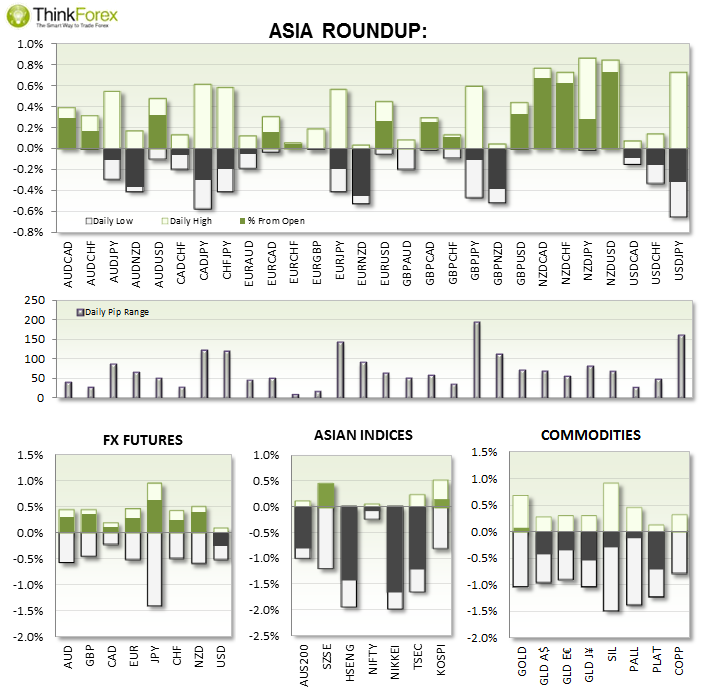

JPY: Japan is now in recession following a 2nd consecutive contracting GDP, which is -0.4% missing expectations of 0.5%. The previous quarter was -1.8%. The consensus is for a snap election and delay of the next sales tax rise.

AUD: Vehicle sales down -1.6%

UP NEXT:

Pairs to Monitor:

TECHNICAL ANALYSIS:

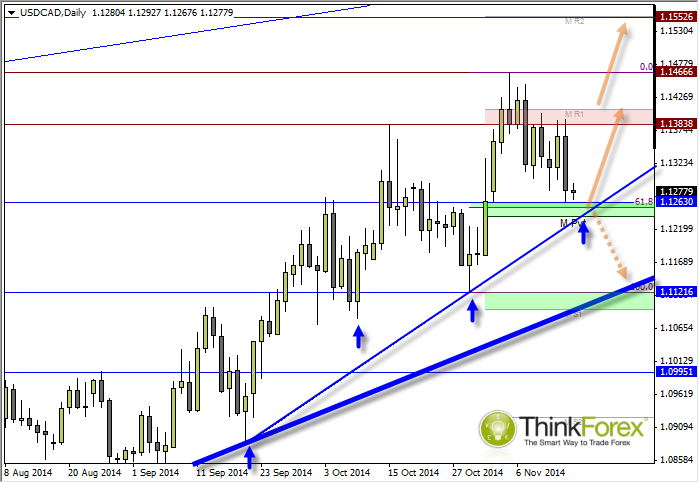

USD/CAD: Potential for swing low to form above support

There are several technical levels close by which may act as support and offer the potential for a relatively high reward/risk ratio to assume a long position.

The cycle troughs have been quite rhythmical, so if these remain consistent then we can expect a cycle low this week.

If there is anything going against the trade right now, it's the Bearish Engulfing Candle from Friday and that price remains around the lows of this candle. However if you look back at previous swing lows you'll notice that each swing low has seen a grizzly bearish candle right before the turning point.

Those eager to get in could consider buying at market. These who prefer a little more confirmation can see if we generate a bullish candle today or tomorrow.

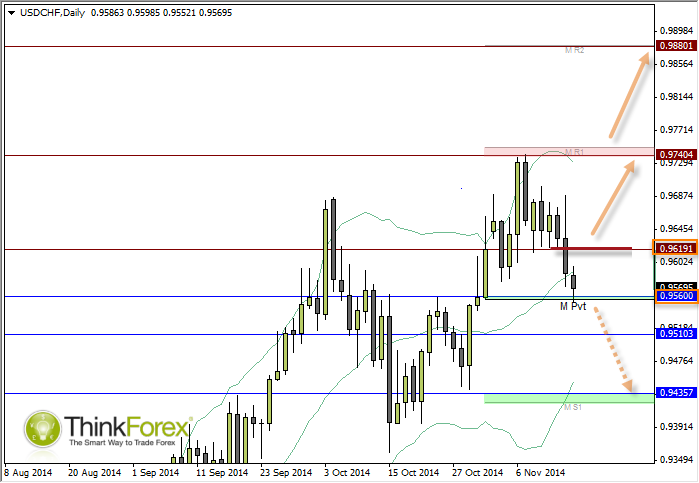

USD/CHF: Swissy ponders at a juncture

We have seen price revert to the mean as suggested on the 12th November and now await for either a basing pattern to form around current levels, or for a deeper retracement.

One option would be to set a buy-stop above 0.9720 resistance to catch any upside break. Should price break below 0.9560 then the order can be cancelled.

Alternatively a break below 0.9560 support could be taken as a sign for price to visit the lower Bollinger Band. However keep in mind this is trading against the dominant, bullish trend.

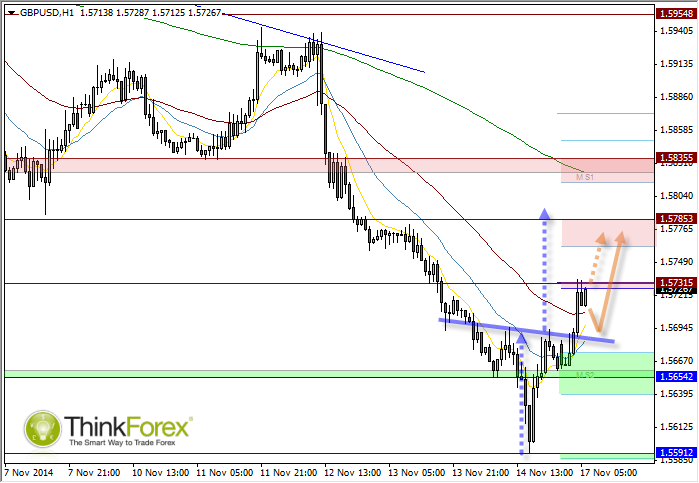

GBP/USD: Inverted Head and Shoulders in play

The 'Head' of the H&S rejected 1.56 with a V-Bottom to suggest aggressive buying at this level. The neckline has been confirmed and may act as support upon any retracements. A break below the neckline invalidates the setup.

However we may not see a retracement as price is forming a Bull Flag below 1.573 resistance. A break above this level should open up 1.578.