers at the BoE on their toes. This morning's UK inflation headline happened to fall to a new 4 ½ year low of +1.6%, y/y, in March, while factory gate inflation at +0.5% was the lowest since October 2009. Digging deeper, it's no surprise to see UK house prices gained +9.1% in the 12-months to February -- the strongest rise in four-years. The monthly reading was +0.2%, m/m, in March. Sterling suffered a knee-jerk reaction, printing a cable low £1.6657 before an aggressive 83 pip climb ensued. The +1.6% headline print was well below the BoE's target level of +2%. Tomorrow's release of UK's earning growth numbers (+1.8% vs. +1.4% expected) and jobs data should make it interesting for the pound. According to the techies, cable offers are becoming mooted north of £1.6735-45. Stronger resistance for the currency stands alone every +15 pips through this handles halfway point, up to and including the option heavy £1.6800 level.

The single currency remains relatively steady (€1.3800) ahead of US CPI and earnings being reported stateside later this morning. Earlier during the Euro session, the April German ZEW survey came in very wide of the mark, with the economic sentiment sliding to 43.2, compared with 45.0 expected. The bulk of the disappointed came in the shape of Ukraine, with the conflict weighing heavily on sentiment. The surprise came in the form of current conditions surging to a nearly three-year high of 59.5 versus 51.8 as expected. The split result has done little for the EUR -- it seems that the Euro holiday thinned trading sessions prefer to rely on North America for direction.

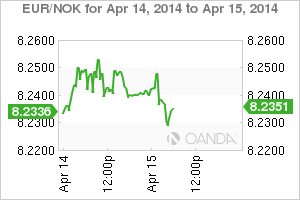

With obvious tensions on the rise in the Ukraine, perhaps Europeans do not need to look so far afield when gauging investment opportunities and potential hedging requirements. The 'real' threat of disruption to oil and gas supply to mainland Europe may drive Norwegian oil and gas companies to outperform -- making them the short term winner. This scenario would naturally support the NOK. Even with a dovish ECB, the market should be expecting the 18-member single currency to underperform outright and on the cross thereby directly supporting the NOK via mainland monetary policy. Finally, rising inflation concerns in Norway could argue for a tighter monetary policy from the Norges bank -- from an interest rate differential position the NOK could be a winner.