The WSJ recently featured an article about the silver lining in Chinese growth. Even though the GDP growth rate had fallen below 7% to 6.9%, there was evidence of rebalancing away from the same-old-same-old lending based model of infrastructure spending to the household sector (emphasis added):

There is robust growth in China if you know where to look, some contrarian investors believe. Monday’s gross-domestic-product report offered the latest sign that the world’s second-largest economy is slowing. But the gloom is overdone, said some portfolio managers who are focusing on the nation’s booming service sector.

Their purchases amount to a bet on Beijing’s efforts to engineer an economic rebalancing, toward a consumer-led, service-driven economy from one dominated by manufacturing and trade. While slowing Chinese economic growth and declines in the country’s use of materials such as copper, nickel and cement have rippled through financial markets, some traders say some less-publicized metrics paint a more upbeat picture.

To name a few, box-office sales are up more than 50% this year, Internet traffic through mobile devices has nearly doubled and railway passenger traffic and civil aviation are increasing steadily, government data show.

The most recent numbers highlighted the Chinese economy’s increasingly dual nature. China reported its economy expanded at a 6.9% annual rate in the third quarter, its slowest pace since the global financial crisis. At the same time, the services sector expanded 8.4%, accounting for more than half of China’s GDP growth for the first time, according to official statistics.

For years, US investors have either bought iShares China Large-Cap (N:FXI) or commodity related vehicles as a way to play Chinese growth. Now that there is growing evidence of growth rebalancing, those vehicles may not be the most appropriate anymore.

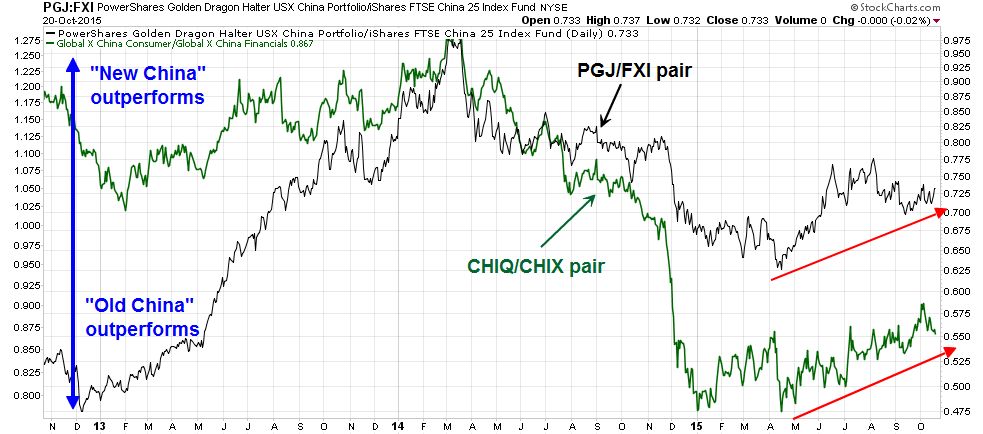

Consider this chart of two "New China" vs. "Old China" pairs (New China: Global X China Consumer (N:CHIQ):Global X China Financials (N:CHIX); Old China PowerShares Golden Dragon China Portfolio (N:PGJ):FXI)).

The first is a long position in PGJ vs. a short position in FXI which is depicted in black. The Golden Dragons Index is far more heavily weighted in consumer services and technology, which are also consumer e-commerce oriented (think Baidu (O:BIDU), etc.), while the FTSE China 50 Index is tilted towards financials, which represent "Old China" finance and infrastructure plays.

The second pair is a long position in CHIQ, Global X China Consumer ETF, and a short position in CHIX, Global X China Financials ETF, depicted in green.

In both cases, these pairs tell the story of progress of growth rebalancing towards the consumer sector of the economy. Even if you don't want exposure to China, monitoring these pairs is a useful way of seeing how rebalancing is progressing in real-time.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.