The latest Black Knight HPI Report shows what I call the "Uneven Housing Recovery". Nationally, prices are up 4.5% from a year ago, and down 0.1% from last month. Variances are wide.

A few pictures will explain what I mean:

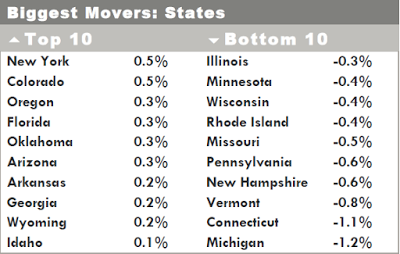

Biggest Movers This Month

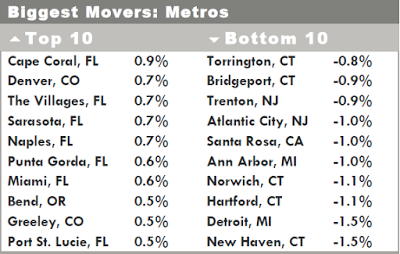

Biggest Metro Movers This Month

Think Florida looks good?

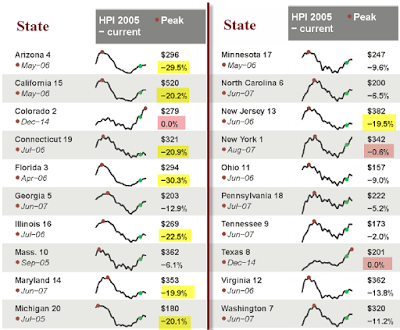

Then let's take a look at the largest 20 states in alphabetical order:

Performance of Largest 20 States

Percentages are relative changes of HPI from dates shown to December 2014. Numerical ranking by most recent month’s percentage change follows state name.

I reformatted the top-20 Black Knight table double-wide to make it easier to read.

Home prices in Texas and Colorado exceed their 2005-2006 highs. New York has nearly recovered to its previous high, made in 2007.

Worst Large-Population Performers

- Florida -30.3% since April 2006

- Arizona -29.5% since May 2006

- Illinois -22.5% since July 2006

- Connecticut -20.9% since July 2006

- California -20.2% since May 2006

- Michigan -20.1% since July 2005

- Maryland -19.9% since June 2007

- New Jersey -19.5% since June 2006

Performance Analysis

Florida, Arizona, and Illinois are the three worst performers of the largest 20 states in terms of recovery. Recovery has to do with several factors including magnitude of previous bubble, jobs, and tax policy.

Illinois did not have the bubble of numerous cities in Florida, Arizona, or California. Nor has Illinois had to suffer through a Detroit-style bankruptcy ... yet.

Rather, Illinois lags in the recovery because of poor job prospects, poor tax policy, and what most would consider poor weather. There is little here to attract businesses or immigrants from other states.

In particular, the property tax situation in Illinois is unsustainable. A home that might sell for $300,000 could require as much as $7,000 a year in property taxes, or more.

Taxes vary depending on home rule rates and how aggressive someone is willing to be in fighting tax hikes and property valuations. I have fought tax hikes twice in the last 10 years and won. Most don't. If everyone did, no one would get them.