US FED will release the statement today, without any press conference, and we will probably have some range-bound market till FED statement. Expectations towards rate hike are rising and we could see a rate hike in between September and December. US CPI has come in line with expectations, Core Durable Orders also while major news release for CAD will be GDP later in the week (Friday). However, any mention of a possible hike is bullish to USD, and traders will pay close attention to FED’s statement.

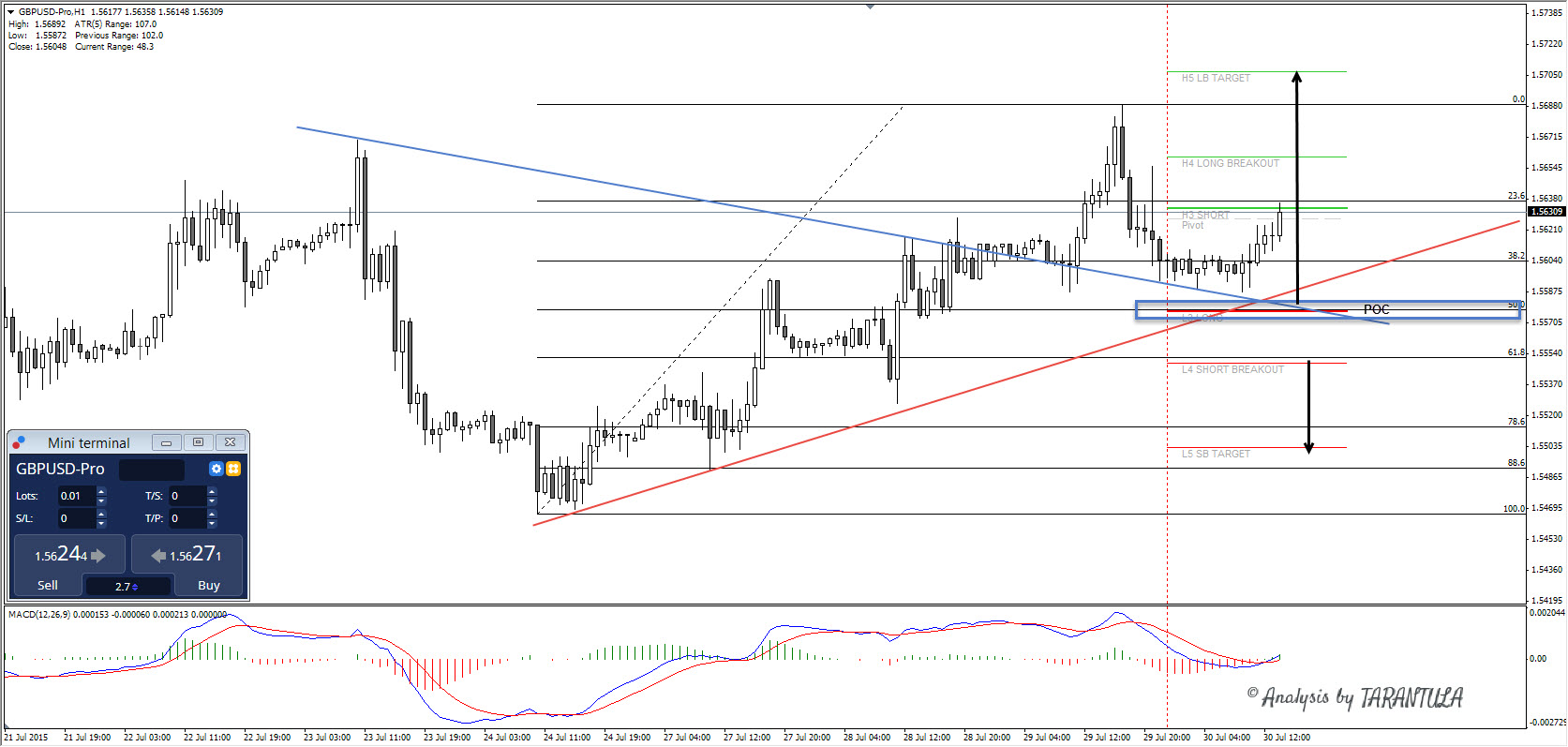

Technically, USD/CAD has broken through 4h trend line, and it is falling towards POC. POC1 (L4, triple bottom, 50.0 fib) comes at 1.2930 zone and the zone could reject the price. If the retracement continues, next zone to watch for is 1.2865-45 (L5, 61.8 fib) just above strong round number support, which makes a confluence with double top/historical breakout point and 78.6. That support is naturally 1.2800. If the pair gains upward momentum after rejection, it will target .1.3030 and 1.3100. Only H4 close above 1.3100 will target 1.3150. However, a drop below 1.2800 could extend towards 1.2750 and 1.2700.