Overview

Vivint Solar (VSLR) offers distributed solar energy — electricity generated by a solar energy system installed at or near customers’ locations — to residential customers based on 20-year contracts at prices below their current utility rates.

Based in Provo, Utah, the company is scheduled a $350 million IPO on NYSE with a market capitalization of $1.8 billion at a price range midpoint of $17 for Wednesday, Oct.1, 2014.

According to GTM Research, an industry specific research firm, VSLR was the second largest installer of solar energy system in the U.S. residential market with approximately 8% market share in 2013 and 9% in the first quarter of 2014, up from 1% in 2012 according to its 'Q2 2014 PV Leaderboard' report.

Management

Manager, Co-managers: Goldman Sachs, BofA Merrill Lynch, Credit Suisse, Citi, Deutsche Bank, Morgan Stanley, Barclays, Blackstone Capital Markets

Joint-managers: None

SEC Documents

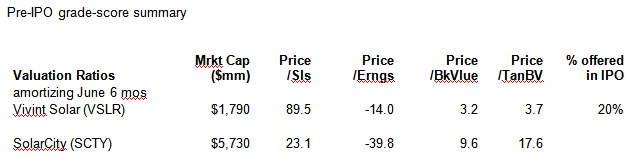

Valuation (Glossary)

Conclusion

Buy:

- 6 mos revenue up +423% to $10 million.

- #2 in the solar installation business

- Loss tripled to -$64 million from $-21 million

For the six months ended June '14

-- Revenue up +423% to $10 million.

-- Loss tripled to -$64 million from $-21 million

SolarCity (SCTY) down to $61 from $70 in last 2 weeks. In the last month SolarCity (SCTY) has seen a high of $70 and is now $62, not a good sign for the category.

To put the conclusions and observations in context, the following is reorganized, edited and summarized from the full S-1 referenced above.

Business

VSLR offers distributed solar energy — electricity generated by a solar energy system installed at or near customers’ locations — to residential customers based on 20-year contracts at prices below their current utility rates.

VSLR currently operates in Arizona, California, Hawaii, Maryland, Massachusetts, New Jersey and New York.

2nd largest installer of residential energy systems

According to GTM Research, an industry research firm, VSLR was the second largest installer of solar energy systems to the U.S. residential market with approximately 8% market share in 2013 and 9% in the first quarter of 2014 up from 1% in 2012, according to its ‘Q2 2014 PV Leaderboard’ report.

Growth plan

During 2014 VSLR plans to open at least 20 new offices in states in which it currently has operations and new states into which it is expanding.

Additionally, VSLR is considering the option of expanding into markets outside of the residential market. These markets may include small businesses such as community retailers as well as larger retailers and manufacturers

VSLR’s customers pay little to no money upfront, typically realize savings of 15% to 30% relative to utility-generated electricity immediately following system interconnection to the power grid and continue to benefit from guaranteed energy prices over the term of their contracts, insulating them against unpredictable increases in utility rates.

VSLR’s 20-year customer contracts generate predictable, recurring cash flows and establish a long-term relationship with homeowners.

Investment funds

Through its investment funds, VSLR owns an interest in the solar energy systems VSLR instalsl and ownership of the solar energy systems allows it and the other fund investors to benefit from various local, state and federal incentives.

Together, these cash flows and incentives facilitate VSLR’s ability to obtain financing and to optimize its financial returns on investment.

These cash flows are not impacted if a customer decides to move or sell the home prior to the end of the customer contract term because the customer contracts allow VSLR’s customers to transfer their obligations to the new home buyer (subject to a creditworthiness determination).

If the home buyer is not creditworthy or does not wish to assume the customer’s obligations, the contract allows VSLR to require the customer to purchase the system.

VSLR’s sources of financing are designed to offset its direct installation costs and most, if not all, of its allocated overhead expenses.

Direct relationship with homeowners

VSLR’s direct relationship with homeowners also facilitates its ability to control quality and provide high levels of customer service and provides it with an opportunity to offer additional value-added products and services to its customers.

From its inception in May 2011 through June 30, 2014, VSLR has experienced rapid growth, installing solar energy systems with an aggregate of 129.7 megawatts of capacity at more than 21,900 homes in seven states for an average solar energy system capacity of approximately 5.9 kilowatts.

Intellectual property

As of June 30, 2014, VSLR, through its wholly owned subsidiary Solmetric Corporation, or Solmetric, had five patents and six pending applications with the U.S. Patent and Trademark Office.

These patents and applications relate to shade and site analysis. VSLR’s issued patents start expiring in 2026.

While VSLR does not currently have an extensive patent portfolio, it intends to file additional patent applications as VSLR innovates through its research and development efforts.

Solmetric is best known for the “SunEye” hardware and “PV Designer” software product lines. Solmetric’s products are fundamental to VSLR’s solar installation efforts and give VSLR more accurate solar energy assessments during the pre-install process and fast and accurate performance testing during commissioning and operations and management.

The SunEye is a handheld electronic tool that provides shade analysis. PV Designer allows layout and energy production estimates for the optimum photovoltaic design on a customer’s home.

Competition

VSLR believes that its primary competitors are the traditional utilities that supply electricity to its potential customers.

VSLR competes with these traditional utilities primarily based on price (cents per kilowatt hour), predictability of future prices (by providing pre-determined annual price escalations) and the ease by which customers can switch to electricity generated by its solar energy systems.

VSLR believes that it competes favorably with traditional utilities based on these factors in the states where VSLR offers its solar power purchase and solar energy leasing services.

VSLR also competes with companies that are not regulated like traditional utilities but that have access to the traditional utility electricity transmission and distribution infrastructure pursuant to state and local pro-competitive and consumer choice policies and with solar companies with business models that are similar to VSLR's such as SolarCity Corporation.

VSLR believes that it competes favorably with these companies based on its customer service, including its speed from signing a customer agreement to installation, its in-house installation, operations and maintenance teams, and a results-focused back office that quickly and efficiently addresses customer inquiries.

5% shareholders pre-IPO

313 Acquisition LLC 97.2%

Dividend Policy

No dividends are planned.

Use of proceeds

VSLR intends to use the $320 million in proceeds from its IPO as follows:

Approximately $58.8 million of the net proceeds received by VSLR from this offering will be used to repay revolver borrowings incurred under revolving lines of credit with Vivint.

VSLR plans to use the remaining net proceeds that it receives in this offering for working capital and general corporate purposes.

VSLR may also use a portion of the net proceeds to acquire, license and invest in complementary products, technologies or businesses; however, VSLR currently has no agreements or commitments to complete any such transaction.

The full IPO calendar is available at IPOpremium

Disclaimer: This VSLR IPO report is based on a reading and analysis of VSLR’s S-1 filing, which can be found here, and a separate, independent analysis by IPOdesktop.com. There are no unattributed direct quotes in this article.