In its weekly release, Houston-based oilfield services company Baker Hughes Inc. (NYSE:BHI) reported a higher U.S. rig count (number of rigs searching for oil and gas in the country) than the previous week. The West Texas Intermediate (WTI) oil futures are currently trading at around $44 per barrel.

Analysis of the Weekly Rig Data

Weekly Summary: Rigs engaged in exploration and production in the U.S. totaled 481 in the week ended Aug 12, 2016. This was up by 17 from the week before.

The current nationwide rig count is just more than half the prior-year level of 884. Notably, the count had peaked at 4,530 in 1981. Inversely, an all-time low was recorded in March. Since then the rig count has recovered marginally.

Rigs engaged in land operations were 461 compared with 443 in the previous week. Inland water activity involved three rigs, down by one from the prior week. Offshore drilling was flat at 17 units.

Natural Gas Rig Count: The count rose by two from last week to 83. However, the current natural gas rig count is almost 95% below the high of 1,606 reached in late summer 2008. In the year-ago period, there were 211 active natural gas rigs.

Oil Rig Count: The count was up by 15 from the previous week at 396. The number had skyrocketed to 1,609 in Oct 2014 – the highest figure to have been reported since Baker Hughes started breaking up oil and natural gas rig counts in 1987. The current tally is well below the previous year’s rig count of 672.

Rig Count by Type: The number of vertical drilling rigs rose by four to 62, while the horizontal/directional rig count (encompassing new drilling technology that can drill and extract gas from dense rock formations, also known as shale formations) was up by 13 to 419.

Gulf of Mexico (GoM): The GoM rig count was flat at 17 units.

Conclusion

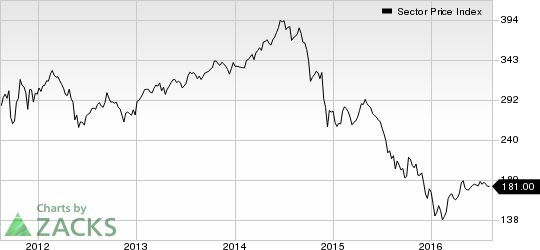

Key Barometer of Drilling Activity: The Baker Hughes data, issued since 1944, acts as an important yardstick for energy service providers in gauging the overall business environment of the oil and gas industry.

An increase or decrease in the Baker Hughes’ rotary rig count weighs heavily on demand for energy services like drilling, completion and production provided by companies that include large-cap firms such as Halliburton Co. (NYSE:HAL) , Schlumberger Ltd. (NYSE:SLB) and Weatherford International plc (NYSE:WFT) .

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

WEATHERFORD INT (WFT): Free Stock Analysis Report

BAKER-HUGHES (BHI): Free Stock Analysis Report

SCHLUMBERGER LT (SLB): Free Stock Analysis Report

HALLIBURTON CO (HAL): Free Stock Analysis Report

Original post

Zacks Investment Research