Trading Themes: Bulls didn’t get the June signal they were looking for from the April FOMC and despite the Fed sounding a little more optimistic about global conditions, the domestic outlook was downgraded once again with both inflation and growth forecasts lowered, underscored by a weaker-than-expected Q1 GDP print. Traders now look ahead to the upcoming employment reports with bulls hoping for further strong numbers.

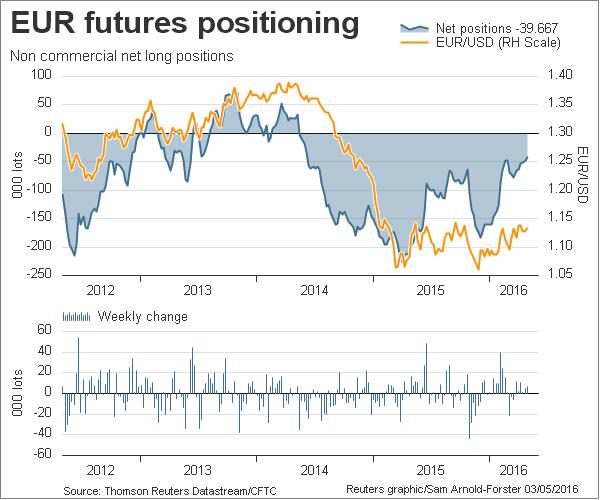

EUR: Despite recent weak inflation data, EUR remains supported by a weaker USD.

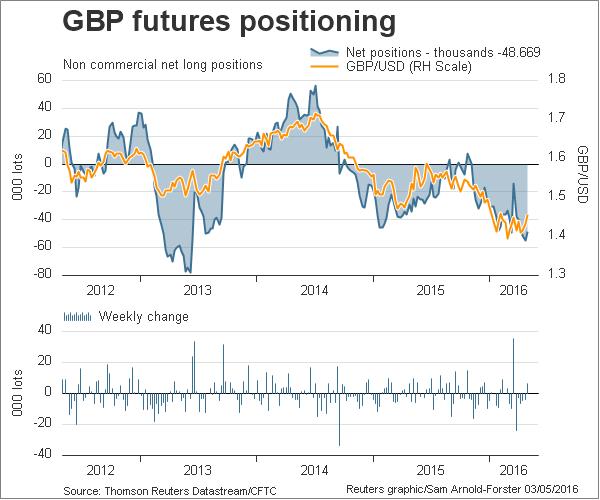

GBP: An improvement in the Brexit outlook keeps rate supported. GDP data beat expectations, keeping rate supported – PMI data next

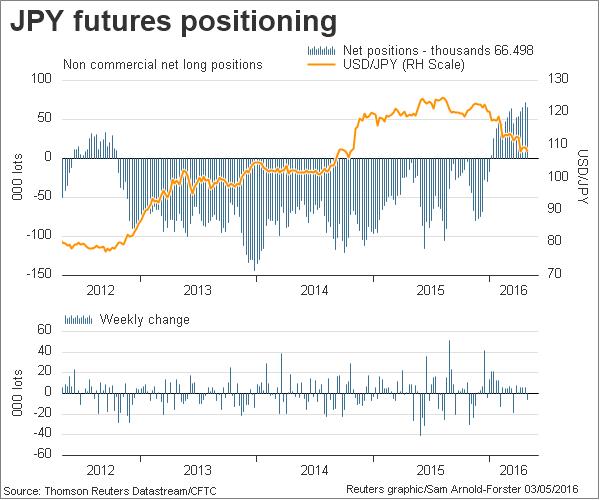

JPY: BOJ shocked markets by refraining from any further action leaving JPY strongly bid

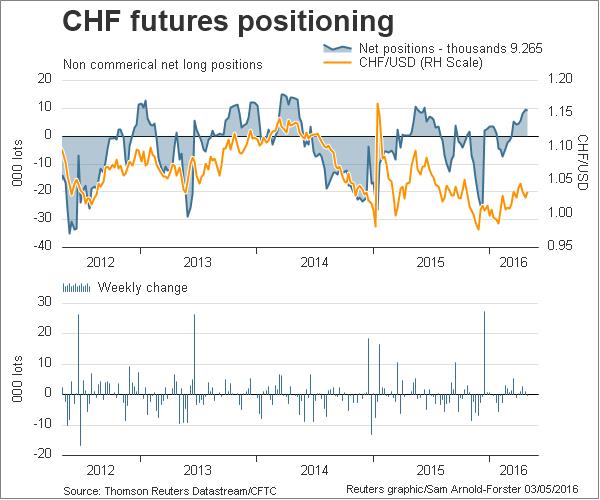

CHF: A lack of EUR downside keeps the pressure off the SNB for now.

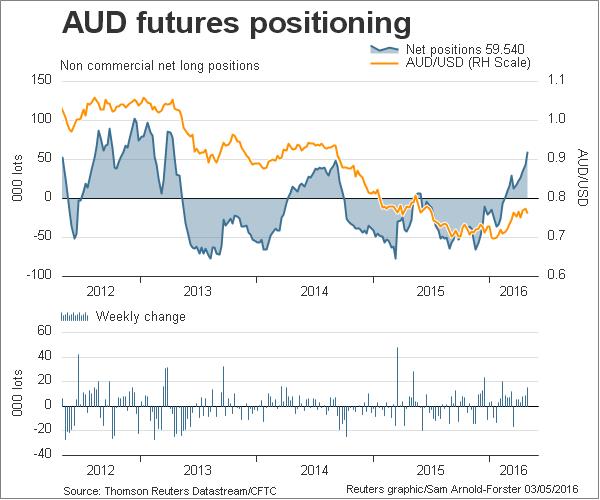

AUD: RBA slashed rates further to 1.75% to combat persistent low inflation – bank also highlighted the continued risks from China slow-down.

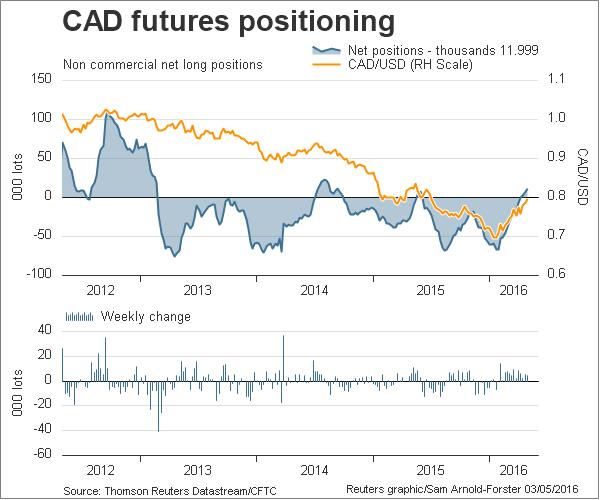

CAD: Supported by stronger oil and better-than-expected CPI print. Unemployment rate in focus later in the week.

Let’s take a look at what the latest COT report data is showing us from a trend and net change week over a week perspective…

- EUR bearish, flat on the week

- GBP bearish, decreased on the week

- JPY bullish, increased on the week

- CHF bullish, increased on the week

- AUD bullish, increased on the week

- CAD bearish, decreased on the week

EUR/USD Outlook – Bearish

Despite some weak data prints, the euro remained supported over the week, benefiting from a weaker USD. On the data front, German harmonized CPI fell into negative territory whilst Eurozone CPI also printed below expectations with headline inflation falling deeper into negative territory and core CPI printing 0.8% against 0.9% expected. EZ Retail Sales the only key domestic data print on the week.

COT Indicators

- Index active buy signal ticks up

- Strength active sell signal ticks up

- Momentum buy signal ticks up

LFOrder Flow Trader Bullish

GBP/USD Outlook – Bearish

Sterling strengthened over the week bolstered by an improvement in the Brexit outlook as the latest polls show an increasing number of voters are in favour of the UK remaining in the EU. These moves were furthered by positive Data flow as Q1 GDP printed above expectations, following on from a recent up tick in CPI. Domestic data focus this week will be on a raft of PMI data sets.

COT Indicators

- Index sell signal consolidates

- Strength sell signal consolidates

- Momentum sell signal given

LFOrder Flow Trader Bullish

USD/JPY Outlook – Bullish

The Japanese yen was driven sharply higher over the week in response to the BOJ April rates meeting which saw the bank shock markets by refraining from any further easing at this point. This decision came just as the latest inflation data showed the Japanese economy has once again slipped back into deflation. Alongside keeping current policy unchanged the bank lowered its growth and inflation forecasts for fiscal 2017.

COT Indicators

- Strength active sell signal, ticks down

- Index active sell signal ticks down

- Momentum sell signal given

LFOrder Flow Trader Bearish

USD/CHF Outlook – Bullish

With EUR having moved counter-intuitively higher in response to the latest ECB measures, it seems some pressure has likely been alleviated from the SNB who refrained from moving on rates at their recent meeting. Worth noting however that recently SNB’s Jordan has warned of a “nuclear” option in the event of continued CHF appreciation stating that the SNB can cut the exemption from negative deposit rates that it extended to most domestic banks’ reserves. The latest CPI data for Switzerland showed that inflation grew 0.3% MoM as expected, adding support for the Swiss franc.

COT Indicators

- Strength active sell signal consolidates

- Index active sell signal consolidates

- Momentum buy signal given

LFOrder Flow Trader Bearish

AUD/USD – Outlook Bullish

The RBA confirmed market expectations by slashing their headline cash rate a further .25% to 1.75% at their May rates decision citing continued low inflation (highlighted by last week’s disappointing reading) and continued threat from the slow-down in China).

COT Indicators

- Strength active buy signal, ticks up

- Index active buy signal ticks up

- Momentum buy signal given

LFOrder Flow Trader Bearish

USD/CAD Outlook – Bullish

The Canadian dollar has continued to strengthen this week boosted by yet further gains in oil which continue to print fresh five month highs. Canadian GDP in February printed in line with expectations. Traders now look ahead to domestic Unemployment rate on Friday.

COT Indicators

- Strength sell signal ticks consolidates

- Index active sell signal consolidates

- Momentum sell signal consolidates

LFOrder Flow Trader Bearish