USD/JPY

Open 102.61

High 102.73

Low 102.38

Close 102.57

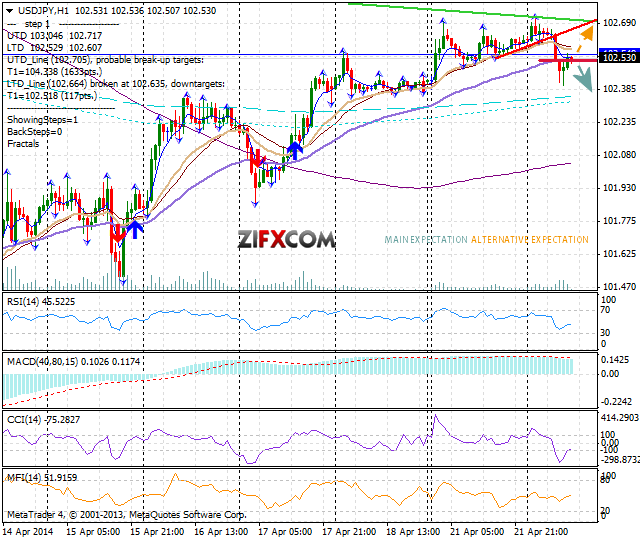

On Monday USD/JPY increased insignificantly with 30 pips. The currency couple appreciated from 102.38 to 102.71 yesterday, not matching the negative money flow sentiment at around -11%, closing the day at 102.57. This morning the dollar lifted slightly further against the Yen, reaching 102.73, than corrected.

On the 1 hour chart quotes are held within trading range, while on the 3 hour chart wider trading scope has formed. Break above yesterday's top and nearest resistance 102.73 would encourage further recovery of the dollar. Immediate support is yesterday's bottom at 102.38, and consistent break below it could strengthen the Yen further down towards next target 101.26.

Today were Japan Leading and Coincident indicators indexes, both at 5 GMT.

Quotes are moving below the 20 and just above the 50 the EMA on the 1 hour chart, indicating short term bearish and medium term slim bullish pressure. The value of the RSI indicator is neutral and hesitant, MACD is positive and tranquil, while CCI has crossed down the 100 line on the 1 hour chart, giving over all light short signals.

Technical resistance levels: 102.73 103.60 104.42

Technical support levels: 102.38 101.26 100.10

Today so far +2 pips profit/loss on USD/JPY today from the following sent to clients only signal:

5:15 GMT+1 Buy USD/JPY at 102.64 SL 102.38 TP 103.14, exit sent at 5:37 GMT+1.

Today so far +29, last Thursday +69.