As regular readers of MetalMiner know, we are not shy about saying what we think is moving the markets and where we think they are going. But from time to time, we also like reviewing what the analyst market is saying – and whether we agree with them or not.

So a recent poll by Reuters of some 33 analysts (or as Thomson Reuters’ Andy Home loosely puts it, “participants”) certainly makes interesting reading.

All seem to agree that 2014 and 2015 will make an interesting couple of years, but not because anyone is seeing a return of the super-cycle or a global reflation driving demand. No, in fact there is widespread consensus that demand will be steady if unspectacular. A slowing China will translate into a slowing Asia in general, but will be partly offset by a growing North America and a recovering Europe to keep demand up while not rising strongly.

On the contrary, analysts agree that most of the action will be on the supply side with some metals like copper, aluminum and nickel remaining in surplus, but with others like lead and zinc moving either into deficit or at least a sufficiently constrained surplus that prices will be forced to rise.

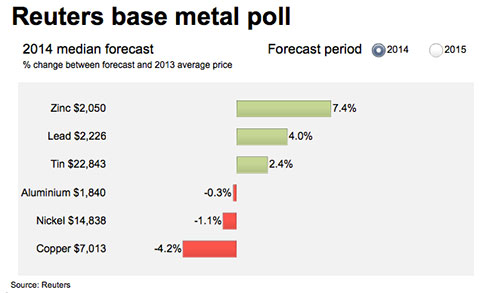

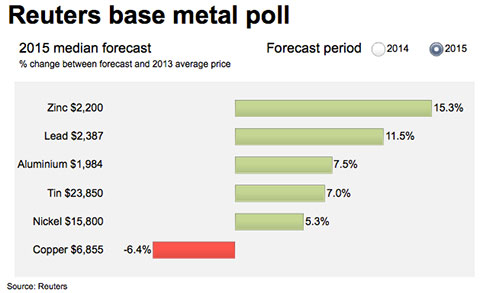

As we have written ourselves over recent months, although the copper market is failing to translate rising ore supply into rising refined metal supply, this is generally agreed to be just a matter of time and of the 33 participants polled, all agreed on a surplus in both 2014 and 2015 with the consensus view being a median price drop to $7,013 per metric ton this year and $6,855 per metric ton next year.

Of the other metals in surplus, aluminum will continue to struggle with oversupply, albeit with a tightening surplus this year and next. The surplus this year is seen at 568,400 tons, compared to an oversupply of 591,747 predicted in a previous poll.

As a result, the cash aluminum price is seen averaging $1,840 a ton this year, according to 31 analysts, down from previous forecasts of $1,885, and slightly lower than average 2013 cash prices of $1,844.95 a ton.

Next year, aluminum prices are seen at $1,984.10 a ton, coinciding with a further tightening of the surplus to 500,000 tons in 2015, although with the stock and finance game in full swing, it is difficult to call the market in deficit – this huge immeasurable sponge soaking up excess supply is an unpredictable yet sizeable swing factor in the demand equation.