In this article I will provide my view on the GBP/JPY, CHF/JPY and the EUR/GBP. These are the pairs that I am currently interested in or was interested in last week for trading with the FxTaTrader weekly strategy. I will pick one to analyze in more detail from the pairs that have not been discussed yet recently.

_______________________________________________________

Open/pending positions of last week

GBP/JPY

This pair will be analyzed briefly. For more information read the article Weekly Review Strategy, Week 19 where the pair was tipped for going long. The pair looked interesting last week for taking long positions. Positions have been opened and closed before the important British election news. Profit was made on the total positions. The GBP is an average currency from a longer term perspective and has a high currency score of 8 at the moment. The JPY is a weak currency and has had a currency score of 1 for several weeks. With a currency score difference of 7 and the GBP better classified, it is an interesting pair.

- On the weekly (decision) chart the indicators are looking strong for going long.

- In the weekly chart the Ichimoku is meeting all the conditions.

- The MACD is in positive area and the histogram is showing increase of momentum.

- The Parabolic SAR is long and showing the preferred pattern of higher stop loss on opening of new long and short positions.

Ranking and rating list Week 20

Rank: 1

Rating: + + +

Total outlook: Up

_______________________________________________________

CHF/JPY

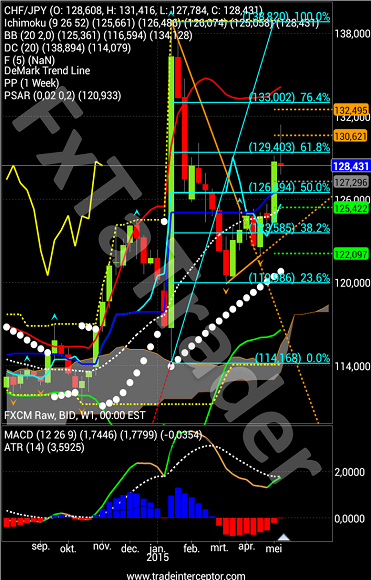

This pair will be analyzed in detail. The pair found the uptrend again in week 18 after a strong pullback during the last 2 months. The pair found support around the 23.6% Fibo level measured from the low of Jan 14 at 114,079 and the high of the day after at 138,870. The pair offered a good opportunity last week and (pending) orders have been opened for this pair.

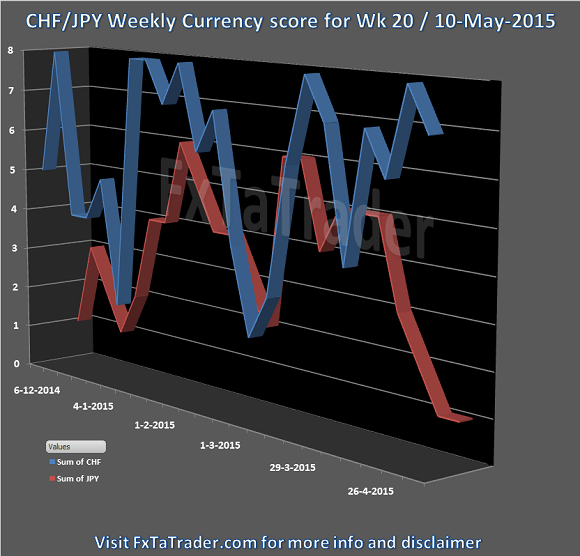

- As can be seen in the Currency Score chart in my previous article of this weekend, the CHF has a score of 7 and the JPY a score of 1.

- In the current Ranking and Rating list of this weekend the pair has a rank of 2. This list is used as additional information besides the Currency score and the Technical Analysis charts.

- Besides the general information mentioned, the outlook in the TA charts also makes this an attractive opportunity.

Ranking and rating list Week 20

Rank: 2

Rating: + + +

Weekly Currency score: Up

Based on the currency score the pair looked interesting in the last 3 months. The CHF is a strong currency from a longer term perspective and had in the last weeks a score of of 6 to 8. The JPY is a weak currency from a longer term perspective and had in the last weeks a score of 1 to 3. With currently a score difference of 6 and the CHF being better classified, it is an interesting pair for taking positions in the coming week.

_______________________________________________________

Monthly chart: Up

- On the monthly (context) chart the indicators are looking strong for going long.

- The Ichimoku is meeting all the conditions.

- The MACD is in positive area and gaining momentum.

- The Parabolic SAR is long and showing the preferred pattern of higher stop loss on opening of new long and short positions.

- Since the monthly chart is used to get the context of how that pair is developing for the long term, the indicators are looking fine because they are showing strength in the current uptrend.

Weekly chart: Up

- On the weekly (decision) chart the indicators are looking strong for going long.

- The Ichimoku is meeting all the conditions.

- The MACD is in positive and the histogram is showing increase of momentum.

- The Parabolic SAR is long and showing the preferred pattern of higher stop loss on opening of new long and short positions.

Daily chart: Up

- On the daily (timing) chart the indicators are looking strong for going long.

- The Ichimoku is meeting all the conditions.

- The MACD is in positive area and gaining strength.

- The Parabolic SAR is long and showing the preferred pattern of higher stop loss on opening of new long and short positions.

Total outlook: Up

CHF/JPY Weekly chart

_______________________________________________________

Possible positions for coming week

EUR/GBP

This pair will be analyzed briefly. For more information read the article Weekly Review Strategy, Week 18, where the pair was tipped for going short. The pair looks interesting again after the strong pullback in week 18. The GBP is an average currency from a longer term perspective and has a high currency score of 8 at the moment. The EUR is a weak currency with a currency score of 2. With a currency score difference of 6 and the GBP better classified, it is an interesting pair.

- On the weekly (decision) chart the indicators are looking strong for going short.

- In the weekly chart the Ichimoku is meeting all the conditions.

- The MACD is in negative area but the histogram is showing consolidation.

- The Parabolic SAR is not short but showing the preferred pattern of lower stop loss on opening of new long and short positions.

Ranking and rating list Week 20

Rank: 3

Rating: - - -

Total outlook: Down

_______________________________________________________

If you would like to use this article then mention the source by providing the URL FxTaTrader.com or the direct link to this article. Good luck in the coming week and don't forget to check my weekly forex "Ranking and Rating list" and the "Currency Score".

_______________________________________________________

DISCLAIMER: The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for 'Forex Trading Journal' purpose only. Nothing should be construed as recommendation to purchase any financial instruments. The choice and risk is always yours. Thank you.