The Canadian dollar is showing little movement on Friday, as USD/CAD trades at the 1.16 line. On the release front, Canada releases CPI and Retail Sales data. The markets are bracing for weak figures, so we could see the Canadian dollar could find itself under pressure in the North American session. There are no US releases to wrap up the trading week.

In the US, Thursday’s key releases were a mix. Employment numbers continued to impress, as unemployment claims dropped to 289 thousand, the lowest level in six weeks. The easily beat the estimate of 297 thousand. The news was not as good on the manufacturing front, as the Philly Fed Manufacturing Index slid to 24.5 points, down from 40.6 points in November. The November reading was unusually high, and the markets had expected a sharp downturn, with the estimate standing at 26.3 points.

All eyes were on the Federal Reserve on Wednesday, as the Fed released its monthly policy statement. Previous Fed policy statements have usually stated that the Fed would maintain low rates for a “considerable time”, but the December statement changed terminology, saying the Fed would be “patient” before raising rates. In a follow-press conference, Federal Reserve chair Janet Yellen was less ambiguous, saying that the Fed was unlikely to raise rates for the “next couple of meetings”. The markets took this to mean that a rate hike is in the works, although not before April. The Canadian dollar showed some volatility on Wednesday but was almost unchanged on the day.

Canadian numbers have not impressed this week, and the trend could continue on Friday, as the markets are expecting weaker readings from CPI and Retail Sales. Canadian Wholesales Sales was unexpectedly weak in October, as the key indicator slipped to 0.1%, compared to a strong gain of 1.8% a month earlier. The estimate stood at 0.9%. On Tuesday, Canadian Manufacturing Sales declined by 0.6%, compared to a gain of 2.1% in the previous release. Despite these poor key releases, the Canadian dollar has managed to hold its own against its US counterpart.

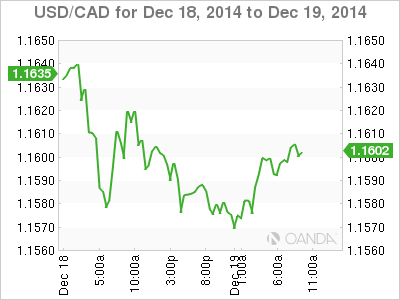

USD/CAD for Friday, December 19, 2014

USD/CAD December 19 at 11:25 GMT

- USD/CAD 1.1595 H: 1.1601 L: 1.1568

USD/CAD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.1278 | 1.1414 | 1.1493 | 1.1669 | 1.1723 | 1.1875 |

- USD/CAD was flat in the Asian session. The pair has edged higher in European trade.

- 1.1493 continues to provide strong support.

- On the upside, 1.1669 is an immediate resistance line.

- Current range: 1.1493 to 1.1669

Further levels in both directions:

- Below: 1.1493, 1.1414, 1.1278, 1.1124 and 1.1004

- Above: 1.1669, 1.1723, 1.1875 and 1.1975

OANDA’s Open Positions Ratio

USD/CAD ratio is showing gains in long positions on Friday. This is consistent with the movement of the pair, as the Canadian dollar has posted small gains. The ratio has a majority of short positions, indicative of trader bias towards USD/CAD moving to lower ground.

USD/CAD Fundamentals

- 13:30 Canadian Core CPI. Estimate 0.1%.

- 13:30 Canadian Core Retail Sales. Estimate 0.2%.

- 13:30 Canadian CPI. Estimate -0.2%.

- 13:30 Canadian Retail Sales. Estimate -0.4%.