USD/SGD is showing little movement on Monday, as the pair trades at the 1.38 line early in the North American session.

In economic news, Singapore CPI posted a decline of 0.5%. It’s a quiet start to the week in the US, with only one event on the schedule, Flash Manufacturing PMI. The estimate stands at 51.0 points.

Singapore released its year-on-year CPI for April, and the index came in at -0.5%, as consumer inflation continues to drop. The April report marked the 18th consecutive month that CPI has declined. This marked the longest stretch of declines since 1977.

The Monetary Authority of Singapore expects inflation to rise in the second half of 2016, in part due to the expectation that oil prices will continue to rise during the year. We’ll get a look at Singapore GDP for the first quarter on Wednesday. The fourth quarter release was a disappointment, with a flat reading of 0.0%.

Last week’s Federal Reserve minutes were more hawkish than expected, resulting in strong volatility in the global currency markets. The minutes indicated that a June interest rate hike remains firmly on the table, and the currency markets have reacted with strong volatility.

According to the minutes, the Fed wants to see stronger growth in the second quarter as well as better numbers from the inflation and employment fronts. If this is achieved, the Fed said it “likely would be appropriate” to raise rates at the June meeting.

This message is somewhat hawkish in comparison to recent statements by Fed chair Janet Yellen, which were more cautious about the strength of the US economy.

The markets were skeptical that June would be a “live meeting”, with most analysts assuming that the Fed would continue to sit on the sidelines.

The minutes have drastically changed market sentiment, however, since it’s clear that the June meeting will be a crucial one, as it could mark the Fed’s first interest rate hike this year.

With the Fed saying that a key factor in a rate hike decision will be the strength of the US economy, upcoming major economic indicators will be under the market microscope, particularly inflation and employment numbers.

USD/SGD Fundamentals

Monday (May 23)

- 00:00 Singapore CPI. Actual -0.5%

- 10:15 US FOMC Member James Bullard Speaks

- 13:45 US Flash Manufacturing PMI. Estimate 51.0

*All release times are EDT

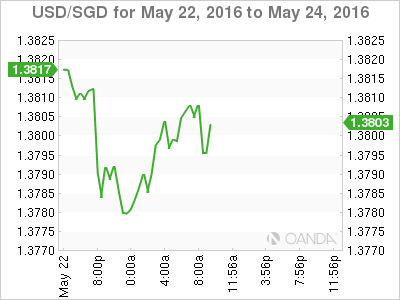

USD/SGD for Monday, May 23, 2016

USD/SGD May 23 at 9:00 EDT

Open: 1.3811 Low: 1.3770 High: 1.3812 Close: 1.3797

USD/SGD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.3535 | 1.3639 | 1.3721 | 1.3808 | 1.3901 | 1.4043 |

- USD/SGD has shown limited movement in the Monday session

- 1.3721 is providing support

- 13808 was tested in resistance and could break during the day

- Current range: 1.3721 to 1.3808

Further levels in both directions:

- Below: 1.3721, 1.3639 and 1.3535

- Above: 1.3808, 1.3901 and 1.4043