- RBA keeps rates on hold

- Abe’s Aide guides Yen higher

- Will CAD’s GDP influence BoC Poloz?

- Market to focus on NFP

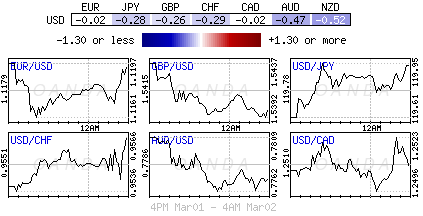

Capital Market are finally on the move, albeit somewhat slow. Record low bond yields, record high global equities indices and strained forex ranges are beginning to provide more trading opportunities in these first few days of March. Lets hope that this is the beginning of something a tad more promising, especially after last months -33% drop in market volatility.

Until now, Central Banks rate announcements had virtually handcuffed markets with their ‘transparent and forward approach’ to rate decisions. The change in tact this month, a shock rate ‘cut’ from the PBoC last weekend and the surprise ‘no’ rate move from the RBA overnight, is managing to keep investors on their toes. The market is now unsure how the BoC will react tomorrow. Governor Poloz threw a curve ball last week and upset the loonie bear that had been pricing in another consecutive rate cut.

RBA Flatfoots Aussie Bears

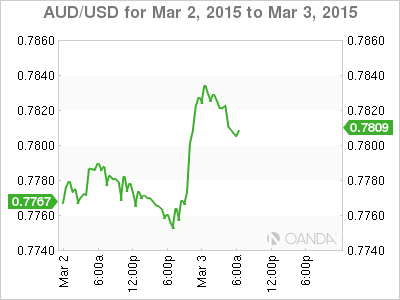

The probability for a second successive RBA policy easing tracked above +60% heading last night’s decision. However, after last month’s unexpected cut, Governor Stevens once again surprised investors with a rate “hold” at +2.25%. The statement was mainly a reiteration of that of last month, though notably more brief, since last month’s decision went to some length in explaining the cut.

It seems that the latest Australian data was not enough to spook Aussie policy makers. A key component of the statement was the reiteration that further easing may be appropriate, which is being seen as “continued easing bias” likely to translate into an eventual easing in April or May. Markets will again focus on Aussie property prices for rate vindication as housing inflation has been cited as a potential deterrent for RBA to take an extra accommodative stance.

The AUD initial reaction managed to gain almost one cent (AUD$0.7830) on the greenback after the RBA no shift surprise. The “no” follow through, or lack there of, should certainly provide an opportunity for the AUD bear to improve their short-position average. The unchanged decision has allowed the AUD to temporarily rally, at least until the dovish rhetoric filters throughout Capital Markets.

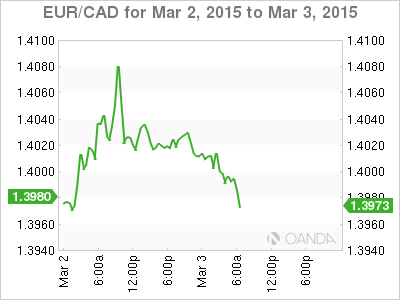

Will the RBA influence the BoC?

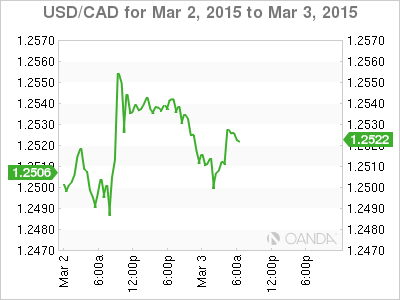

An unchanged RBA is a blow for the loonie dove advocating a BoC rate cut tomorrow. The shock January 21 BoC rate cut preceded the RBA rate cut on February 3. Like Yellen, Governor Poloz from the BoC did not provide a clear signal about whether the Bank of Canada will again lower interest rates during a speech given last week. The Governor emphasized that last months -25bps cut (on the back of plummeting energy prices) buys time to see how the Canadian economy responds.

Up until then, the market majority had been assuming it was a slam-dunk that the BoC would be easing again on March 4; however, the possibility of a potential pause has thrown an extra spanner into the Canada’s bear tool kit. Poloz reiterated that collapsing oil prices are a “net negative” and a setback for a Canadian economy trying to get back to full capacity and full employment.

Will Canada’s Q4 GDP report pressure the BoC?

A disappointing Canadian GDP headline this morning could put pressure on the markets to price in a rate cut at tomorrow’s BoC rate meeting. If there is a wide miss versus expectations has the potential of putting the CAD under immediate pressure outright and on the crosses. Market consensus is looking for +2% headline print, well below the forecasted headline releases by the Governor in January. The details are expected to show that most of the strength still comes from household consumption, while growth in residential investment likely dipped into negative territory, and net exports are expected to have weighed on growth as a result of lower oil prices. Inventories are a big uncertainty and leave the overall forecast with “modest downside risk.”

Canada, a G7 member, is suffering more than most from the sharp fall in oil prices. The -60% fall in crude prices in eight-months is having a massive impact on the country’s economic growth. Already this week investors were delivered some horrid Canadian headlines. Last month’s Canadian manufacturing PMI came in at a record low 48.7 on Monday. The markets apathy towards the USD has been able to keep the CAD in check and range bound for the time being. However, tomorrow’s rate announcement could be the catalyst that is needed to push the loonie bear to new record lows outright. The market remains a better buyer of USD on any pullbacks until proven wrong.

Japanese Jawboning Aids Yen

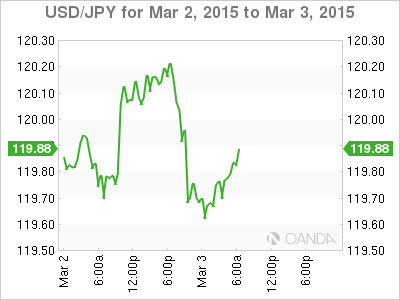

The AUD was not alone; USD/JPY was also among the more active dollar majors in the overnight session. The ‘mighty’ dollar happened to fall from its lofty ¥120 handle to below ¥119.60 as influential PM Abe advisor Honda warned against potential overheating of the economy as a result of overly aggressive BoJ policy.

Honda said that Japanese policy makers should not react to lower oil prices weighing on inflation. Also pushing the Yen higher was corporate surveys that saw about +90% of respondents calling for Governor Kuroda to change the time frame for achieving +2% inflation and over +50% for the BOJ to make the deadline vague and push it back.

Even economic releases suggest that the BoJ should be standing aside for the time being. Japan labor cash earnings – a closely watched inflation indicator – saw yet another negative year-over-year print on inflation-adjusted basis. The jawboning and disappointing economic headlines has managed to weigh on Japanese equity prices which continues to have a strong correlation to USD moves.