Daily Briefing

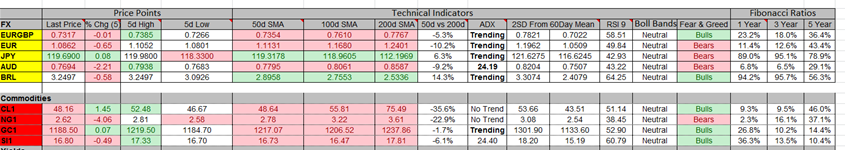

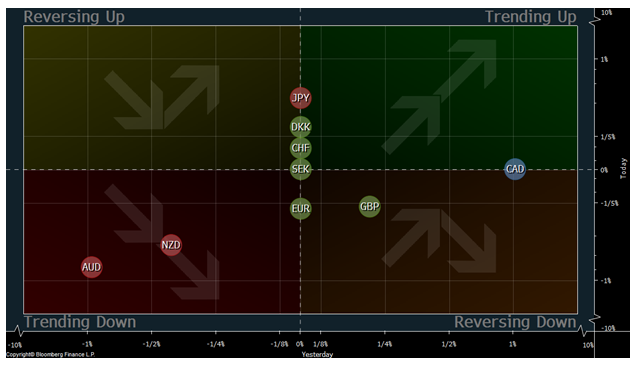

Currencies

- EUR/USD: The pair has broken is trading below its downward trend line on a 30 minute time frame. The next resistance is at 1.108 and the support is at 1.071.

- USD/JPY: The pair is moving in a sideway pattern on a 30 minute time frame. The next support is at 118.38 and resistance at 121.18

- GBP/USD: The pair has broken out of a downward wedge pattern on a 30 minute time frame. The resistance is near the 1.5077 and support is at 1.4745

Indicator

Indices

- Asian Markets closed mostly higher by building on gains on top of yesterday. The Hang Seng index is the best performing index during the session and it closed higher with a gain of 3.80%. The index is up nearly by 2.02% in the past 5 days.

- European indices futures are trading higher during the early hours of trading. The FTSE 100 index is the best performing index during the session and it is trading higher with a gain of 0.51%. The index is up by almost 0.84% in the past 5 days.

- US futures are also trading higher ahead of the FOMC minutes. Most indices closed lower during the last session and the NASDAQ index was the worst performer with a loss of 0.22%.

TOP News

- The German factory orders fell to -0.9% while the forecast was 1.5%

- The supper mergers are back, Shell (LONDON:RDSa) has bought the BG group in $69.6 billion

- The French trade balance came in at -3.4B while the previous reading was at -3.7B

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Things to Remember

Stop loss is your biggest friend so make sure you use it

Market Sentiment

- Gold: The precious metal is in process of filling the gap on a 30 minute time frame. The next support is near the 1170 and the next resistance is near the 1230.

- Crude Oil: The black gold is trading above its upward trend line on a 30 minute time frame. The near term support is at the $50.0 mark and the resistance is at 54.

- VIX: Volatility index gained nearly 0.27% on the last trading day.

News Agenda For Today

08:30 GMT

GBP – Services PMI

Trends

Disclaimer: The above is for informational purposes only and NOT to be construed as specific trading advice. responsibility for trade decisions is solely with the reader.