Talking Points:

- US Dollar Stalls at 5-Month High, Downswing Risk Remains

- S&P 500 Recovery Continues as Buyers Aim for July Peak

- Crude Oil at Risk of Deeper Losses on Trend Support Break

US DOLLAR TECHNICAL ANALYSIS – Prices Index continue to push higher having reversed upward as expected after putting in a Bullish Engulfing candlestick pattern. A daily close above the 38.2% Fibonacci expansion at 10582 exposes the 50% level at 10606. Negative RSI divergence warns a pullback may be around the corner. A turn below support at 10554, the 23.6% Fib, opens the door for a test of the 14.6% expansion at 10536.

S&P 500 TECHNICAL ANALYSIS – Prices declined as expected after putting in a bearish Evening Star candlestick pattern with negative RSI divergence. A bounce following a test of the 1900.00 figure sees prices aiming for resistance at 1968.40, the 76.4% Fibonacci retracement, with a close above that targeting the July 24 high at 1991.40. Alternatively, a turn below the 61.8% Fib at 1954.20 aims for the 50% retracement at 1942.80.

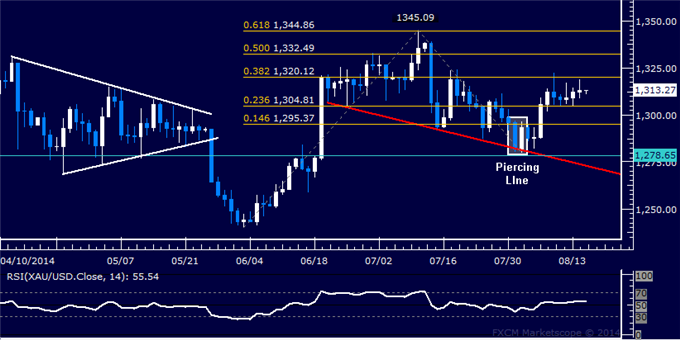

Gold TECHNICAL ANALYSIS – Prices launched higher as expected after putting in a bullish Piercing Line candlestick pattern. Resistance is now at 1320.12, the 38.2% Fibonacci expansion. A break above that on a daily closing basis exposes the 50% level at 1332.49. Alternatively, a reversal below the 23.6% Fib at 1304.81 clears the way for a test of the 14.6% expansion at 1295.37.

CRUDE OIL TECHNICAL ANALYSIS – Prices turned aggressively lower anew, taking out rising trend lien support set from June 2012. Sellers now aim to challenge the 38.2% Fibonacci expansion at 94.29, with a break below that exposing the 50% level at 92.97. Alternatively, a turn above the 23.6% Fib at 95.91 opens the door for a test of 96.91, the intersection of the trend line (now recast as resistance) and the 14.6% expansion.