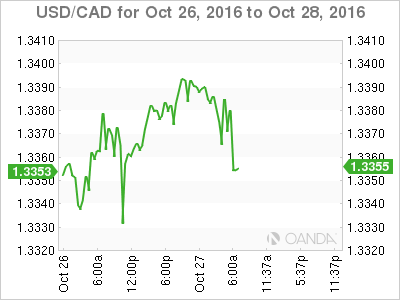

USD/CAD is almost unchanged on Thursday, as the pair trades at 1.3370. In the US, there are two key releases on the schedule – core durable goods orders and unemployment claims. There are no Canadian releases for the remainder of the week. On Friday, the US will release Preliminary GDP, with an estimate of 2.5%. We’ll also get a look at UofM Consumer Sentiment.

The Canadian dollar continues to struggle, as USD/CAD climbed to 1.3395 earlier on Thursday. The currency is trading close to its lowest levels since March and has lost 1.9 percent in the month of October. The Canadian dollar sagged late last week, after the Bank of Canada’s rate decision to maintain its benchmark rate at 0.50%, where it has been pegged since July 2015.

The BoC downgraded its forecasts for economic growth, projecting GDP to grow 1.1 percent in 2016, down from its forecast of 1.3 percent in July. For 2017, growth is expected at 2.0 percent, down from 2.2 percent in July. The bank stated that the lower forecasts were a result of weaker housing demand and lower export forecasts. Earlier this week, the Canadian government and the BoC renewed the inflation target of 2 percent until 2021.

The markets remain confident that the Fed will press the rate trigger in December, with a hike priced in at 72 percent by CME Fed Watch. The prospect of a US rate hike for the first time in a year has bolstered the US dollar against its rivals, including the Canadian dollar. The US economy remains strong, buoyed by a labor market that is close to capacity, with unemployment at a healthy 5.0%.

Inflation levels remain low and are unlikely to show much improvement in the next few months. Although the Fed would prefer stronger inflation, other economic indicators remain strong enough such that the lack of inflation is unlikely to be the critical factor in the Fed rate decision. The Fed will also hold a policy meeting in early November, but is unlikely to make any rate moves just before the US presidential election.

USD/CAD Fundamentals

Thursday (October 27)

- 8:30 US Core Durable Goods Orders. Estimate 0.2%

- 8:30 US Unemployment Claims. Estimate 261K

- 8:30 US Durable Goods Orders. Estimate 0.1%

- 10:00 US Pending Home Sales. Estimate 1.2%

- 10:30 US Natural Gas Storage. Estimate 71B

Upcoming New Events

Friday (October 28)

- 8:30 US Advance GDP. Estimate 2.5%

- 10:00 US Revised UofM Consumer Sentiment. Estimate 88.2

*All release times are EDT

*Key events are in bold

USD/CAD for Thursday, October 27, 2016

USD/CAD October 27 at 6:20 GMT

Open: 1.3373 High: 1.3395 Low: 1.3359 Close: 1.3362

USD/CAD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.3028 | 1.3120 | 1.3253 | 1.3371 | 1.3457 | 1.3587 |

- USD/CAD posted small losses in the Asian session but has retracted in European trade

- 1.3253 is providing strong support

- 1.3371 was tested earlier in resistance and remains a weak line. It could break in the North American session

Further levels in both directions:

- Below: 1.3253, 1.3120, 1.3028 and 1.2922

- Above: 1.3371, 1.3457 and 1.3587

- Current range: 1.3253 to 1.3371

OANDA’s Open Positions Ratio

USD/CAD ratio is almost unchanged in the Friday session, consistent with the lack of movement from USD/CAD. Currently, short positions command a strong majority (69%), indicative of trader bias towards USD/CAD breaking out and moving to lower ground.