Earnings releases are picking up pace and results from 36 S&P 500 members or 10.1% of the index’s total membership are already out.

As far as the tech sector is concerned, total earnings are expected to be down 6.2% on 2.7% higher revenues, which would follow the sector’s 4.5% earnings decline on 0.4% higher revenues in Q1.

This week, investors will be watching semiconductor stocks closely as a number of them are expected to come up with their quarterly results. The semiconductor industry serves as a driver, enabler and indicator of technological progress. Developments in the industry determine the way we work, transport ourselves, communicate, entertain ourselves and respond to our environment.

The industry has been struggling for the last year due to global economic headwinds, such as a slowdown in China and a strengthening dollar. The PC market slump can’t be ignored either.

Let’s take a sneak peek into six major companies in the semiconductor space - Intel Corporation (INTC), Advanced Micro Devices, Inc. (AMD), Maxim Integrated Products, Inc. (MXIM), Mellanox Technologies, Ltd. (MLNX)Fairchild Semiconductor International Inc. (FCS) and NVECorp (NVEC) that will report earnings this week.

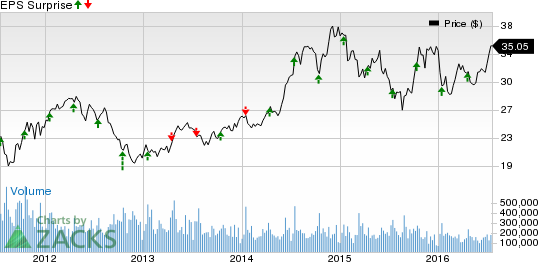

Intel Corporation (NASDAQ:INTC) , one of the world's largest semiconductor chip makers, is slated to report second quarter fiscal 2016 results on Jul 20.

For the quarter, Intel has an Earnings ESP of +1.85% and it carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for the quarter is pegged at 54 cents.

Last quarter, Intel posted a positive earnings surprise of 10.20%. The company’s earnings exceeded the Zacks Consensus Estimate in the preceding four quarters with an average positive surprise of 11.53%.

Intel’s increased focus on non-PC areas like programmable logic, security, retail, manufacturing and autonomous vehicles are likely to drive growth. (Read more: Intel (INTC) Stock Earnings Preview: Looking Good into Q2)

Advanced Micro Devices, Inc. (NASDAQ:AMD) , a leading semiconductor company, is slated to report second quarter fiscal 2016 results on July 21.

For the quarter, Advanced Micro has an Earnings ESP of 0.00% and it carries a Zacks Rank #3 (Hold). The Zacks Consensus Estimate for the quarter is pegged at a loss of 11 cents.

Last quarter, the company posted a positive earnings surprise of 6.67%. Notably, the company has missed the consensus mark twice and matched once in the preceding four quarters resulting in a negative average surprise of 15.86%.

We note that the decline in global PC demand could impact the company’s profits in the upcoming quarter. However, the company is strengthening its position in key markets with the introduction of several APUs and GPUs. It has also taken initiatives in immersive computing markets like virtual and augmented reality which could boost its second-quarter results. (Read more: What's in Store for Advanced Micro (AMD) in Q2 Earnings?)

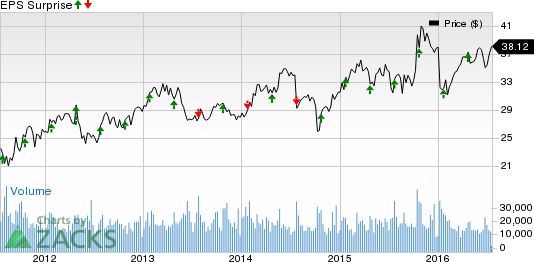

Maxim Integrated Products, Inc. (NASDAQ:MXIM) that designs, develops, manufactures, and markets a broad range of linear and mixed-signal integrated circuits,will report fourth quarter 2016 results on Jul 21.

For the quarter, Maxim has an Earnings ESP of 0.00% and it carries a Zacks Rank #4 (Sell). The Zacks Consensus Estimate for the quarter is poised at 48 cents.

Last quarter, the company’s earnings were in line with the Zacks Consensus Estimate. The company has delivered positive surprises in two of the last four quarters with an average positive surprise of 3.18%.

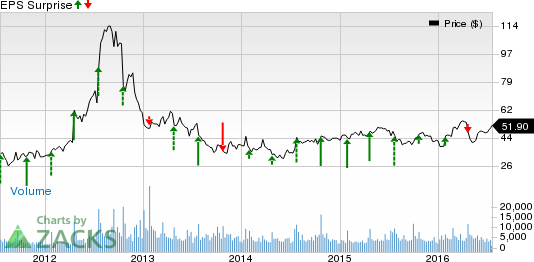

Mellanox Technologies, Ltd. (NASDAQ:MLNX) , a leading supplier of high-performance, end-to-end interconnect solutions for data center servers and storage systems, is set to report second quarter fiscal 2016 results on Jul 20.

For the quarter, Mellanox has an Earnings ESP of 0.00% and it carries a Zacks Rank #3 (Hold). The Zacks Consensus Estimate stands at 55 cents.

Last quarter, the company posted a negative earnings surprise of 8.70%. Notably, Mellanox has delivered positive surprises in three of the last four quarters resulting in a positive average surprise of 16.10%.

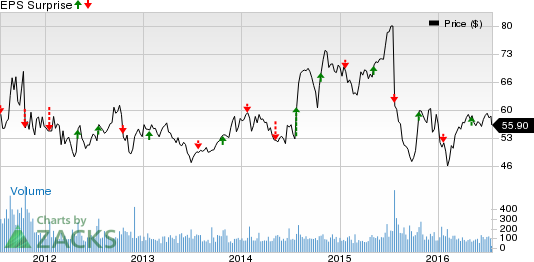

Fairchild Semiconductor International Inc. (NASDAQ:FCS) , a global company solely focused on designing, manufacturing and marketing high performance semiconductors for multiple end market uses, is expected to report second quarter fiscal 2016 results on Jul 21.

For the quarter, Fairchild Semiconductor has an Earnings ESP of 0.00% and it carries a Zacks Rank #3 (Hold). The Zacks Consensus Estimate stands at 16 cents.

Last quarter, the company posted a negative earnings surprise of 23.08%. Fairchild Semiconductor has delivered negative surprises in three of the last four quarters resulting in a negative average surprise of 20.34%.

NVE Corp (NASDAQ:NVEC) , a developer and seller of spintronics, a nanotechnology that utilizes electron spin rather than electron charge to acquire, store, and transmit information, is set to report first quarter 2017 results on Jul 20.

For the quarter, NVE has an Earnings ESP of 0.00% and it carries a Zacks Rank #3 (Hold). The Zacks Consensus Estimate stands at 54 cents.

Last quarter, the company posted a positive earnings surprise of 1.89%. NVEhas delivered negative surprises in two of the last four quarters resulting in a negative average surprise of 0.21%.

ADV MICRO DEV (AMD): Free Stock Analysis Report

MELLANOX TECH (MLNX): Free Stock Analysis Report

NVE CORP (NVEC): Free Stock Analysis Report

INTEL CORP (INTC): Free Stock Analysis Report

MAXIM INTG PDTS (MXIM): Free Stock Analysis Report

FAIRCHILD SEMI (FCS): Free Stock Analysis Report

Original post

Zacks Investment Research