Many around the world might be watching interest rates a little closer today, due to the Fed announcement this afternoon. Regardless of what the Fed does this afternoon, how do you make decisions regarding rates and bond prices? Should you base your decision on 10 words Janet says this afternoon or by relying on patterns created by billions of free thinking people over the past few decades? I suspect you know what I favor!

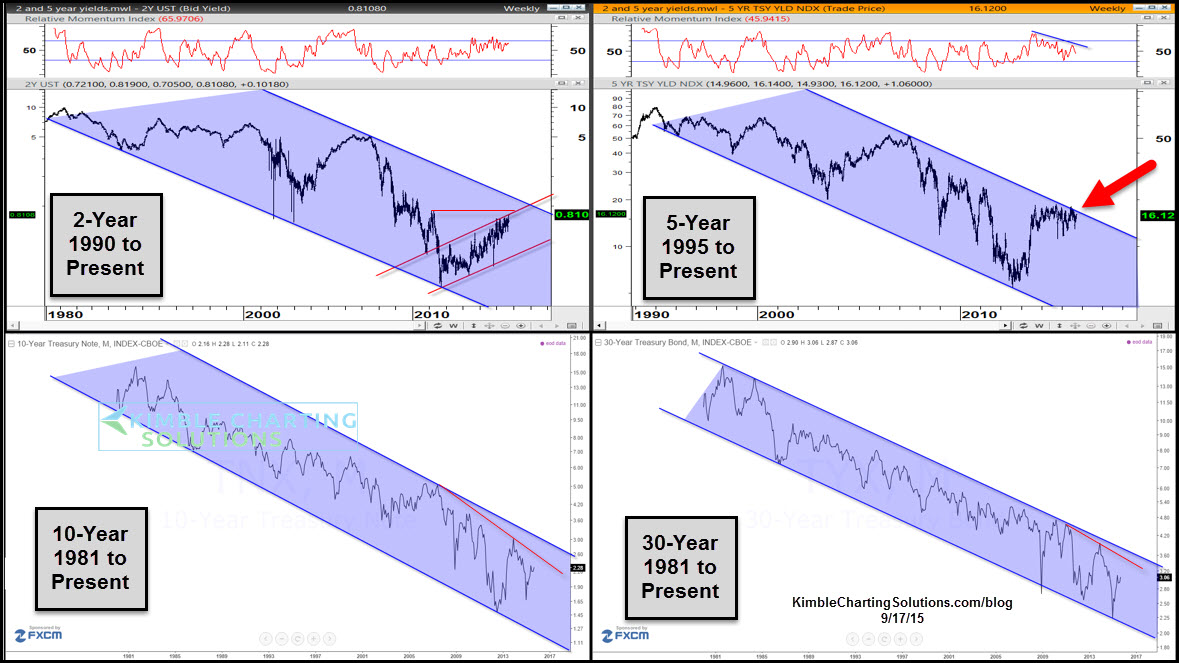

The 4-pack below looks at the U.S. 2-, 5-, 10- and 30-Year yield patterns going back at least 20-years.

As one can see, from a long-term perspective, each of these remain inside of multi-decade falling channels. The closest to breaking out is the 5-year yield, as it has been near the top of its 20-year falling channel for the past year.

I have a question for you…Are these patterns more influenced by the Fed or billions of free thinking investors/traders?

Some would say that the Fed might have the most influence over the 2-year note and the longer the note/bond is, the lower the influence by the Fed. Whether this is true and you agree with it or not, the bottom line is, none of these long-term falling yield channels have broken to the upside. The 10- and 30-year yields aren’t even that close to long-term falling resistance.

From a short-term perspective, I will be watching the price action of the iShares 20+ Year Treasury Bond ETF (NYSE:TLT) today very closely, due to the pattern situation in the chart below

TLT came into the year on a roll, as it screamed higher in 2014, moving almost 40% higher in 12-months. Once TLT hit channel resistance in January of this year it stopped on a dime and started a steep fall.

As it was hitting resistance in January, I shared “10 Reasons Rates Are About To Rise/Bonds Fall In Price”. Soon after sharing these reasons, TLT quickly lost 25% of its value, as bonds experienced one of the largest short-term declines in history. The decline then stopped as it hit rising support, that is again being tested today at (1) above.

I will admit I have a bias and that bias is…Don’t overlook the power of billions of free thinking people and investors when it comes to trends. Governments in the end have never been able to control the free markets and I doubt what the Fed does or doesn’t do this afternoon will change the fact that rates remain solidly in 20-year falling channels.