Yesterday's weak set of data from the US included retail sales, PPI, and industrial production, all of which weighed on the sentiment, pushing the US dollar lower.

The economic calendar today is quiet with the August CPI data being the sole data point of interest which could potentially turn out to be a market mover ahead of next week's FOMC decision.

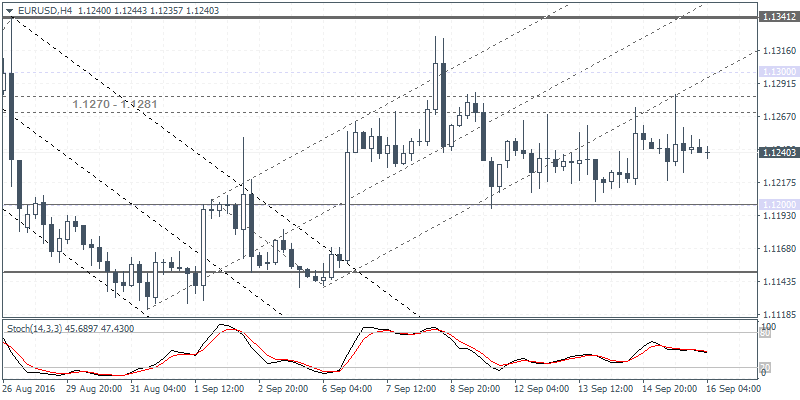

EUR/USD Daily Analysis

EUR/USD (1.1240) continues with its ranging price action as consolidation within the inside bar continues to build up. Prices briefly hit the resistance level of 1.1270 - 1.1280 yesterday but were met with rejection, sending the euro to trade back into the range. The US CPI data will likely bring a major impact on the EURUSD today with the likelihood of the single currency breaking above 1.1280, while to the downside, 1.1200 remains the key levels of interest.

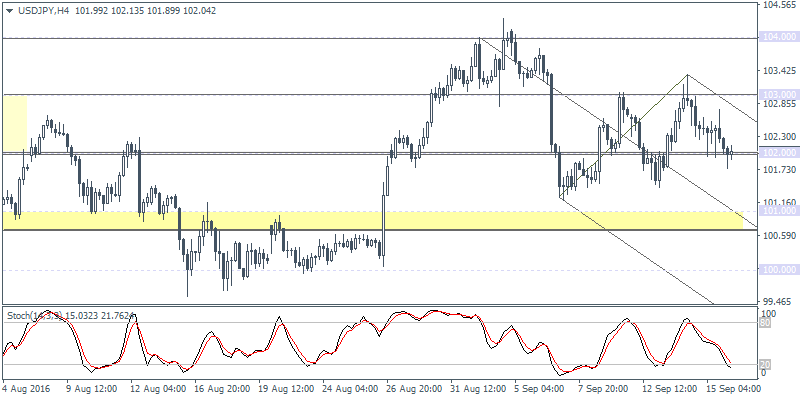

USD/JPY Daily Analysis

USD/JPY (102.04) has been holding up above the 102.00 support level for the past few days. Price action remains flat as long as the support holds up while the resistance at 103.00 keeps a lid on the gains. Still, a breakout off these levels is expected. To the upside, 104.00 comes into focus while to the downside, a break below 102.00 could see prices testing the 101.00 - 100.80 support level. USD/JPY remains flat, but the price action is similar to that of EUR/USD which indicates a potential breakout on the horizon.

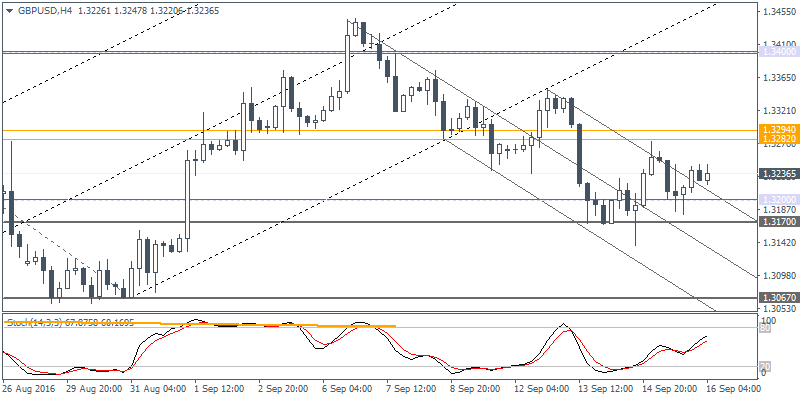

GBP/USD Daily Analysis

GBP/USD (1.3236) closed with a doji yesterday after bouncing off the 1.3200 handle the day before. Prices remain flat, but GBPUSD could be seen testing 1.3400 in the near term. Price action shows multiple tests to the 1.3200 - 1.3170 support level, which has managed to hold out strongly so far. The median line breakout could see another potential decline to 1.3200 ahead of a rally towards 13282 - 1.3294 resistance level. Above this resistance, further upside could potentially see GBP/USD retesting the 1.3400 resistance level.

Gold Daily Analysis

XAU/USD (1313.41): Gold prices extended the declines to the 1314 - 1312 support level yesterday. A breakdown below this support could see gold prices touch down to the $1300 psychological level. The 4-hour chart shows a bullish divergence which points to a near term pull back towards the 1327.50 - 1330.00 resistance level. The gains are likely to be limited near this level into next week.