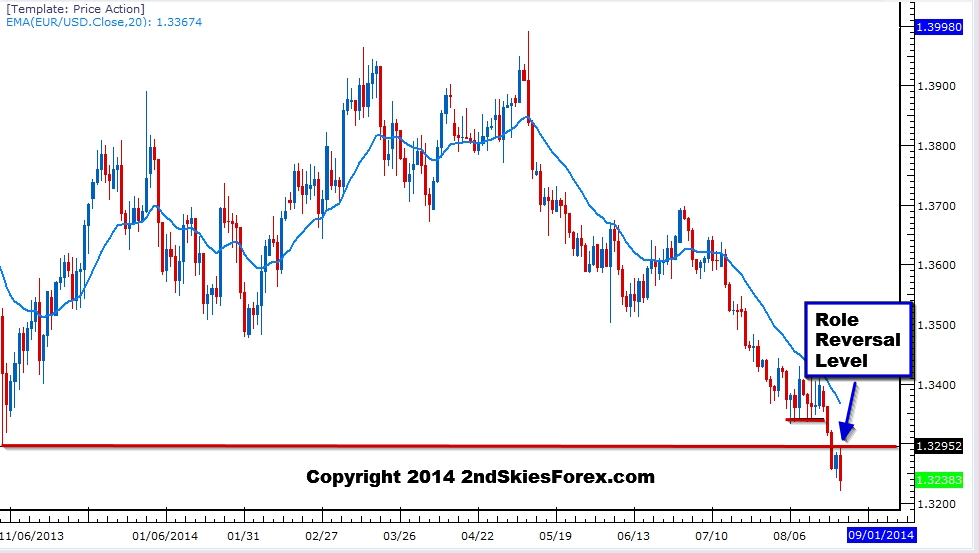

EURUSD – 4 For 5

Closing bearish last week 4 out of 5 days, the Euro is continuing to press the downside as the USD gains broadly across the majors. To end last week, the pair touched a key resistance level, and then sold off the rest of the day, confirming bears are happy to sell on mild retracements.

For now, we are maintaining a bearish view while the price action is below 1.3350 on a daily closing basis. Until then, we’ll look for pullbacks towards 1.3290 & 1.3345 to get short. Downside support levels come in at 1.3193 and 1.3100.

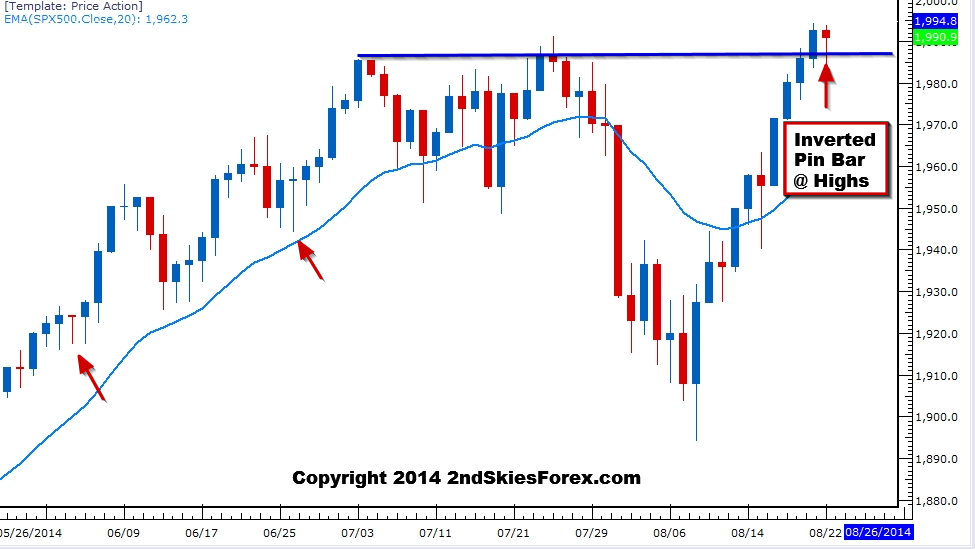

S&P 500 – Forms Inverted Pin Bar at Highs

Closing bullish 7 of the last 10 days, the S&P 500 produced all time highs as we wrote in our market commentaries from last week. After touching a high of 1994, the major US index formed an intra-day pullback near the highs.

However, the pullback found buyers intra-day, thus creating an inverted pin bar at the highs. In the past, the inverted pin bars near the highs has usually led to new swing highs being made. They have either resulted in an immediate push higher, or a small pullback which led to buyers stepping in taking it further north.

Either way, bulls are still in control and seem set to touch the ‘big figure‘ at 2000. Any corrective pullbacks towards 1940/45 should be considered good opportunities to get long and trade with the trend. Only a daily close below 1900 would change our medium term bullish sentiment.

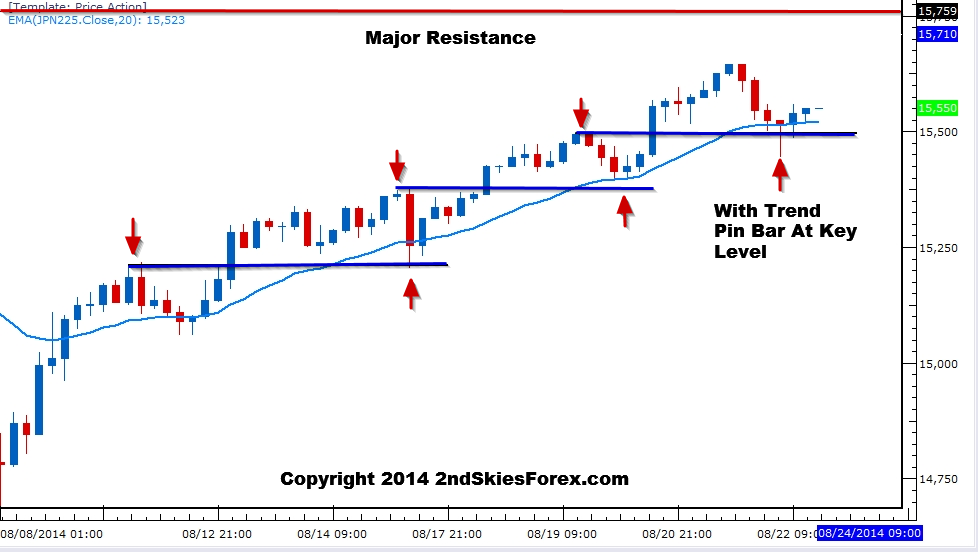

Nikkei 225 – With Trend Pin Bar At Key Level (4hr chart)

Up over +700 points since bottoming out on Aug. 8th, the Nikkei has been in a structured uptrend, offering several good with trend trade setups. As you can see on the 4hr chart below, the Japanese index has consistently pulled back to key role reversal levels where buyers stepped in and started a new up-leg.

In this latest instance, the index formed a with trend pin bar at a key level. If the pattern holds, then the index should form a new high. Major resistance comes in at 15760 which is over 200 points above. Bulls not already long can consider getting long on corrective pullbacks early to start this week near the support zone around 15500-15045.

Only a daily close below 15000 breaks the pattern, and suggests either a range bound market, or a deeper correction lower. Until then, maintaining a decent bullish bias for now.