Western Potash Corp. just confirmed by news release that it indeed owns a significant portion of the world-class KP405 potash deposit, which is jointly operated by Rio Tinto Plc and North Atlantic Potash Inc. in Saskatchewan, Canada. Shortly thereafter, Greg Klein of Resourceclips.com published an interview with Patrick Power, VP Corporate Finance and Director of Western Potash Corp. He also interviewed the Saskatchewan government official, Doug MacKnight, Executive Director of Lands and Mineral Tenure for Saskatchewan’s Ministry of Economy.

The statements in Greg Klein’s interview, as well as the map included in Western Potash’s news release, confirm that our last article entitled “Potash Power Plays: Rio Tinto’s Big Blunder” was absolutely correct that Western Potash indeed owns a significant portion of the neighboring KP405 potash deposit, which was recently hailed by its alleged owners (Rio Tinto and North Atlantic Potash, a Canadian subsidiary of Russian fertilizer powerhouse JSC Acron) as a “tier one” discovery that is “massive” and “a world-class project” capable of supporting a long-life and low-cost potash mine.

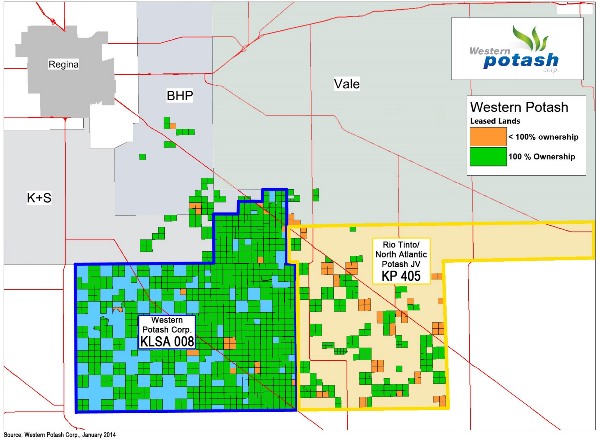

Western Potash released the following map showing its part ownership of the KP405 potash deposit:

Since our last article, we have received some emails from our newsletter subscribers asking if we are overstating that the Australian mining giant Rio Tinto made a “big blunder” while putting a foot into the Canadian province of Saskatchewan – home of the world’s largest and richest potash fields.

Patrick Power’s interview statements in Resourceclips.com provide the answer:

“It’s happened before with companies, usually smaller, not Rio Tinto-sized companies. They forget that when you’re granted Crown ground in this part of the world, you still need rights to the freehold. It’s on a checkerboard basis. It’s almost impossible to mine that without having an agreement with us or taking us over. Those are the two options they have. The other is to back away.”

Certainly, there is a difference between Crown and Freehold grounds, however in this case it does not make a difference because both – in equal measure – empower the owner with a mineral right. In other words: Those who hold Crown or Freehold grounds own the deposit.

In the Resourceclips.com article, the Saskatchewan government official, Doug MacKnight, confirmed:

“I wouldn’t be surprised to hear that one potash company owns mineral rights in another potash company’s area. When the land was first being settled the railway got some mineral rights, the Hudson’s Bay Company got some mineral rights and the early homesteaders got some mineral rights. Throughout southern Saskatchewan about 15% to 20% of the mineral rights are privately owned, but it’s not an even distribution. Especially in that area of Saskatchewan, you’re going to get a mix of Crown and freehold ownership and it’s not in a contiguous block. It’s in a checkerboard pattern. So it would not surprise me in the least that one company could hold the potash rights from the Crown in a township and other private owners may have a variety of private rights.”

In a document entitled “Resource Summary”, North Atlantic describes the KP405 deposit ownership as follows:

“The mineral tenure is secured as both Crown rights and agreements with freehold owners of mineral rights.”

It will be interesting to see if North Atlantic must revise that statement now, because Greg Klein came to the same conclusion after talking to Patrick Power and Doug MacKnight while quoting both as follows:

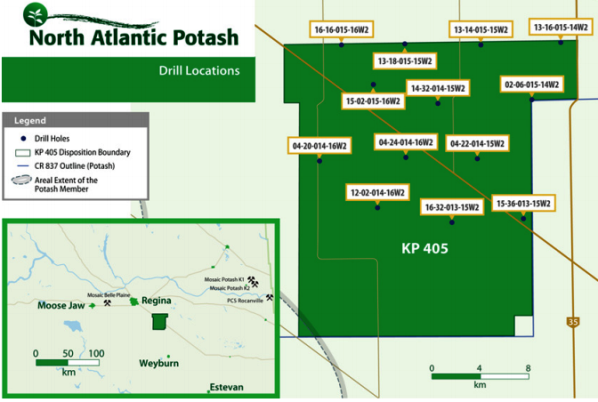

“Power speculates that Rio didn’t learn about the mixed ownership until after it teamed up with North Atlantic in 2011. “Rio’s been drilling on quarter sections that they own, literally metres from our properties.” But the minerals below can hardly be mined in quarter sections, he points out. MacKnight emphasizes that mixed ownership doesn’t prevent mining. “You just have to deal with the owners. If you want to produce it you have to negotiate it…. Historically it has not been an impediment. Everybody’s interested in seeing mines built.”

Greg Klein tried to get in touch with Rio Tinto and North Atlantic who both had not replied back to an interview request. We also tried to get a statement from Rio Tinto but without success. JSC Acron, a publicly listed fertilizer company with a prime market capitalization of $2 billion, must be even-handedly surprised when learning about their joint venture partner having made a strategic blunder and that KP405 is going wild as Western Potash conquered large parts of it like a thief in the night and as quite as mice? Back in September 2011, North Atlantic was confident enough to herald in an interview:

“We strongly believe that together with the professional experience and financial capabilities that Australian-based Rio Tinto brings to this project, we will be able to be the next producing mine in Canada.”

In February 2013, North Atlantic unveiled:

“The price today, at $400 (per tonne), you couldn’t justify a new operation (in Saskatchewan). But if you look five years out when the mine would come into production, and the five years after that which is the period you would pay for (the mine), what do you think the price will be then? That’s why you have to look at it strategically over the next 10 years.”

In conclusion, we simply reiterate the title of our initiating coverage on Western Potash from February 19, 2014: “Primed to build a world-class potash mine“; and even tend to adapt the wording of North Atlantic that, by the same token, Western Potash “will be able to be the next producing mine in Canada”.

Disclaimer:

Neither Rockstone Research nor the author was compensated or instructed by any of the companies mentioned herein to produce or publish this content. However, the author holds shares of Western Potash Corp. and therefore would financially benefit from volume and price appreciation. Please read the full disclaimer on within the original research report and on www.rockstone-research – none of this content is to be construed as an “investment advice” as this article is intended for information use only and the author is not a registered investment advisor.