While it’s typically the marquee event for any given week (if not the whole month), yesterday’s FOMC monetary policy statement was a bit of a dud (see FOMC Instant Reaction). The central bank made only small tweaks to its monetary policy statement, careful not to tip the scales in the increasingly important “September-vs.-December” debate over liftoff for interest rates. The dollar saw a bit of a recovery after the report, but all in all, traders expecting substantial volatility were disappointed yesterday.

Thankfully, market participants also had today’s Q2 US Advance GDP estimate to look forward to, and as it turns out, that report was far more instructive on the US economy’s performance than the typically-opaque FOMC statement. US GDP rose at a 2.3% annualized rate in the second quarter, slightly below the 2.5% reading expected, but just about every other aspect of the report was better than anticipated. Q2 GDP was powered by the consumer, with personal consumption rising at 2.9%, better than the 2.7% growth rate expected. The strong reading in this more sustainable growth source shows strength underneath the surface of the headline number. Most importantly, the Q1 GDP estimate was revised sharply higher, from -0.2% annualized up to +0.8%, showing that the Q1 slowdown was not nearly as bad as many economists feared. The simultaneous initial weekly jobless claims report was also generally solid, printing at 267k after last week’s historically low 255k reading.

Of course, all US economic reports are immediately filtered through the lens of Fed policy and though today’s GDP reading is unlikely to lead to a dramatic shift in interest rate expectations, it lends a bit of support to the hawks. Looking ahead, next week’s NFP report will absolutely essential, with traders looking for 250k jobs and an uptick in average hourly earnings to help bolster the case for a September rate hike.

Pair to Watch: USD/CAD

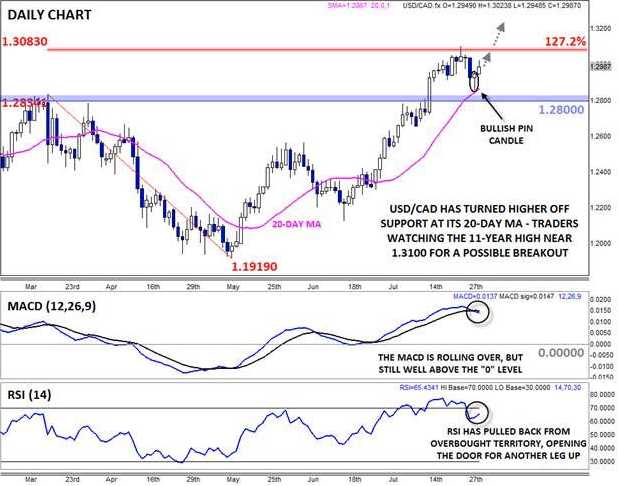

For its part, USD/CAD briefly set an 11-year high above 1.3060 on Friday, but bulls opted to book profits at that level, leading to a pullback to the 20-day MA around 1.2860 yesterday. From there, buyers stepped back in to support the pair, creating a clear Bullish Pin Candle*, or hammer formation, on the daily chart; for the uninitiated, this pattern shows an intraday shift from selling to buying pressure and is often seen at near-term bottoms in the market. While the lagging MACD indicator has started to roll over, it is still well above the “0” level and the RSI has also pulled back from overbought territory, potentially clearing the way for another leg higher.

From here, all eyes will be on last week’s high in the 1.3060-1.3100 zone; if bulls are able to muster enough strength to break that barrier, a strong continuation to 1.32 or higher could be in play. The overall bias will remain generally higher as long as oil prices remain subdued and USD/CAD holds above previous-resistance-turned-support near the 1.2800 handle.

*A Bullish Pin (Pinnochio) candle, also known as a hammer or paper umbrella, is formed when prices fall within the candle before buyers step in and push prices back up to close near the open. It suggests the potential for a bullish continuation if the high of the candle is broken.

Source: FOREX.com