The special interest in 2nd quarter earnings continues. With a light week on data coming up and an apparent reduction in geopolitical concerns, I expect continued attention to corporate earnings. Pundits will be asking:

What is the verdict on earnings?

Prior Theme Recap

In my last WTWA I predicted that attention to earnings reports would dominate over Fed news. Many would be wondering whether the expected weak earnings would undermine the market rally. This was a good call. The stories about Greece and China faded, despite the live coverage of Greek protests. Chair Yellen got the expected live coverage, but there was nothing new. While the answer to the question about earnings sinking the market was “no” it was the right question.

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can try it at home.

This Week’s Theme

There is continuing interest in year-over-year comparisons showing an expected decline. The importance of earnings is one of the few aspects of stock evaluation nearly universal agreement. The market typically changes focus from week to week, but this is an exception. I expect focus will remain on the continuing question:

What is the verdict on earnings?

The Viewpoints

The earnings story is controversial, including a range of viewpoints. We need to consider both aspects of this week’s question – the possible earnings decline and the effect on the stock market.

Earnings declines

- A weak economy has finally taken a toll on corporate profits, especially in some sectors. FactSet reports, for example, that excluding Apple (NASDAQ:AAPL), the technology sector will be down 6% year-over-year.

- A strong dollar hurts the exports and profit margins of many large companies. FactSet reports that this is the most common reason cited for earnings weakness.

- Profit margins are extended and overdue for a reversion to normal levels.

- Early reports show a 72% “beat rate” on earnings and 56% on revenues. Some of these are versus reduced expectations, complicating the interpretation.

Impact on stocks

Last week I asked whether earnings reports might sink the market. Instead, the news was pretty good and the market was pretty favorable. Brian Gilmartin summarizes the earnings week.

The question now is whether the supportive news will continue this coming week. The verdict is still pending.

As always, I have my own ideas in today’s conclusion. But first, let us do our regular update of the last week’s news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week’s Data

Each week I break down events into good and bad. Often there is “ugly” and on rare occasions something really good. My working definition of “good” has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially – no politics.

- It is better than expectations.

The Good

There was some good economic news.

- The Greek crisis abated with an apparent compromise avoiding a Grexit and providing new terms for a bailout.

- The China market achieved some stability. Here are a few useful perspectives:

- There is an overall rebalancing of the economy with a slight slowing of growth. (Andy Rothman of Matthews Asia).

- The impact on US equities varies widely by sector (Northern Trust).

- Plenty of skepticism about government efforts to manipulate or support stock prices. (Barry Ritholtz).

- The government has a “big bazooka,” using $483 billion. (Bloomberg).

- The real Chinese economy is more important than the stock market. (David Dollar, Brookings).

- But should we believe the figures? (The Economist).

- How much risk is there for US investors, and how to play the opportunities? (Dash of Insight).

- Building permits and housing starts were strong. There were some complaints that the increases emphasized multi-family units. There is evidence of pent-up demand for housing (Value Plays). Calculated Risk calls it a “strong report.” Here is why:

- Fed commentary remained positive. The Yellen testimony seemed to set the stage for rate hikes while maintaining a positive economic outlook.

- Industrial production and capacity utilization beat expectations. (Calculated Risk).

The Bad

There was also some negative data last week, partly on the policy front.

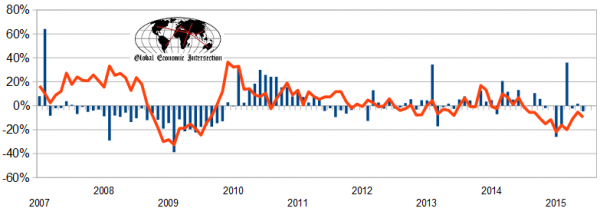

- Sea container shipments are weak. This includes both imports and exports according to Steven Hansen at GEI. As usual in his reports, he provides differing time periods and some smoothing to help interpret a noisy data series. This will be important as we monitor with the longshoremen strike effects dissipate. Meanwhile, expect some negative effect on GDP. Steven importantly notes:

Consider that imports final sales are added to GDP usually several months after import – while the import cost itself is subtracted from GDP in the month of import. Export final sales occur around the date of export.

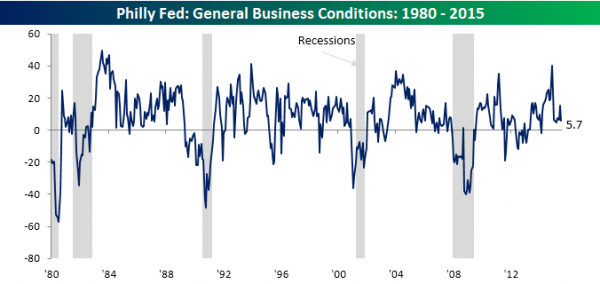

- Philly Fed index missed expectations, although it did remain positive. Bespoke has the story and a great chart.

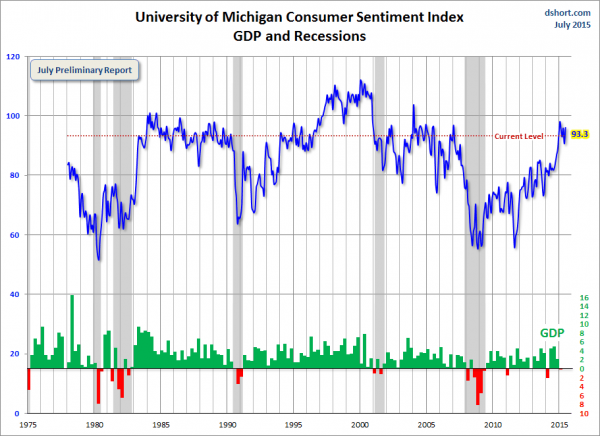

- Michigan sentiment declined and missed expectations. Doug Short always has the best coverage and chart on this story. He notes that sentiment is still pretty positive.

- Retail sales disappointed. Bloomberg has the story, including plenty of speculation about seasonal effects.

Noteworthy

The inflation data remain meaningless, showing a modest increase. Some observers twist and turn these results in two astounding ways:

- They include food and energy when these items make the data seem worse, usually making sarcastic comments about how the Fed excludes items – never giving any recognition to the reasons. Then, when these items are improving the headline data the pundit focuses on the core. Amazing.

- They use high inflation to scare people witless (TM OldProf euphemism). When inflation is low, it is cited as a “miss” of the Fed’s inflation target, showing that the economy is weak.

Maybe we need a “pundit position project.”

See the Cleveland Fed’s take.

The Ugly

Chattanooga shootings. The underlying “reasons” for these events seem to change, but there are disturbing continuing themes. (Washington Post).

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. Think of The Lone Ranger.

Taking on the most popular financial site qualifies Fabius Maximus for this week’s award. Instead of a single refutation, we have a series of insights into charts and data. The commentary ranges from exposing half-truths, conspiracy-mongering, selective use of data, and outright deception. Read the entire article for examples. (HT to GEI where the work is regularly cited).

ZH is an ugly version of Wal-Mart (NYSE:WMT) or Amazon (NASDAQ:AMZN). It would be sad but insignificant if ZH was exceptional. But ZH is a model of successful web publishing, probably taking mindshare from mainstream providers of economic and market insights. I see websites using its methods proliferating in other fields. For example, geopolitics has become dominated by sites that provide a continuous stream of threat inflation as ludicrous as the worst of ZH.

Quant Corner

Whether a trader or an investor, you need to understand risk. I monitor many quantitative reports and highlight the best methods in this weekly update. For more information on each source, check here.

Recent Expert Commentary on Recession Odds and Market Trends

Bob Dieli does a monthly update (subscription required) after the employment report and also a monthly overview analysis. He follows many concurrent indicators to supplement our featured “C Score.”

RecessionAlert: A variety of strong quantitative indicators for both economic and market analysis. While we feature the recession analysis, Dwaine also has a number of interesting systems. These include approaches helpful in both economic and market timing. He has been very accurate in helping people to stay on the right side of the market.

Georg Vrba: An array of interesting systems. Check out his site for the full story. We especially like his unemployment rate recession indicator, confirming that there is no recession signal. He gets a similar result from the Business Cycle Indicator. Georg continues to develop new tools for market analysis and timing, including a combination of models to do gradual shifting to and from the S&P 500.

Doug Short: Provides an array of important economic updates including the best charts around. One of these is monitoring the ECRI’s business cycle analysis. Recently the ECRI finally admitted to the error in their forecast, but still claims the best overall record. This is simply not true. I rejected their approach in real time during 2011 and also highlighted competing methods that were stronger. Until we know what is inside the black box (I suspect excessive reliance on commodity prices and insistence on unrevised data) we will be unable to evaluate their approach. Doug is more sympathetic in his last update. While I disagree, it will require a longer post to elaborate.

ECRI now thinks that a near-term recession is unlikely, and Doug has the story.

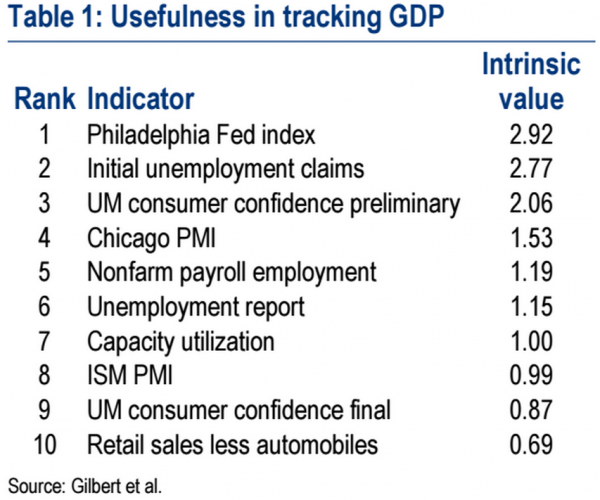

A new academic study (Gilbert, et al.) analyzes economic releases in terms of both intrinsic value and the effects on asset prices. For us quant folks, this is interesting stuff!

Merrill Lynch’s report on the study was picked up at Business Insider, where you can get a summary of the findings. Naturally it is better to read the paper, but few will join me in doing that. The list of important releases corresponds well to what we highlight on WTWA with one important exception: The Philly Fed release, which I have routinely downplayed. I will promote this on our list to watch, and perhaps take it up as a separate question. Meanwhile, here is the list of indicators most useful for tracking GDP.

The Week Ahead

It is a light week for economic data.

The “A List” includes the following:

- New home sales (F). Important housing recovery indicator.

- Leading indicators (Th). Widely accepted as an important forward read on the economy.

- Initial jobless claims (Th). The best concurrent news on employment trends, with emphasis on job losses.

The “B List” includes the following:

- Existing home sales (W). Less significant for construction and economic growth than new home sales.

- Crude oil inventories (W). Current interest in energy keeps this on the list of items to watch.

It is a quiet week for Fed speeches. We shall learn whether the Greek bailout deal hangs together.

Mostly, the earnings stories will dominate the news.

How to Use the Weekly Data Updates

In the WTWA series I try to share what I am thinking as I prepare for the coming week. I write each post as if I were speaking directly to one of my clients. Each client is different, so I have five different programs ranging from very conservative bond ladders to very aggressive trading programs. It is not a “one size fits all” approach.

To get the maximum benefit from my updates you need to have a self-assessment of your objectives. Are you most interested in preserving wealth? Or like most of us, do you still need to create wealth? How much risk is right for your temperament and circumstances?

My weekly insights often suggest a different course of action depending upon your objectives and time frames. They also accurately describe what I am doing in the programs I manage.

Insight for Traders

Felix has shifted to bullish after more than a month in a neutral stance. The confidence in this three-week forecast remains very low with the continuing extremely high percentage of sectors in the penalty box. Felix has shifted back to fully invested, including some foreign exposure. For more information, I have posted a further description — Meet Felix and Oscar. You can sign up for Felix’s weekly ratings updates via email to etf at newarc dot com. Felix appears almost every day at Scutify (follow him here).

The 200-day moving average remains as an influential trading signal. For investors, it helps them to stay on the right side of the market. For traders, it is significant as long as many others believe it to be! CNBC covered Evercore ISI technical analyst Rich Ross and this chart:

Market Wizard (a term oft-applied to those featured in the Jack Schwager books) Marty Schwartz (via Tradeciety) has eleven rules for traders. These are quite different from most such trader lists, and well worth reading. I often highlight the difference between investing and trading. Trader Schwartz captures this in Rule #6 Understand the News. A key point is that what matters is not the actual data, but the perception of the data.

Another good one is #4 which tells you where to set your stops. Hint: Don’t be predictable!

I agree. From my own experience, Chicago trading pit lore includes many stories about “running the stops” on quiet summer days.

Insight for Investors

I review the themes here each week and refresh when needed. For investors, as we would expect, the key ideas may stay on the list longer than the updates for traders. Major market declines occur after business cycle peaks, sparked by severely declining earnings. Our methods are focused on limiting this risk. Start with our Tips for Individual Investors and follow the links.

We also have a page summarizing many of the current investor fears. If you read something scary, this is a good place to do some fact checking.

In Part Two of my series on risk I used the Chinese market as an example of headline risk (link above). My main objective is to explain how to navigate the ever-threatening headlines. Along the way I share a few ideas of how you might profit from stocks with Chinese exposure.

Other Advice

Here is our collection of great investor advice for this week.

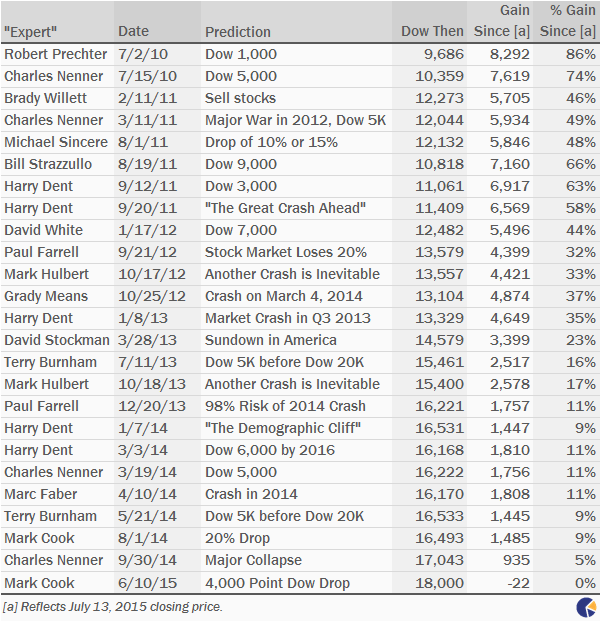

If I had to pick a single most important article, it would be Michael Johnston’s (Fund Reference) article, A Visual History of Market Crash Predictions. Here is a clear statement of the theme:

The 2008 recession drove a number of companies out of business, but it was a boon to a very specific corner of the financial media. The meltdown empowered the perma-bears who make a living scaring investors into sub-optimal asset allocation strategies recommended by their $49.99 monthly newsletter. Armed with marketing materials celebrating their brilliant recession calls, this group has spent the better part of the decade since terrorizing gullible and risk-averse investors with more recession predictions.

More than just a series of links or brief quotations, the article provides a colorful recap of specific and aggressive warnings from serial offenders (Charles Nenner, Harry Dent, Terry Burnham, Paul B. Farrell, Mark Cook, Michael Sincere, Robert Prechter, Mark Hulbert, David White, Bill Strazzulo, David Stockman, Marc Faber, Brady Willett, and Grady Means). To appreciate the excessive confidence and scary tone of the warnings from these pundits, you should take the time to read the entire article. Here is the summary:

Stock Ideas

Biotech is just a beginning bonanza, not a bubble, according to some impressive sources (Wall Street Week). Byron Wien of Blackstone (NYSE:BX) Blackstone Group notes:

…even at current levels, investors are underestimating the transformative potential of biotech innovation.

“Most people still don’t recognize the gigantic implications of this phenomenon,” Wien said. “Major breakthroughs are going to be taking place in cancer, heart disease, Alzheimer’s, diabetes, multiple sclerosis and other diseases.”

Jeffrey Solomon, the Cowen Group President, notes favorable regulatory changes and inflows/outflows in the sector, concluding that the biotech trade is “compelling.”

Ben Levisohn (Barron’s) notes that it is almost exactly one year since Fed Chair Yellen warned of a biotech bubble. Since then the iShares NASDAQ Biotechnology ETF (NASDAQ:IBB) has gained 57%. It might make more sense to pay attention to Yellen on the economy and interest rates and less on stock advice!

Personal Finance

Professional investors and traders have been making Abnormal Returns a daily stop for over ten years. The average investor should make time (even if not able to read every day as I do) for a weekly trip on Wednesday. Tadas always has first-rate links for investors in this special edition. As always, there are several great links, but I especially liked this great post (yet another) from Ben Carlson. It is a nuanced discussion about the goal of early retirement.

Economic Outlook and the Fed

San Francisco Fed President (via GEI) has an upbeat take. “The U.S. economy is looking quite good. Growth is on a solid trajectory, and the FOMC’s maximum employment goal is in sight. Risks from abroad are unlikely to overturn strong U.S. fundamentals.”

Janet Yellen says to expect a rate increase this year. Jeff Gundlach says “no.” One person chairs the Fed and the other sells bonds. Take your pick. Robert Huebscher provides the evidence.

80% of economists expect a rate hike this year. (WSJ).

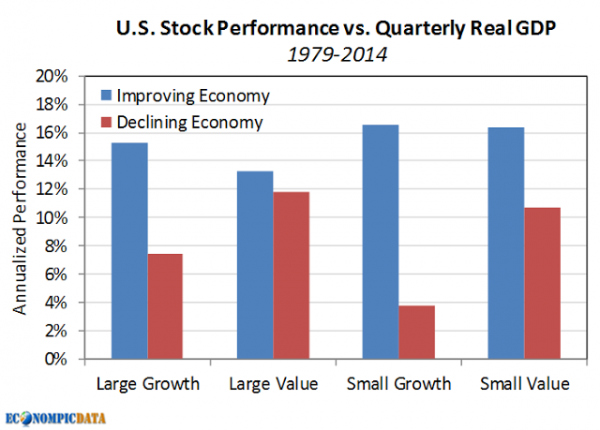

Consider not where the economy is, but what direction it is moving. Here is why you should care. (Econompicdata)

Final Thought

Sometimes the theme does not change from week to week, although the news does. Last week I was expecting a tough quarter for earnings comparisons. There were plenty of headwinds. This week it looks a bit better.

We might all be surprised that the earnings reports included some big positives. I still see the summer months as a possible inflection point for earnings and for stocks. While I understand the current caution, I remain optimistic for the long term. The economic evidence supports this viewpoint, and earnings will follow.

The economic skepticism continues along with excessive emphasis on bond substitutes.

Take what the market is giving you – the cheap stocks and sectors. Avoid the crowded trades.

This means a bias toward sectors that will benefit from rising rates (banks) and avoiding those that will be hurt (utilities).