On Thursday, the U.S. dollar index decreased due to negative macroeconomic data. The Retail sales unexpectedly fell in January lower than expected. This added pessimism to some participants of the Forex market. They believe that the GDP growth in the fourth quarter could reach only 2.3 %. Whereas, according to official preliminary data the U.S. economy grew by 3.2%. Recall that the second reading of U.S. GDP will be released on February 28. It should be noted that yesterday's unemployment figures for the week were also negative. However, it is believed that the bad weather is to blame. Investors expect that in the remaining days of February, the situation in the U.S. labor market can still improve. Today, we expect the macroeconomic in the U.S. data that could affect the Dollar. At 14-15 GMT (0) the announce of the growth of industrial production in January is expected. Its outlook is positive. At 14-55 GMT (0) we will see the University of Michigan consumer index for February. It is expected to be weak. In general, the data in the U.S. are conflicting today. Investors will take the information from the Eurozone into account. EUR/USD" title="EUR/USD" height="347" width="702">

EUR/USD" title="EUR/USD" height="347" width="702">

The Euro (EUR/USD) appreciated yesterday (growth on the chart ) due to the weak U.S. statistics. Today, investors will be focused on the EU's GDP for the fourth quarter, which will be released at 10-00 GMT (0). Earlier, the head of the ECB, Mario Draghi said that this information may confirm recovery of the European economy. The expected GDP growth is 0.4%. However, we do not exclude that good the data can move the euro down on the chart. Some investors believe that the ECB is interested in a weak currency for continued economic growth and may cut interest rates at its meeting on March 6.

The Pound (GBP/USD) rose yesterday to the three-year maximum. Besides the weak U.S. and strong British macroeconomic data, this is due to a noticeable difference in the yields of government bonds of two countries. The spread is at its maximum from the middle of 2010, which makes the pound more attractive. In our opinion, this may make the British currency locally overbought. Any macroeconomic negative is able to make it fall

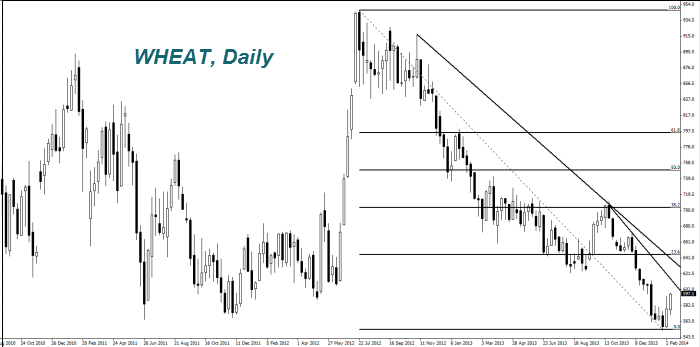

As it was expected, there is a good rise in wheat prices (WHEAT) after lowering its forecasts on its reserve by the USDA due to too cold weather. This week, the Ministry published a forecast of wheat exports - 626.6 thousand tons. It coincided with the market expectations. The cost of soybean (Soyb) rose on expectations of increased demand from China. Meanwhile, the USDA predicts an increase in soybean acreage from 76.5 million acres to 78 million. As a result, the crop in 2014/15 could reach 3.48 billion bushels. This, according to U.S. Department of Agriculture, will lead to significantly lower prices.

XAG/USD" title="XAG/USD" border="0" height="347" width="702">

XAG/USD" title="XAG/USD" border="0" height="347" width="702">

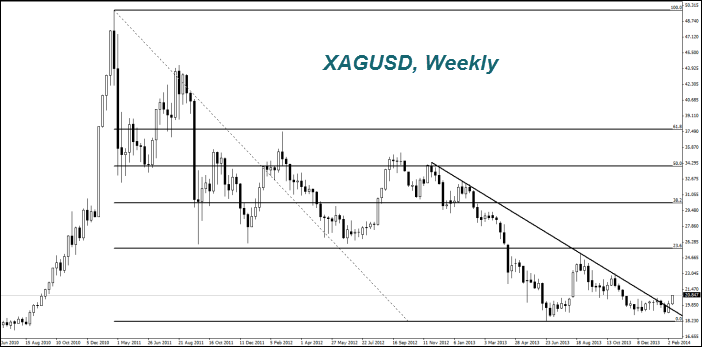

The price of Gold (XAU/USD) and Silver (XAG/USD) dramatically improved on the weak U.S. economic data has. Investors see Gold (XAU/USD) and Silver (XAG/USD) as defensive assets. Silver gets expensive for ten days in a row for the first time since March 2008. Gold went up by 8.6% and exceeded $ 1,300 per ounce for the first time in three months since the beginning of 2014. Meanwhile, a number of major Western banks expect the Gold price to drop in the area of $ 1050 per ounce by the end of this year due to continued economic growth in the U.S. and Europe. The main demand for precious metals is now concentrated in the developing countries, China and India.