USD/JPY continues to have a quiet week, as the pair remains close to the 110 line in the Thursday session. On the release front, Japanese corporate inflation posted a weak gain of 0.2%, matching the forecast. In the US, it’s a busy day, with three key events – Core Durable Goods Orders, Unemployment Claims and Pending Home Sales. If there are some unexpected readings, we could see some volatility in the currency markets during the North American session. On Friday, the US releases Preliminary GDP and UoM Consumer Sentiment.

The Japanese economy remains hampered by weak inflation levels, which was underscored by SPPI, which posted a weak gain of 0.2%. Tokyo Core CPI, the most important Japanese inflation indicator, has posted four straight declines, and more bad news is expected in the April report, with an estimate of -0.4%. Meanwhile, the G7 finance ministers held meetings last week in Tokyo and the threat of currency intervention surfaced during the summit. There was strong disagreement between the US and Japan regarding recent statements from Japan that it would intervene in the currency markets to curb the yen’s sharp appreciation in 2016. Japanese Finance Minister Taro Aso insisted that recent currency moves were “one-sided and speculative” and recent yen gains had been disorderly. US Treasury Secretary Jack Lew countered that the yen’s move were not disorderly. The tension between the US and Japan over the yen was not resolved at the G-7 meeting and is likely to heat up if the currency rebounds and moves closer to the symbolic 100 level.

As little as a week ago, talk of a June rate hike was off the radar, but that has quickly changed after last week’s Fed minutes. The report was more hawkish than expected, and this resulted in strong volatility in the currency markets. It has also renewed market speculation about a June rate hike. Odds of a rate hike in June increased to 40% on Wednesday, compared to just 4% one week ago. Still, the Fed will be hard-pressed to raise rates if key indicators don’t show improvement, particularly inflation numbers. On Monday, FOMC member John Williams reiterated that he expected the Fed to raise rates two or three times in 2016. However, there appears to be a gap between the hawkish message some FOMC members are sending out and market sentiment, as many analysts are projecting only one rate hike this year. The guessing game as to what the Fed has in mind is likely to continue into June, but it’s safe to say that another rate move will be data-dependent, so stronger US numbers will increase the likelihood of a quarter-point hike at the June policy meeting. The Fed will be closely monitoring key events this week, notably GDP and UoM Consumer Sentiment.

USD/JPY Fundamentals

Wednesday (May 25)

- 19:50 Japanese SPPI. Estimate 0.2%. Actual 0.2%

Thursday (May 26)

- Day 1 – G7 Meetings

- 10:10 US FOMC Member James Bullard Speaks

- 12:30 US Core Durable Goods Orders. Estimate 0.3%

- 12:30 US Unemployment Claims. Estimate 275K

- 12:30 US Durable Goods Orders. Estimate 0.3%

- 14:00 US Pending Home Sales. Estimate 0.6%

- 14:30 US Natural Gas Storage. Estimate 67B

- 16:00 US FOMC Jerome Powell Speaks

- 19:30 Japanese Tokyo CPI. Estimate -0.4%

- 19:30 Japanese National Core CPI. Estimate -0.4%

Upcoming Key Events

Friday (May 27)

- 12:30 US Preliminary GDP. Estimate 0.8%

- 14:00 US Revised UoM Consumer Sentiment. Estimate 95.7

*Key releases are highlighted in bold

*All release times are EDT

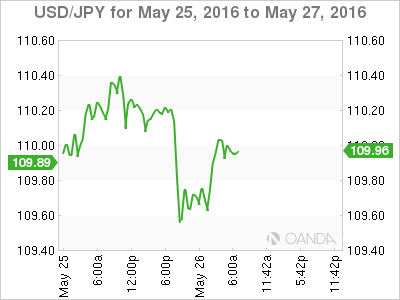

USD/JPY for Thursday, May 26, 2016

USD/JPY May 26 at 10:00 EDT

Open: 110.13 Low: 109.40 High: 110.13 Close: 109.97

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 107.57 | 108.37 | 109.87 | 110.66 | 111.30 | 112.26 |

- USD/JPY posted losses in the Asian session but has recovered in European trade

- 109.87 remains fluid and has switched to a support role. It is a weak line and could see further action during the day

- There is resistance at 110.66

- Current range: 109.87 to 110.66

Further levels in both directions:

- Below: 109.87, 108.37, 107.57 and 106.19

- Above: 110.66, 111.30 and 112.26

OANDA’s Open Positions Ratio

The USD/JPY ratio is showing slight movement towards short positions on Thursday. Long positions retain a majority (55%), indicative of trader bias towards USD/JPY breaking out and moving higher.