Forex News and Events:

The UK 3-month average unemployment rate falls below BoE’s former 7.0% threshold, the average earnings signal that improvement in life standards may have begun in the UK. The Cable is upbeat today, while solid offers pre -1.6823 (year high) are to be cleared. In the Euro-zone, the final CPI figures confirmed softness in EZ inflation dynamics. Market reaction remains subdued, EUR/USD trends higher. In New Zealand, the weak dairy prices and softer Q1 inflation weigh on NZD despite hawkish RBNZ expectations at April 24th policy meeting.

UK jobless rate falls to 6.9%

The UK 3-month average unemployment rate falls below 7.0% for the first time since 2009. The UK jobless rate is now below the 7% threshold that Mark Carney had set at the first stage of his forward guidance in June 2013. Given the unexpected and steep drop in unemployment, Carney had to revise his decision on last February to be able to keep the interest rates at the historical lows to sustain economic recovery. Today’s report also showed that 3-month average weekly earnings rose from 1.4% to 1.7%, slightly lower than 1.8% expected; while the ex-bonus earnings (1.4% vs. 1.7% expected & 1.3% last) missed expectations.

As knee-jerk reaction, GBP/USD rallied to 1.6816 (30-day upper Bollinger band). Resistance remains strong below 1.6823 (year high), light option bids stand at 1.6795/1.6810 for today’s expiry. Technically, GBP/USD trades comfortably in the mid-range of Nov’13 – Apr’14 up-trending channel. The bias is on the upside.

EUR/GBP legged down to 0.82332 post-data. Trend and momentum indicators remain comfortably bearish. We keep our eyes set at 0.82250 (April downtrend channel base), then 0.82042 (March 5th low) as long as 50-dma resistance holds (0.82820).

China slowdown could have been worse

The great news out of China was that the GDP growth decelerated slower-than-expected through the first quarter of 2014. The Chinese gross domestic product grew at the slower pace of 7.4% y/y in Q1 versus 7.7% a quarter ago. This has been slightly faster than 7.3% consensus and interestingly has been enough to lift the sentiment in Asia. The emerging Asia stocks mostly rallied. Korean Won, Malaysian Ringgit, Philippines Peso, Thai Baht outperformed the US dollars. Yuan consolidated losses above 6.2197. Decent option bids at 6.2000/6.2100 are likely to keep the downside safe through the day.

AUD/USD’s “relief rally” post-Chinese GDP remained capped at 0.9380. After all, the news was only less disappointing. The bullish momentum shows signs of weakness. A daily close below 0.9315 will send MACD (12, 26) in the red zone and place 21-dma (currently at 0.9259) at risk. Versus NZD, the Aussie extends gains above 1.0900 for the first time since February 4th. Decent option bids are waiting to be activated at 1.0900 for today and tomorrow expiry.

Weak dairy prices weigh on NZD

The 5th consecutive decline of -2.6% in dairy prices at today’ GDT auction weigh on NZD-complex more than the softer 1Q CPI figures. The weakness in dairy prices is damaging for New Zealand’s trade terms, while the trade weighted Kiwi index stands at record highs. The slower acceleration of 0.3% in m-o-m CPI (vs. 0.5% exp. & 0.1% last) & of 1.5% y-o-y (vs. 1.7% exp. & 1.6% last) is unlikely to influence RBNZ decision at April 24th policy meeting. April 8th CFTC data shows that the NZD speculative long positions increased for the eight consecutive weeks on RBNZ rate hike expectations. The speculative nature of NZD-longs however increases the risk of a short squeeze.

Today's Key Issues (time in GMT):

2014-04-16T11:00:00 USD Apr 11th MBA Mortgage Applications, last -1.60%2014-04-16T12:30:00 CAD Feb Int'l Securities Transactions, exp 3.00B, last 1.09B

2014-04-16T12:30:00 USD Mar Housing Starts, exp 970K, last 907K

2014-04-16T12:30:00 USD Mar Housing Starts MoM, exp 7.00%, last -0.20%

2014-04-16T12:30:00 USD Mar Building Permits, exp 1010K, last 1018K, rev 1014K

2014-04-16T12:30:00 USD Mar Building Permits MoM, exp -0.40%, last 7.70%, rev 7.30%

2014-04-16T13:15:00 USD Mar Industrial Production MoM, exp 0.50%, last 0.60%

2014-04-16T13:15:00 USD Mar Capacity Utilization, exp 78.70%, last 78.80%, rev 78.40%

2014-04-16T13:15:00 USD Mar Manufacturing (SIC) Production, exp 0.60%, last 0.80%

2014-04-16T14:00:00 CAD Bank of Canada Rate Decision, exp 1.00%, last 1.00%

2014-04-16T18:00:00 USD U.S. Federal Reserve Releases Beige Book

The Risk Today:

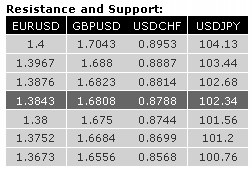

EUR/USD has not challenged hourly resistance at 1.3833 (15/04/2014 high), suggesting a period of sideways trending. A test of the resistance at 1.3967 (03/12/14 high) is still likely. An hourly support is at 1.3800 (15/04/2014 low). Failure to find support here, will warn of a larger downside corrective phase to1.3673. In the longer term, EUR/USD is still in a dominate uptrend, suggesting additional upside can be anticipated. A significant resistance now lies at 1.3876 (24/03/2014 high).

GBP/USD is looking to breach the hourly resistance area between 1.6750 (15/04/2014 high). A break above would validated a short-term bullish trend reversal formation. The next resistance can be found at 1.6823 (17/02/2014). The short-term bullish momentum is intact as long as the hourly support at 1.6684 (previous resistance) holds. In the longer term, prices continue to move in a rising channel. As a result, a bullish bias remains favoured as long as the support at 1.6460 holds. A major resistance stands at 1.7043 (05/08/2009 high).

USD/JPY has broken the support at 102.68 (19/03/2014 high), leading to a sharp decline. Prices are now basing close to a key support between 101.56 (see the rising trendline from 100.76 (04/02/2014 low)) and 100.76 (see also the 200 day moving average). A resistance now stands at 102.68 (previous support). A long-term bullish bias is favoured as long as the key support area given by the 200 day moving average (around 100.80) and 99.57 (see also the rising trendline from the 93.79 low (13/06/2013)) holds. A major resistance stands at 110.66 (15/08/2008 high).

USD/CHF has further recovered off 0.8744 (11/04/2014 low) breaching hourly resistance at 0.8814 (01/04/2014 pivot low). However, the dominate bearish momentum suggests a challenge to key support at 0.8699 (13/03/14). From a longer term perspective, the structure present since 0.9972 (24/07/2012) is seen as a large corrective phase. The recent technical improvements suggest weakening selling pressures and a potential base formation. A decisive break of the key resistance at 0.8930 would open the way for further medium-term strength.