70 RSI is as 70 RSI does. Sure, you can go well above. I understand that, but yesterday most of the key index charts hit 70 RSI on the short-term, sixty-minute charts. Normally you pull back from there and today was no different. The market gapped down a little bit and spent the day below the flat line. Nothing dramatic, but it did succeed in allowing the overbought oscillators to begin and unwinding process, which, of course, many will question as to whether we've seen the ultimate top. Probably not, but you never know. Markets sell when they get too overbought to allow for more energy on the next attempted move higher. This seems to be no different.

You never know for sure, but the oscillators behaved appropriately with price, so, for now, we take it as a proper way to get more energy for another attempt higher in time. Volume was low with most traders allowing the pullback. It doesn't mean we won't fall further early next week, but a lot of the dirty deed was done today. No damage from a technical perspective. The bulls still own the playing field. I'm a big believer that it's best not to get too overbought for it almost guarantees a negative divergence on the next move up. Pulling back appropriately at the first signs of overbought can help prevent that. Although the bulls would rather things get out of control on the up side, in the end it serves them better when we pull back immediately from short-term, overbought conditions. That's what took place today. Still bullish behavior, bigger picture for now. So, the market got its medicine from the mouth that roared. Another excuse not to raise rates took place with the market rallying for two days on the news before pausing to refresh today. More drugs for the bullish players.

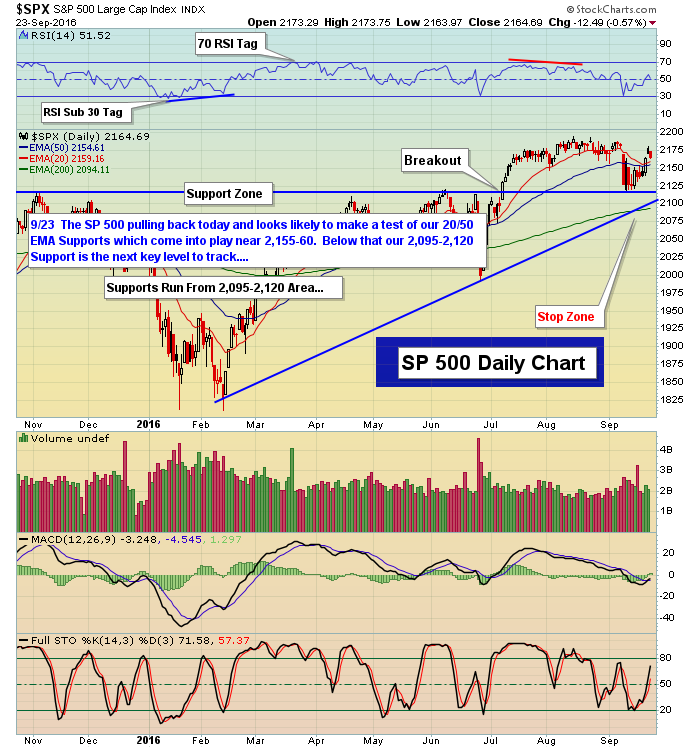

That said, we are still decently below the breakout on the S&P 500, which we all know by now is 2194. A double top the bulls are begging to see go away so as to get the next leg up under way. The realities of the world seem to be holding back the breakout to some degree, but you have to wonder how long the bears can hold this market from taking out 2194 without some unexpected bad news. It is interesting that the extra spark the fed Yellen gave still hasn't provided the big move the market is craving. The charts just aren't bearish enough for the bears to get excited or too hopeful. The daily charts have unwound quite a bit, yet there is no break down or anything close to it. Since the 2120 double bottom tap, we've moved decently higher and are now headed towards the upper end of the channel. All of this, however, can't hide the fact that we're still nowhere overall as we trade below the 2194 breakout and key support at 2120 down to 2093.

Who knows what will occur to get us above 2194 on a closing basis but you have to give the benefit of the doubt to the bulls since the trend is higher, even though it's in a grinding fashion. An annoying one at that. For now, you stay long with plenty of fear about what could happen should the real world happen to take over one of these unexpected days. The onus is on the bears to make that a real event.