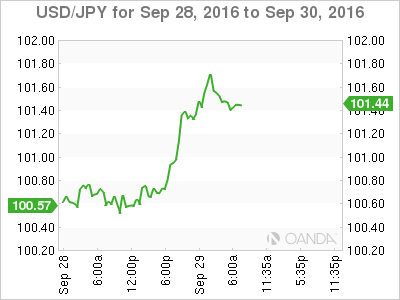

The Japanese yen continues to lose ground this week. USD/JPY has pushed above the 101 line and is currently trading at 101.40. It’s a busy day on the release front. Japanese Retail Sales declined 2.1%, missing expectations. Later in the day, Japan releases Tokyo Core CPI and Household Spending. In the US, today’s key release is Final GDP, with the estimate standing at 1.3%. We’ll also get a look at unemployment claims and pending home sales.

Japanese retail sales dropped 2.1% in August compared to a year ago, its lowest monthly decline since March 2015. This weak reading points to sluggish consumer spending, as consumers remain pessimistic about the economy and are holding tight to their purse strings. Weak spending is having a negative effect on inflation, which remains very low. We’ll get a look at Household Spending and inflation indicators later on Thursday, and weak numbers could send the yen lower.

Earlier this week, BoJ Governor Haruhiko Kuroda said that the bank did not expect to make any major changes in its bond-buying scheme. The markets took this as a sign that the BoJ will stick with its current monetary policy, which has allowed the yen to climb 17 percent since January, when the BoJ first adopted negative rates. The yen last pushed below the 100 level in late August, and Japanese currency came very close to this symbolic line earlier this week.

US consumer confidence numbers continue to impress the markets. The CB Consumer Confidence jumped to 104.1 points in September, much higher than the forecast of 98.6 points. This excellent release improved upon a strong August report of 101.1 points.

Stronger consumer confidence often translates into increased spending by consumers, which is vital for economic growth. If upcoming consumer spending numbers also move higher, the likelihood of a December hike will likely increase. Currently, the markets have priced in a quarter-point hike in December at 48 percent.

With the Federal Reserve staying on the sidelines in September and the November meeting just before the US election, the markets have circled December as the next date for a possible rate hike. Last week’s policy statement was generally upbeat and broadly hinted at a December rate hike. However, the markets can be forgiven for remaining somewhat skeptical, as the Fed has previously talked about a strong US economy and failed to follow up with a rate hike.

Currently, a rate hike is priced in at 48 percent, but plenty can happen before the December policy meeting. The Fed has been sending out mixed messages about a rate hike, and this was underscored in the September decision, in which three FOMC members dissented and voted for an immediate hike. This lack of clarity has been disconcerting to the markets, which are always allergic to uncertainty.

The markets haven’t forgotten that last December, the Fed projected a series of hikes in 2016, and has yet to deliver even one hike this year. As we approach December, the Fed will need to send out a more uniform message in order to restore its credibility with the markets.

USD/JPY Fundamentals

Wednesday (September 28)

- 19:50 Japanese Retail Sales. Estimate -1.7%. Actual -2.1%

Thursday (September 29)

- 2:35 BoJ Governor Haruhiko Kuroda Speaks

- 8:30 US Final GDP. Estimate 1.3%

- 8:30 US Unemployment Claims. Estimate 260K

- 8:30 US Final GDP Price Index. Estimate 2.3%

- 8:30 US Goods Trade Balance. Estimate -62.6B

- 10:00 US FOMC Member Jerome Powell Speaks

- 10:00 US Pending Home Sales. Estimate -0.1%

- 10:30 US Natural Gas Storage. Estimate 57B

- 16:00 US Federal Chair Janet Yellen Speaks

- 19:30 Japanese Household Spending. Estimate -2.1%

- 19:30 Tokyo Core CPI. Estimate -0.4%

- 19:30 Japanese National Core CPI. Estimate -0.4%

- 19:30 Japanese Unemployment Rate. Estimate 3.0%

- 19:50 BoJ Summary of Opinions

- 19:50 Preliminary Industrial Production. Estimate 0.5%

- 20:00 BoJ Governor Haruhiko Kuroda Speaks

Friday (September 30)

- 10:00 US Revised UoM Consumer Sentiment. Estimate 90.1

*All release times are EDT

*Key events are in bold

USD/JPY for Thursday, September 29, 2016

USD/JPY September 29 at 6:50 EDT

Open: 100.94 High: 101.75 Low: 100.90 Close: 101.45

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 99.79 | 100.55 | 101.20 | 102.36 | 103.02 | 104.32 |

- USD/JPY posted strong gains in the Asian session. In European trade, the pair posted slight gains but then retracted

- 101.20 has switched to support following strong gains by USD/JPY in the Asian session

- There is resistance at 102.36

- Current range: 101.20 to 102.36

Further levels in both directions:

- Below: 101.20, 100.55, 99.71 and 98.95

- Above: 102.36 and 103.73 and 104.32

OANDA’s Open Positions Ratio

USD/JPY ratio has shown gains in short positions. Currently, long positions have a substantial majority (67%), indicative of trader bias towards USD/JPY continuing to move higher.