The economic calendar includes an avalanche of important data in the coming week. The daily economic news, culminating in the jobs report on Friday, will dominate the market discussion. The popularity of parsing everything through the lens of Fed policy creates a special situation. Pundits will ask:

Will the economic data alter Fed policy?

Prior Theme Recap

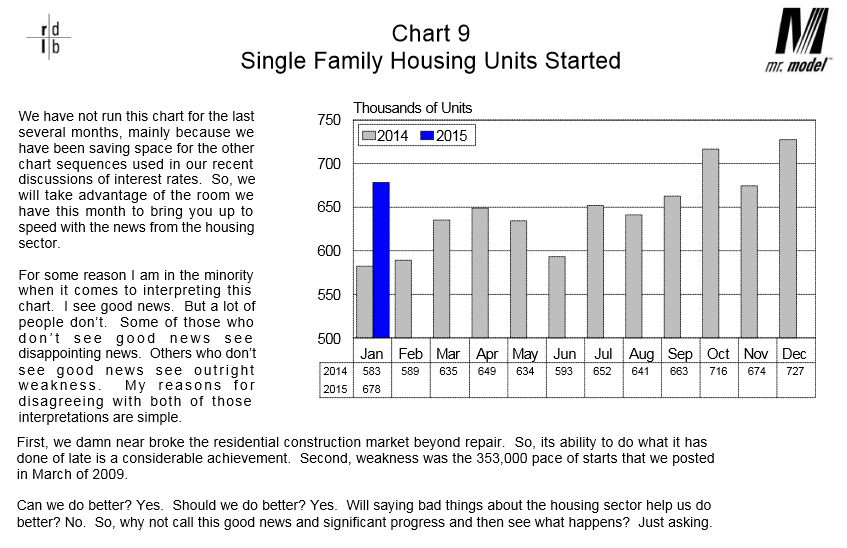

In last week’s WTWA I predicted that the punditry would focus on housing data and economic impacts with a brief diversion for the Yellen testimony. That was as good call, since the housing debate bracketed the testimony and still followed our themes at week’s end, especially on CNBC programming. Josh Brown’s excellent article, 10 reasons the housing market could go ballistic this spring, captures the spirit of the discussion. Regular readers know that I have long recommended viewing pent-up demand (reason #2) along with shadow inventory. All ten reasons are interesting.

Feel free to join in my exercise in thinking about the upcoming theme. We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead.

This Week’s Theme

The upcoming week is loaded with interesting data, more than we often see in two weeks and including the most important reports. With Fed Chair Yellen’s testimony fresh in our minds, it will be natural to combine questions about the Fed with interpretation of the data.

Will the Economic Data Alter the Fed’s plan?

The Viewpoints

Here are the key viewpoints on the economy and Fed policy:

- The Fed is on course to raise interest rates this year. Vice-Chair Fischer suggests that the current balance sheet effect, without any more buying, is 110 bps on the 10-Year yield. This leaves room to normalize rates.

- The Fed will remain data dependent, with a possible delay until next year (Bloomberg).

- The Fed will be forced to initiate more QE. (Critics fearing deflation).

- The Fed has undermined all data. It is hopelessly “behind the curve” from a failure to raise rates earlier. (Critics fearing hyperinflation).

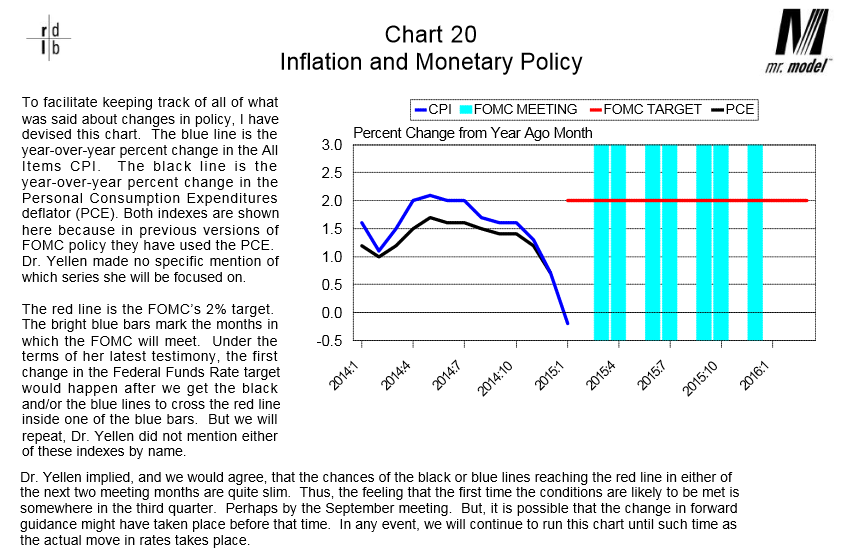

Critics of all flavors were represented during Chair Yellen’s Congressional testimony. The same economic data will be viewed quite differently depending upon the viewing lens. Bob Dieli emphasizes the inflation test as especially important and provides an interesting chart to consider the timing of the first rate hike:

As always, I have some additional ideas in today’s conclusion. But first, let us do our regular update of the last week’s news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week’s Data

Each week I break down events into good and bad. Often there is “ugly” and on rare occasion something really good. My working definition of “good” has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially – no politics.

- It is better than expectations.

The Good

There was some good news last week.

- Progress in Greece. The four-month delay was agreed upon.

- Inflation is still subdued. And no, it is not a deflationary threat, explains Brian Wesbury.

- Weekly jobless claims dipped. Back below 300K. Calculated Risk analyzes and charts the significance.

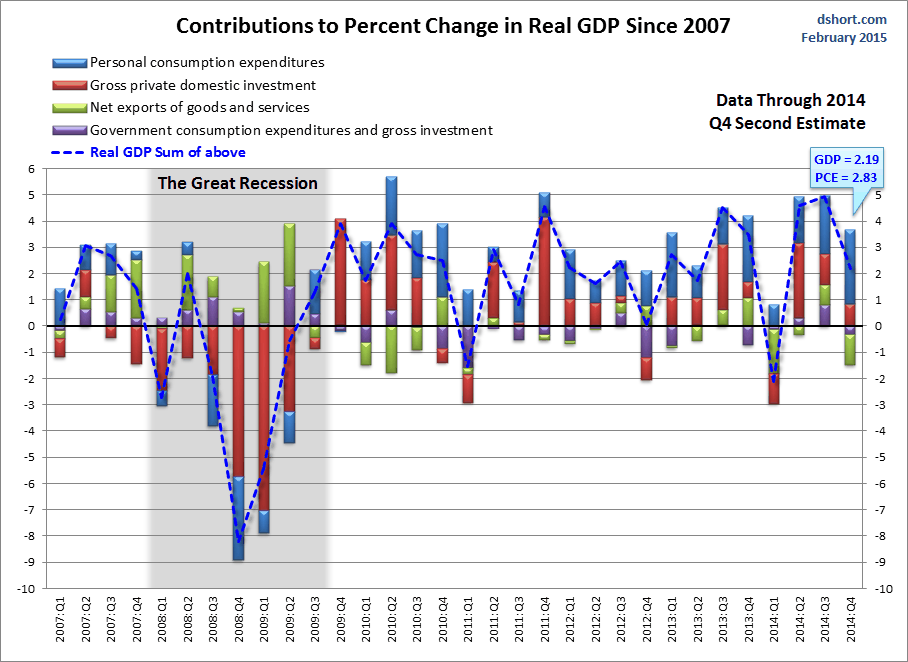

- Q4 GDP was revised lower, but beat expectations at 2.2%. While the market sold off later in the day, this did not seem to be a major factor. Some were encouraged at the reasons for the revisions, including a lower inventory effect. Doug Short has the best summary of the effect of each component:

- Durable goods orders beat expectations. Steven Hansen at GEI has a complete analysis, including a longer trend and some caveats.

- Earnings reports strengthened. The blended growth rate is 3.7%. Companies beating estimates are seeing solid stock price increases. (FactSet). Brian Gilmartin is pretty optimistic about the picture for 2015 focusing on increases in the bottom-up estimates.

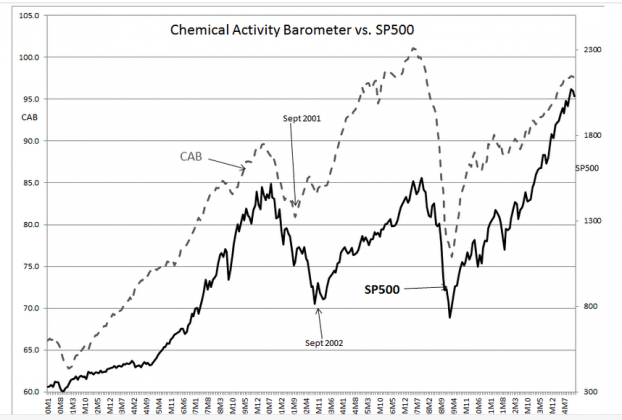

- The chemical activity index. We always appreciate updates from “Davidson” via Todd Sullivan. The correlation suggests “a rise in equity prices for the next 12 months or so.”

- Michigan sentiment rebounded to 95.4. This is slightly off the recent high, but still very strong.

- Pending home sales hit 18 month highs. (Calculated Risk) This is a forward looking indicator, but Bill remains concerned about NAR sales estimates. He has an update noting major revisions in seasonal adjustments for the West region.

The Bad

There was also some discouraging economic news.

- Fund managers are bullish. This is negative on a contrarian basis (The Short Side of Long). Contra from The Fat Pitch, tracking financial bloggers. Both sources have interesting charts, so make up your own mind. I am scoring this with the standard contrarian interpretation.

- Jobless claims rose dramatically to 313K, the most since December, 2013. This is an important series, but difficult to track with moving holidays like President’s Day. (Bloomberg)

- Ukraine cease fire is in jeopardy, hanging by a “hair trigger.” (CNN) This is a continuing human tragedy and a major drag on the world economy.

- Existing home sales disappointed, the lowest level since May, 2014. Mesirow Financial observes that the best investment properties have traded and the baton must now be passed to first-time buyers – a crucial shift. Other observers blame low inventory (WSJ).

The Ugly

Congress is back in action! Or inaction. With minutes to spare before funding would end for the Department of Homeland Security, Congress managed a one-week funding extension. This means that we get to watch the entire story again next week. Groundhog Day was a month ago. Even Greece and the Germans managed a four-month extension.

And following up from a prior “Ugly” the Chicago financial situation gets worse.

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. Think of The Lone Ranger.

This week’s award goes to Nicholas Cola and Jessica Rabe of Convergex. Cola takes on the oft-cited Jeff Gundlach slide deck on the 2015 outlook. Gundlach states that equities have never risen for seven years in a row since 1871. The Convergex analysis, while quite deferential, demonstrates that Gundlach is inaccurate in several respects. The points are all nicely documented and charted in a supplement. The conclusion is that several more years of rally would not be a surprise.

(Note more discussion of bull markets and old age in today’s final thought).

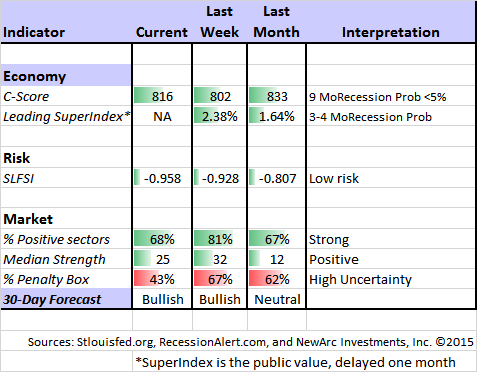

Quant Corner

Whether a trader or an investor, you need to understand risk. I monitor many quantitative reports and highlight the best methods in this weekly update. For more information on each source, check here.

Recent Expert Commentary on Recession Odds and Market Trends

RecessionAlert: A variety of strong quantitative indicators for both economic and market analysis. While we feature the recession analysis, Dwaine also has a number of interesting market indicators. This week he notes an increase in his combined measure of economic stress, although the levels are still not yet worrisome.

Doug Short: An update of the regular ECRI analysis with a good history, commentary, detailed analysis and charts. If you are still listening to the ECRI (three years after their recession call), you should be reading this carefully. Doug has the latest interviews as well as discussion. Also see Doug’s Big Four summary of key indicators.

Georg Vrba: has developed an array of interesting systems. Check out his site for the full story. We especially like his unemployment rate recession indicator, confirming that there is no recession signal. Georg continues to develop new tools for market analysis and timing, including a combination of models to do gradual shifting to and from the S&P 500. I am following his results and methods with great interest. You should, too.

Bob Dieli does a monthly update (subscription required) after the employment report and also a monthly overview analysis. He follows many concurrent indicators to supplement our featured “C Score.”

This week’s report is chock full of insights and ideas. Here is Bob’s take on last week’s theme, housing:

James Picerno, a leading business cycle expert, warns against relying on too few “cherry-picked” indicators. He cites a statement that the housing recovery is faltering. His thoughtful article has several great examples, leading him to conclude as follows:

On that note, recession risk is still quite low, based on a broad review of the published numbers. Yes, the housing market may be an early sign of trouble; ditto the weak trend in commodity prices. But there are many positives one could point to as well. But it’s ridiculous to get into a tit-for-tat debate–my indicators are better than yours! The emphasis should be on developing superior multi-factor business cycle benchmarks. Fortunately, there’s no shortage of efforts on this crucial work. The bad news is that you’re not likely to read about it unless you’re looking beyond the usual suspects.

Sad, but true. The story that “all is well” does not get much attention.

The Week Ahead

It will be a big week for economic data.

The “A List” includes the following:

- Employment report (F). The most watched economic indicator, despite the wide error band and revisions.

- ISM Index (M). Important concurrent economic read with some leading qualities.

- Personal income and spending (M). Will the bonus from lower gas prices show up?

- PCE prices (M). Favorite Fed inflation indicator.

- Auto sales (T). Good non-government verification of spending. Weather effects last month?

- Initial jobless claims (Th). The best concurrent news on employment trends, with emphasis on job losses.

- ADP private employment (W). Deserved recognition as a solid independent measurement of job growth.

The “B List” includes the following:

- ISM services index (W). Less history than the manufacturing index, but now covering more of the economy.

- Beige book (W). Anecdotal economic evidence that the FOMC will use at the next meeting. If you are a veteran of the Art Cashin era you may call this the “tan book.”

- Trade balance (F). Impact of oil prices should be evident.

- Construction spending (M). January data, but an important growth measure.

- Factory orders (Th). January data for this volatile series.

- Crude oil inventories (W). Maintains recent interest and importance.

There is not much FedSpeak, but plenty on the international affairs front.

How to Use the Weekly Data Updates

In the WTWA series I try to share what I am thinking as I prepare for the coming week. I write each post as if I were speaking directly to one of my clients. Each client is different, so I have five different programs ranging from very conservative bond ladders to very aggressive trading programs. It is not a “one size fits all” approach.

To get the maximum benefit from my updates you need to have a self-assessment of your objectives. Are you most interested in preserving wealth? Or like most of us, do you still need to create wealth? How much risk is right for your temperament and circumstances?

My weekly insights often suggest a different course of action depending upon your objectives and time frames. They also accurately describe what I am doing in the programs I manage.

Insight for Traders

Felix has continued a “bullish” posture for the three-week market forecast. The data have improved a bit, but are only slight better than the recent neutral readings. There is reduced uncertainty, reflected by the falling percentage of sectors in the penalty box. Our current position is still fully invested in three leading sectors, and we remain aggressive. For more information, I have posted a further description — Meet Felix and Oscar. You can sign up for Felix’s weekly ratings updates via email to etf at newarc dot com.

This week’s special advice for traders comes from two of my favorite sources: Brett Steenbarger citing Charles Kirk. The basic idea is the importance of not over-fitting your trading models. The important technique is to resist temptation to add many variables for slight theoretical improvements in performance. My partner Vince calls this “pruning.” It is the key to what he calls a “robust” model. When you are looking at a new trading system it is one of the key things to consider. Less is more.

As I have noted for seven weeks, Felix continues to feature selected energy holdings. The focus has shifted from refiners, to producers, to natural gas during this time. Solar stocks have also earned a high rating.

Insight for Investors

I review the themes here each week and refresh when needed. For investors, as we would expect, the key ideas may stay on the list longer than the updates for traders. Major market declines occur after business cycle peaks, sparked by severely declining earnings. Our methods are focused on limiting this risk. Start with our Tips for Individual Investors and follow the links.

We also have a new page summarizing many of the current investor fears. If you read something scary, this is a good place to do some fact checking.

My bold and contrarian prediction for 2015 – that the leading sectors would lose and the laggards would win – still looks promising. I also see plenty of time left in this economic and stock cycle.

Other Advice

Here is our collection of great investor advice for this week:

Personal Finance

The Berkshire Hathaway (NYSE:BRKa BRKb) annual letter is a must-read for investors. If you cannot spare the time to read all 42 pages, see pp. 18-19 for an explanation about why to prefer stocks to bonds in the long run. The risk often comes from our own behavior:

Investors, of course, can,by their own behavior, make stock ownership highly risky. And many do. Active trading, attempts to “time” market movements, inadequate diversification, the payment of high and unnecessary fees to managers and advisors, and the use of borrowed money can destroy the decent returns that a life-long owner of equities would otherwise enjoy. Indeed, borrowed money has

No place in the investor’s tool kit: Anything can happen anytime in markets. And no advisor, economist, or TV commentator – and definitely not Charlie nor I – can tell you when chaos will occur. Market forecasters will fill your ear but will never fill your wallet.

And also see page 34-35. Mr. Buffett advises at least a five-year time horizon for those buying his stock. He also explains the reason for keeping adequate cash reserves (counting Treasuries):

The reason for our conservatism, which may impress some people as extreme, is that it is entirely predictable that people will occasionally panic, but not at all predictable when this will happen. Though practically all days are relatively uneventful, tomorrow is always uncertain. (I felt no special apprehension on December 6, 1941 or September 10, 2001.) And if you can’t predict what tomorrow will bring, you must be prepared for whatever it does.

A CEO who is 64 and plans to retire at 65 may have his own special calculus in evaluating risks that have only a tiny chance of happening in a given year. He may, in fact, be “right” 99% of the time. Those odds, however, hold no appeal for us. We will never play financial Russian roulette with the funds you’ve entrusted to us, even if the metaphorical gun has 100 chambers and only one bullet. In our view, it is madness to risk losing what you need in pursuing what you simply desire.

Barry Ritholtz is on the same theme:

The noise box in your den (and on the wall of your trading room) has been tallying a catalog of potential crises and hazards. That parade of terribles seems to be getting longer each day. Although none of them are new, it is as if all of them have suddenly risen in unison, a chorus of noise, funk and angst. Markets are expensive, the Federal Reserve’s stimulus of quantitative easing and zero interest rates is ending, the euro is collapsing, deflation is a threat, rates are rising, residential real estate is a mess, biotech is a bubble, oil prices are plunging, Grexit will arrive any day.

Stock and Sector Ideas

Surprise! As Pimco reaches beyond its identity as a bond company, it now features income-oriented funds that feature stocks as well. Simon Constable (Barrons) has an excellent story that also includes information about the fund holdings – plenty of ideas.

Barron’s also features Vulcan Materials (NYSE:VMC). We have been looking at stocks in this sector as solid value plays.

“We’re in the second inning of the cycle,” says Rick Lane, lead manager of Broadview Opportunity fund, which owns Vulcan stock (ticker: VMC). Lane sees Vulcan generating more than $1 billion in free cash in the next three years, which could help drive the stock price to $127, up more than 50% from last week’s $82.

Beware the high-yield market.

The thirty most-shorted stocks. (Akin Oyedele at BI)

Market Outlook

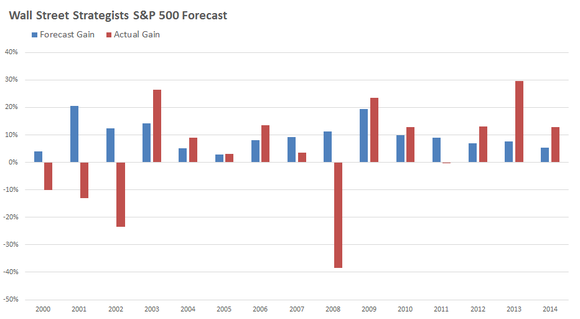

Morgan Housel has another great column, this time on the forecasting failures of Wall Street analysts. He cites the chart below from Birinyi Associates concludes as follows:

Finance is much closer to something like sociology. It’s barely a science, and driven by irrational, uninformed, emotional, vengeful, gullible, and hormonal human brains.

If you think of finance as being akin to physics when it’s actually closer to sociology, forecasting becomes a nightmare.The most important thing to know to accurately forecast future stock prices is what mood investors will be in in the future. Will people be optimistic, and willing to pay a high price for stocks? Or will they be bummed out, panicked about some crisis, pissed off at politicians, and not willing to pay much for stocks? You have to know that. It’s the most important variable when predicating future stock returns. And it’s unknowable. There is no way to predict what mood I’ll be in 12 months from now, because no matter what you measure today, I can ignore it a year from now. That’s why strategists have such a bad record.

Worse than a Blind Forecaster.

No wonder Mr. Buffett recommends a five-year horizon.

Ben Carlson weighs in on the same theme using a great success story.

Perception and Psychology

You probably get involved in the debate over “the dress” and what color it is. For the full story — Market Watch’s Shawn Langlois starts my day with his “Need to Know” column. Perhaps more than anyone I appreciate how difficult this is – something like a daily WTWA. He also contribute other pieces like this one on the Internet debate over the dress. Mrs. OldProf and I disagreed on this one, as did our team at the office. If you managed to miss it, take a look and decide for yourself. There are some important investment lessons:

- No matter how simple the question, people see things differently.

- We do not understand the foundation for our perceptions – not even recognizing why they differ from those of others.

- No wonder people see the same chart, or the same balance sheet, and draw different conclusions.

- Buyers and sellers at the same price….

Business Cycle

Consistent with our Silver Bullet award is this excellent article from Cullen Roche, warning about extreme viewpoints and stubborn adherence thereto. He suggests that the bull market has another $816 million to go.

Final Thought

One of my regular themes is the difference in time frames between traders and investors.

Traders parse everything through the lens of Fed policy. HFT algorithms look for key words and front-run the humans. Human traders do the same thing – but more slowly. The blog posts hit, “explaining” why the Fed will change course.

If you are a trader, you have a tough job competing in this game.

Investors are free to ignore the immediate psychological reaction and to consider the fundamentals. Here are the most important two points:

- The exact timing of the first Fed rate increase does not matter. There is a difference between tight monetary policy and slightly less accommodative policy. Markets do quite well in the early stages of rising rates, especially when starting from a low initial point. This will be ignored by many who will invoke “Don’t fight the Fed.” This will be the fundamental battleground between traders and investors, bears and bulls, and various political types – perhaps lasting for years.

- The end of the business or stock market cycle is not imminent. Bull markets do not die of old age. Investors should understand that this one might run for many years. There are many famous and successful investors who have explained this, but I especially like this year-old analysis from Leon Cooperman. It happened just as a famous technical analyst noted that markets were at “an inflection point” not unlike the 1929 crash. (See also David Rosenberg).