The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Wednesday uncertain.

- ES pivot 2079.25. Holding above is bullish.

- Rest of week bias higher technically.

- Monthly outlook: bias lower.

- Single stock trader: VZ very near a swing trade buy.

Recap

Ah, Turnaround Tuesday to the rescue as the Dow finally snapped an ugly six session losing streak in style with a nice 190 point pop. Thanks to the Fed, the Chinese, whoever, doesn't matter. The bottom line is that the technicals worked. Now we move on to Wednesday but we'll cut to the chase right here - this Wednesday is a Fed day and it is my policy to always call Fed days uncertain.

The technicals

The Dow: The Dow's 190 point pop on Tuesday was enough to bounce it right out of its descending RTC for a bullish setup and finally give us a long-awaited bullish stochastic crossover. And with indicators still oversold, this chart looks bullish.

The VIX: On Tuesday the VIX nicely completed its bearish evening star with a big 13.85% plunge, completely giving up the 200 day MA on a tall red candle. Indicators remain overbought and the stochastic is within inches of a bearish crossover so this chart looks lower to me Wednesday.

Market index futures: Tonight, all three futures are lower at 12:10 AM EDT with ES down 0.12%. On Tuesday ES did very well, retracing all of Monday's losses plus half of last Friday's. That was also enough to solidly complete a bullish stochastic crossover So I have to think this chart remains bullish, though the sag in the overnight suggests we could be in for a pause on Wednesday.

ES daily pivot: Tonight the ES daily pivot rises again from 2067.25 to 2079.25. Despite overnight weakness so far ES remains above its new pivot so this indicator continues bullish.

Dollar index: On Tuesday the dollar continued its stair step decline by actually rising 0.27% but remaining in a two-week downtrend. That may be about to end though because the indicators are now oversold and the stochastic has finally begun to curve around for a bullish crossover all while indicators are still oversold.

Euro: Last night I wrote that "chances are good the euro goes lower on Tuesday". And so they were with the euro falling back to 1.1049 on an almost-dark cloud cover red marubozu. That was enough to curve around the stochastic which is now real close to a bearish crossover. The overnight is trying to rally but the daily trend seems more to suggest continued lower.

Transportation: The Trans had a huge day Tuesday, erasing thee days of losses in one swell foop, sending the indicators off oversold and forming a new bullish stochastic crossover. We're actually near resistance now but there's still some room to run and in any case there's no bearish signs on this chart right now.

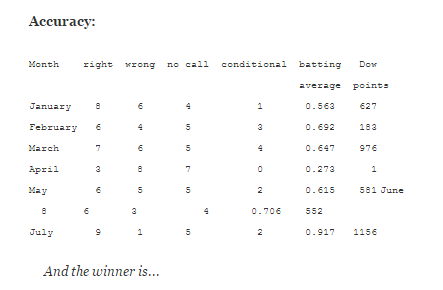

Accuracy:

And the winner is...

As a matter of policy, I am calling Wednesday uncertain. Although someone on CNBC made the interesting point that on Fed days lacking a press conference (as this one is), the market is down 90% of the time. And so far anyway, the futures action seem to be supporting that but it's really all just going to come down to whatever Auntie Janet has to say.

Single Stock Trader

Last night I was thinking Verizon (NYSE:VZ) was near a swing buy and on Tuesday it did post a small six cent gain but on an odd red hammer. Still, we remain quite oversold and right on the edge of the descending RTC, and two hammers are better than one so basically nothing's changed. We're near a buy but I can't quite bless it just yet.