GROWTHACES.COM Forex Trading Strategies

Trading Positions

EUR/USD trading strategy: long at 1.1200, target 1.1450, stop-loss 1.1090

GBP/USD trading strategy: long at 1.5400, target 1.5580, stop-loss 1.5330

USD/CAD trading strategy: short at 1.2530, target 1.2320, stop-loss 1.2630

AUD/USD trading strategy: long at 0.7805, target 0.8020, stop-loss 0.7710

NZD/USD trading strategy: long at 0.7525, target 0.7700 stop-loss 0.7425

EUR/CHF trading strategy: long at 1.0690, target 1.0990, stop-loss 1.0690

EUR/JPY trading strategy: long at 133.55, target 136.00, stop-loss 133.55

GBP/JPY trading strategy: long at 183.60, target 186.60, stop-loss 183.60

Pending Orders

AUD/JPY trading strategy:buy at 92.55, if filled - target 94.80, stop-loss 91.40, risk factor **

We encourage you to visit our website and subscribe to our newsletter to receive daily forex analysis and trading strategies.

Source: Growth Aces Forex Trading Strategies

EUR/USD Under Pressue Of Talk Of Third Greek Bailout Plan

(we stay long)

- Spain's economy minister Luis de Guindos said Euro zone countries are discussing a third bailout for Greece worth EUR 30 billion to EUR 50 billion. He added the new rescue plan would set more flexible conditions for Greece, which had no alternative other than European support. But the spokeswoman for Jeroen Dijsselbloem, who chairs the euro zone finance ministers' group, said there was no discussion of a third bailout.

- Greek Finance Minister Yanis Varoufakis said he was certain Athens would repay a EUR 1.5 billion loan to the International Monetary Fund in March and secure enough liquidity to see it through April.

- Most of Greece's options appear to have been shut off, for now at least. A request for EUR 1.9 billion in profits the European Central Bank made on buying Greek bonds will not be granted until Greece has completed promised reforms. Athens has also sought permission to issue more short-term treasury bills, having reached a cap of 15 billion EUR set by its lenders. The euro zone has made clear it does not want to see that limit lifted. Dutch Finance Minister Dijsselbloem said that Greece's international creditors could pay part of the EUR 7.2 billion remaining in its bailout pot as early as this month if Athens started enacting necessary reforms.

- Monday brought us weaker-than-forecast U.S. ISM manufacturing PMI reading. PMI slipped to 52.9 in February from 53.5 in the previous month. It had been expected to edge down to 53.2.

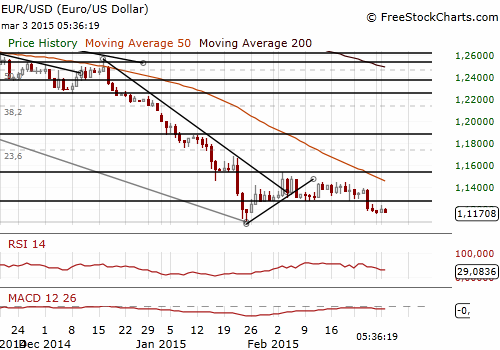

- The EUR/USD is still under pressure. We do not expect any stronger moves of the rate before the ECB meeting on Thursday and important US non-farm payrolls on Friday. Our long position is under threat. However, we do not expect the EUR/USD to break below very strong support level in the area of 1.1100.

Significant technical analysis' levels:

Resistance: 1.1245 (high Feb 27), 1.1317 (10-dma), 1.1345 (21-dma)

Support: 1.1098 (low Jan 26), 1.1047 (low Sep 8, 2003), 1.1000 (psychological level)

USD/CAD: Get Short Ahead Of Wednesday’s BoC Decision

(we stay short)

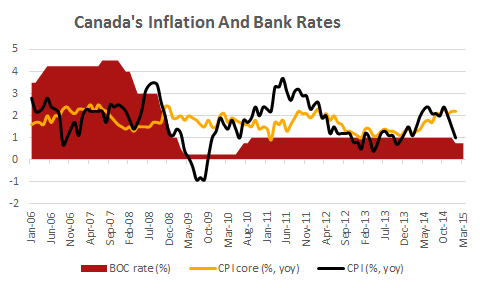

- Canada's current account deficit deteriorated faster than expected in the fourth quarter to CAD 13.92 billion from CAD 9.60 billion in the third quarter. The deficit in the trade in goods was dominated by a CAD 4.25 billion fall in energy exports, mostly due to lower crude oil prices. There were only relatively minor changes in other components of the current account. The deficit in the trade in services narrowed by CAD 74 million, and the deficit in investment income shrank by CAD 385 million.

- The RBC Canadian PMI, a measure of manufacturing business conditions, fell to a seasonally adjusted 48.7 in February from 51.0 in January. It was the lowest level since the survey began in 2010 and only the second time it has fallen below the 50 level that indicates growth in the sector. Oil is a major export for Canada and the recent plunge in crude prices has started to be felt in the economy.

- Investor attention is turning to today’s GDP growth data for the fourth quarter (13:30 GMT) and the Bank of Canada's interest rate decision on Wednesday. The bank cut its benchmark rate by 25 bps in January to 0.75%. We maintain our forecast that there will be no rate cut in March. Markets are now looking at a less than 30% chance of a cut, but they had priced in as much as an 80% chance of another 25 basis point rate cut this week before comments by bank Governor Stephen Poloz dispelled those expectations.

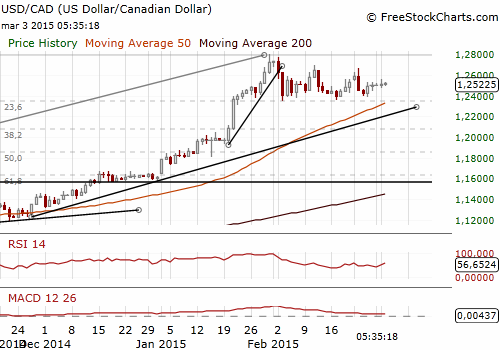

- The CAD weakened on Monday against the USD and the USD/CAD finished at 1.2535. We keep our short USD/CAD position taken at 1.2530 and expect strengthening of the loonie, as we expect dovish BoC but without a rate cut on Wednesday.

- The medium-term outlook for the USD/CAD remains slightly bullish due to divergences in monetary policies.

Significant technical analysis' levels:

Resistance: 1.2565 (high Mar 2), 1.2600 (psychological level), 1.2662 (high Feb 24)

Support: 1.2478 (low Mar 2), 1.2450 (low Feb 27), 1.2388 (low Feb 26)

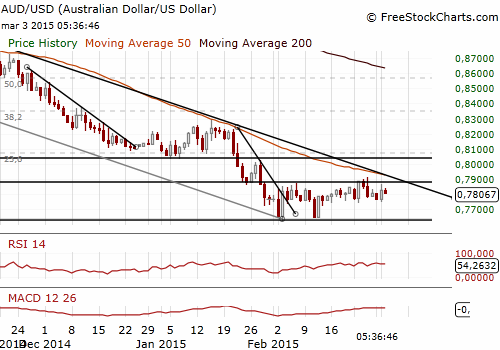

AUD/USD: RBA On Hold, In Line With Our Expectations

(we stay long)

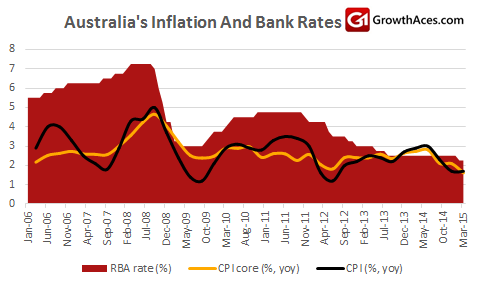

- The Reserve Bank of Australia held its cash rate steady today. RBA Governor Glenn Stevens said: “The Board judged that, having eased monetary policy at the previous meeting, it was appropriate to hold interest rates steady for the time being.”

- The RBA left the door open for rate cuts at forthcoming meetings. The RBA said in a brief statement: “Further easing of policy may be appropriate over the period ahead. The Board will further assess the case for such action at forthcoming meetings.” In our opinion the statement was intended to limit upward pressure on the AUD.

- Investors are still pricing in at least one more cut by the RBA, though the implied probability of a move in April shrank to around 60%, from near 100% previously. The debt market still has 50 basis points worth of cuts priced in over the next 12 months. In our baseline scenario there will be no rate cuts this year. However, we do not exclude one more cut (probably in May after the release of CPI for the first quarter on April 22) if macroeconomic data remain weak.

- Australian current account deficit shrank to AUD 9.6 billion in the fourth quarter of 2014, against forecasts of A$11 billion. It is worth mentioning that net exports added a healthy 0.7 percentage points to GDP growth in the quarter, according to data from the Australian Bureau of Statistics. The GDP report will be released on Wednesday and the median forecast sees a rise of around 0.5% qoq and 2.5% yoy.

- The AUD/USD rose on Tuesday as the market trimmed crowded bearish positions after the Reserve Bank of Australia surprised some by not cutting interest rates at its monthly policy meeting. The AUD/USD reached a session high of 0.7845.

- Our forecast for no change in RBA rates and gradual improvement of global economic activity resulting in higher commodities prices make us stay AUD/USD long. The target of our long position is 0.8020, just below the resistance of 0.8025 (daily high on January 28).

Significant technical analysis' levels:

Resistance: 0.7845 (hourly high Mar 3), 0.7914 (high Feb 26), 0.8025 (high Jan 28)

Support: 0.7748 (hourly low Mar 3), 0.7721 (low Feb 13), 0.7644 (low Feb 12)