The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Tuesday higher.

- ES pivot 2079.00. Holding above is bullish..

- Rest of week bias higher technically.

- Monthly outlook: bias lower.

- YM futures trader: no trade tonight.

Well so the US stock market is apparently now trading on the predictions of British bookies for an election that's still almost a week away asking people to make a decision about something the implications of which most people don't really understand. Ummm, hokey dokey. I suppose I've seen stranger things Not much though. What next? Will the market next week be dependant on the outcome of the third race at Hialeah? The technicals don't stand much of a chance in front of this sort of lunacy.

The technicals

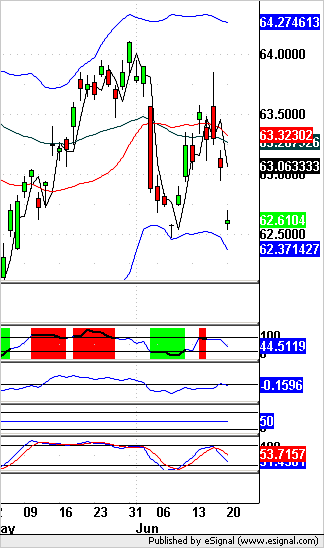

The Dow: On Monday the Dow catapulted out the gate to ridiculous levels before a modicum of common sense returned retracing half of that jump. It was still good for 130 points and the result was an inverted hammer. This is nominally bearish but I suspect this is more a news-driven candle than anything. And my suspicions are bolstered by indicators that are only just off oversold and a stochastic in full-on bullish crossover mode.

The VIX: Last night I noted a doji in the VIX but added that "it's hard to see a reversal higher from here.' Which was about right as the VIX fell another 5.36% on Monday breaking under its 200 day MA before finally bobbing back just barely above it for a fat green hammer. These 200 MA hits from above rarely bounce, so with the indicators all still overbought and falling, and a stochastic in bearhs crossover mode I'd wager there's more downside left here.

Market index futures: Tonight, all three futures are higher at 1:16 AM EDT with ES up 0.37%. ES produced an even taller inverted hammer on Monday but my Dow comment should hold for this one too.

ES daily pivot: Tonight the ES daily pivot rises from 2062.33 to 2079.00. ES remains above its new pivot so this indicator continues bullish.

Dollar index: Monday was clearly a day of extremes. Just look at the poor dollar, doing a cliff-dive 0.70% gap-down doji star to month-long support. Looks like it could be a morning star but the indicators, only halfway to oversold aren't supporting that idea.

Euro: And the euro had about the expected mirror image on Monday, with a gap up to 113515 after nearly touching its upper BB intraday. Looks like a developing evening star but the new overnight seems intent on extending those gains so it's too soon to call the euro lower yet.

Transportation: After a bullish setup off a descending RTC last night, on Monday the trans gave us a bullish trigger on a gap-up inverted hammer that tested (unsuccessfully) their 200 day MA. But the indicators remain all oversold and a new bullish stochastic crossover is in effect making me wonder if this inverted hammer is all it's cracked up to be.

If I had any sense, I'd just call the next three days uncertain until this Brexit nonsense is done with. On the other hand, if I had any sense I'd be in a different business. Tonight we're faced with a bunch of charts with potential reversal candles but I'm not too sure how seriously to take them. In the end, I'm going with the VIX, which is still overbought and moving lower, and the futures which are guiding higher. So that makes it a call for Tuesday higher. Keeping in mind that all it will take is one new Brexit poll to derail the whole thing.

YM Futures Trader

No trade tonight.