USD/TRY has actually entered a new zone after military conflict between Turkey and Russia.

Nov 23,2015 :

Turkey snap elections result in major victory of leading party AKP. This fundamentally moved Turkey into positive territory due to political stability and created optimistic structure for the public, financial and private sector.

Nov 24,2015 :

The day where Turkish leading party AKP would announce the new cabinet with high expectations would weaken USD/TRY further; early in the morning Turkish F-16 shot Russian SU-24 down.

My understanding of Turkey:

Since Jan 2015, I was strongly bullish on every article about USD/TRY. The reason, though, was due to the technical structure of the weekly USD/TRY chart, where it wasn't fitting with the fundamental structure. But in the following weeks, fundamental followed technical structure and USD/TRY moved in the predicted direction right before/after the June 2015 elections, where leading party AKP lost the majority, and USD/TRY moved to over 3.0000 critical level for the first time in history.

While weak TRY could help exporters, on the other hand, there are more negative effects than positive, such as

-Turkish private sector can loan with foreign currency, even without forex revenue.

-Turkey 50% export EZ with EUR, where EUR is almost parity with USD down 40%

-Turkish export is strongly correlated with import raw material where import is based on USD. Weakening EUR/USD actually wiped a big bunch of Turkish exporters' profits on both sides, USD and EUR

Moreover;

-Due to weak EZ GDP, export to zone is also weak.

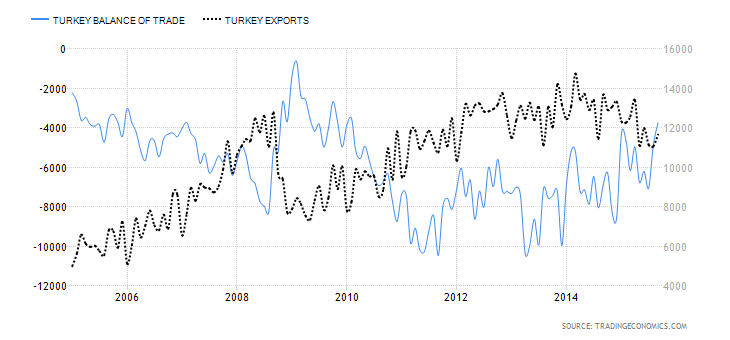

-Turkey has chronic trade deficit issues and trade deficit has reverse correlated with exports.

-Tukey actually has had a growing construction sector for the last decade

-Public debt has dramatically increased in the last decade and there is not much room left to loan more.

To Sum Up:

Turkey actually is growing below 5.0 for last five quarters.

Public debt

Slowing domestic growth

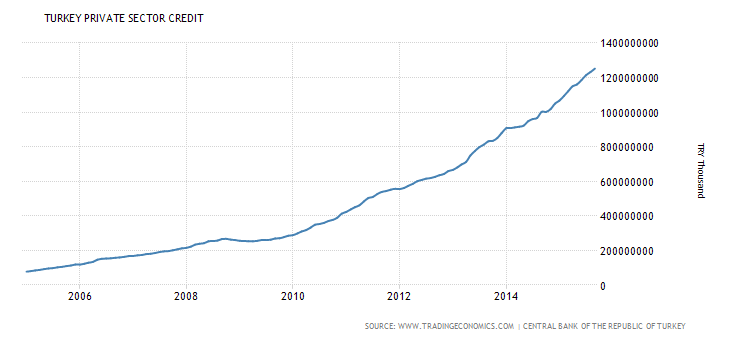

Private sector debt

EUR/USD weakening [where we can expect more with ECB and FED next actions]

Weak EZ GDP and import power

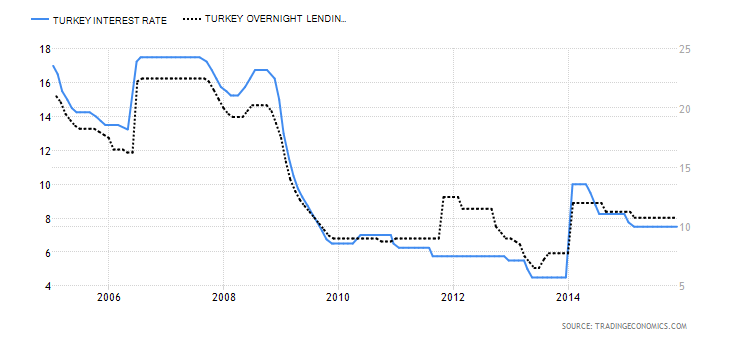

High lending rate even before FED rise, where rise might force Central Bank of Turkey into a logarithmic increase

High unemployment

Very possible housing bubble

And finally, the last brick taken out from the wall is military conflict between Turkey and Russia, when we look into details;

-Turkey natural gas import from Russia

-Turkey's construction projects in Russia

-Tourism income of Turkey

-Deal for the Turkey's first Nuclear Power Reactor with Russia

And actually Russia was the last local country where Turkey actually can work together while having issues with Syria, Iran, Iraq, Armenia, Israel and Egypt

I am bullish on USD/TRY.