The technical outlook for the US dollar, hints to a near term bullish strength, validated by the bearish outlook in gold, GBP/USD, and EUR/USD. While USD/JPY has been trading flat, we could expect theprice to test 102 and 104 in the near term. Today's US GDP revisions and Janet Yellen's speech at the Jackson Hole symposium are the main event risks for the day.

EUR/USD Daily Analysis:

EUR/USD (1.1291): EUR/USD is currently attempting to retest the price zone near 1.1300 with prices trading within Thursday's range of high and low forming an inside bar. A potential breakout from here is quite likely as a result. On the 4-hour chart, after prices broke down from the rising median line, we see a retracement back to the breakout level which comes in near 1.1300. While the bearish divergence remains in play, the correction in EUR/USD remains short lived as a retest to 1.1200 remains on the cards.

USD/JPY Daily Analysis

USD/JPY (100.46): USD/JPY remains flat for another day, but this could soon be changing. The price zone near 100.50 - 100.00 remains of immediate interest which could give way for theprice to test 102.00 which forms the initial resistance level. The re-adjusted pattern on the 4-hour time frame shows the descending triangle which has broken to the upside, but being capped near 100.50 - 100.00. To the downside, a daily close below 100.00 could invalidate this pattern and expose USD/JPY to further downside.

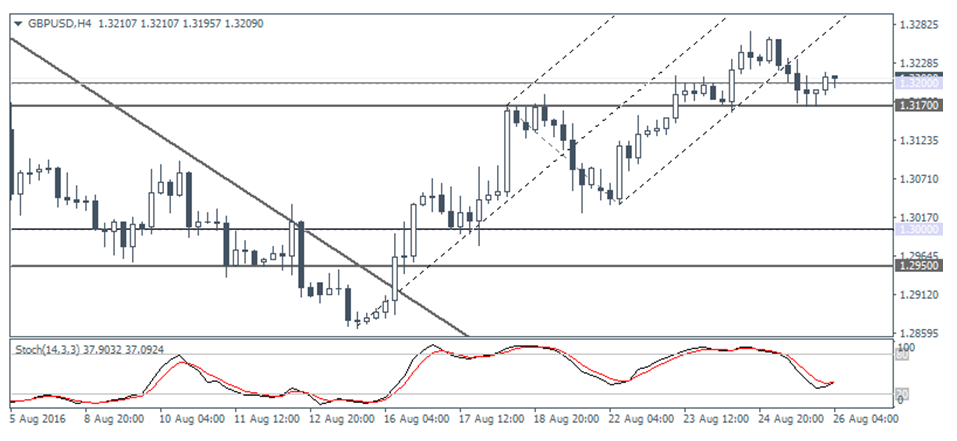

GBP/USD Daily Analysis

GBP/USD (1.3209): GBP/USD is trading near the 1.3200 with the daily Stochastics showing a hidden bearish divergence on the lower high in prices and a higher high on the oscillator. This hints to a potential downside in GBP/USD towards 1.3000. On the 4-hour chart, GBP/USD failed to build on its gains above 1.3200 - 1.31700 and with price breakout from the rising median line, we can expect to see a break down towards 1.3000 - 1.2950 in the event that the resistance gives way. Watch for a potential lower high above 1.3200 for initial clues ahead of the dip to 1.3000.

Gold Daily Analysis

XAU/USD (1324.60): Gold prices fell to 1322 region yesterday after the hourly chart shows a break down in the descending triangle pattern. The declines marked a completion to 161.8% of the measured move, and the current pullback could see a retest of the broken support near 1335 - 1332. On the 4-hour chart, 1327.50 which previously served as support could now be tested for resistance. However, expect further upside to 1335 - 1332 if price forms a higher low. The correction is likely to stall near this level ahead of further declines to 1300.00.