The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Thursday uncertain.

- ES pivot 2036.58. Holding below is bearish.

- Friday bias uncertain technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader standing aside.

Recap

My my, how quickly one can go from hero to zero. The technicals didn't really look at all bearish last night so I said we'd go higher and yet here we are with the Dow tanking 268 points on Wednesday to finish near session lower. All we can do is say ouch, take the heat, and move on. One bad day does not a career make. So with this interesting development, let's see how the picture changes for Thursday.

The technicals

The Dow: Huh - well so much for the impressive hammer candle on Tuesday. Wednesday's big red marubozu made it look like an extra from the Wizard of Oz. This big dump wiped out a month of gains in one day and closed under the lower BB® but even at that did not drive the indicators oversold. So in the absence of any reversal signs at all, I can only call this one lower again.

The VIX: On Wednesday the VIX failed to complete an incipient evening star in a big way with a massive 24.45% explosion for its biggest gain since early October back when, yeah I can't remember what earth-shaking news caused that spike either. Anyway we traded entirely above the upper BB which is quite unusual and the indicators are now back to overbought. But as in early October when that condition went on for three more days, there's no guarantee of coming back to earth on Thursday.

Market index futures: Tonight, all three futures are higher at 12:33 AM EST with ES up 0.17%. On Wednesday ES took a big dump that stopped right on its lower BB, (finally) drove the indicators oversold (remember when I was complaining recently about how long we'd been overbought?), and started the stochastic curving around for a bullish crossover. So is the selling done? Well unlike last night, we're seeing some positive pin action in the overnight and we've also finally hit oversold. Also the stochastic is flattening out so that's all a lot better than last night.

ES daily pivot: Tonight the ES daily pivot dives from 2051.00 to 2036.58. But even after that fall, and even with a rise in ES overnight we're still below the new pivot so this indicator continues to be bearish.

Dollar index: Ho hum - the dollar, like everything else did not respect Tuesday's reversal signs instead falling 0.46% to finally come off overbought. With the hammer failure, there are no bullish signs here.

Euro: At least I got something right when last night I wrote "there's more upside potential than downside risk here on Wednesday" as the euro continued what is now a three day uptrend to close at 1.2443. With indicators still a ways from overbought, there's nothing to suggest anything but higher again here on Thursday.

Transportation: As with the Dow, on Wednesday the Trans ignored Tuesday's hammer and tanked another 1.35% to close below their own lower BB. With a new steep and sharp descending RTC now in place and indicators yet to reach oversold, there are no bullish signs here tonight.

Wednesday's further losses helped clear the air some and actually strengthened the case for a reversal but I'm done trying to catch this particular falling knife. I made the risky call last night and got my head handed to me. Tonight we play it safe and simply call Thursday uncertain. I am expecting a rally any day now - I just don't know for sure if Thursday is it.

ES Fantasy Trader

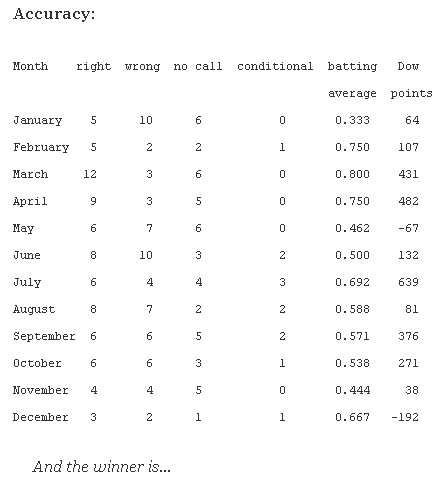

Portfolio stats: the account now stands at $110,500 after ten trades in 2014, starting with $100,000. We are now 7 for 10 total, 5 for 5 long, 2 for 4 short, and one push. Tonight we stand aside.