The Hoot

Actionable ideas for the busy trader delivered daily right up front

Well Hallelujah! In what is now fast becoming a Washington tradition, the odd Kabuki play called "Kick the Can" was acted out once again, coming to its usual slow motion climax Wednesday night just in time to catch Leno on TV. And so now all the good little Demicans and Republicrats can go to bed and sleep soundly in the illusion that they have accomplished something productive. At least one more bit of uncertainty has been taken off the table - until the next production of KtC, winter edition, when we get to do it all over again. Now maybe we can get back to doing some technical analysis.

The technicals (daily)

The Dow: Mr. Market clearly liked the clank of the can clattering down the road one more time as he propelled the Dow up 206 on Wednesday to remain inside the rising RTC. We have now retraced better than half of the debt ceiling worries from last month. However, we're now real close to a resistance line at 15,404, the indicators are now overbought again, and the stochastic has just formed a bearish crossover. o my take here is cautious optimism for Thursday.

The VIX: On Wednesday, the VIX did a cliff dive of Acapulco-like proportions down a massive 21.17% in response to the debt deal. And even with that, the indicators are still not oversold, though the stochastic just eked out a bullish crossover. With the 200 day MA just below us at 14.41 and the lower BB not til 11.93, the VIX could face more downside on Thursday.

Market index futures: Tonight all three futures are modestly lower at 12:51 AM EDT with ES down by 0.09%. ES came very close to its record high from September 19th on Wednesday, and also very close to its upper BB at 1721.45. But this move also drove it overbought and formed a flattish bearish stochastic crossover. That we're not seeing any follow-through in the overnight indicates that some profit-taking may kick in on Thursday. At the current level of 1711.75, we're now just outside the rising RTC, which is a bearish setup.

ES daily pivot: Tonight the pivot jumps from 1697.08 to 1707.17. That still leaves us above the new pivot, though by a lot less. But it's still bullish for now.

Dollar index: The dollar didn't react much on Wednesday, finishing exactly flat on the day, though the inverted hammer played out largely below Tuesday's.gap-up red candle neatly filling the gap. With indicators now overbought, there's a hint of a move lower, though with the way the dollar has been getting yanked about lately, who can tell.

Euro: And the euro remains stuck in its trading range of 1.3525 - 1.3582 pretty much as I expected Monday night. And I still see no sign that the sideways movement is over just yet.

Transportation: The trans did even better than the Dow on Wednesday, closing at record highs just short of their upper BB at 6765. The indicators have just gone overbought and the stochastic has just formed a bearish crossover, so Thursday might be a topping day here though we remain in a rising RTC.

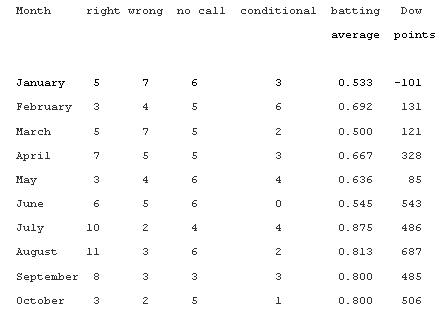

Accuracy (daily calls):

Hmm - while we ow have this messy debt ceiling business off the table for a while at least, we're also nearing the end of op-ex week. While the charts still look at least a little bullish, they're also closing in on some resistance points that make me think further upside is going to be limited. In fact, I'm thinking now that Thursday could be a doji day so I'm just going to have to call Thursday uncertain.

Actionable ideas for the busy trader delivered daily right up front

- Thursday uncertain - doji possible.

- ES pivot 1707.17. Holding above is bullish.

- Friday bias lower technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader standing aside

Well Hallelujah! In what is now fast becoming a Washington tradition, the odd Kabuki play called "Kick the Can" was acted out once again, coming to its usual slow motion climax Wednesday night just in time to catch Leno on TV. And so now all the good little Demicans and Republicrats can go to bed and sleep soundly in the illusion that they have accomplished something productive. At least one more bit of uncertainty has been taken off the table - until the next production of KtC, winter edition, when we get to do it all over again. Now maybe we can get back to doing some technical analysis.

The technicals (daily)

The Dow: Mr. Market clearly liked the clank of the can clattering down the road one more time as he propelled the Dow up 206 on Wednesday to remain inside the rising RTC. We have now retraced better than half of the debt ceiling worries from last month. However, we're now real close to a resistance line at 15,404, the indicators are now overbought again, and the stochastic has just formed a bearish crossover. o my take here is cautious optimism for Thursday.

The VIX: On Wednesday, the VIX did a cliff dive of Acapulco-like proportions down a massive 21.17% in response to the debt deal. And even with that, the indicators are still not oversold, though the stochastic just eked out a bullish crossover. With the 200 day MA just below us at 14.41 and the lower BB not til 11.93, the VIX could face more downside on Thursday.

Market index futures: Tonight all three futures are modestly lower at 12:51 AM EDT with ES down by 0.09%. ES came very close to its record high from September 19th on Wednesday, and also very close to its upper BB at 1721.45. But this move also drove it overbought and formed a flattish bearish stochastic crossover. That we're not seeing any follow-through in the overnight indicates that some profit-taking may kick in on Thursday. At the current level of 1711.75, we're now just outside the rising RTC, which is a bearish setup.

ES daily pivot: Tonight the pivot jumps from 1697.08 to 1707.17. That still leaves us above the new pivot, though by a lot less. But it's still bullish for now.

Dollar index: The dollar didn't react much on Wednesday, finishing exactly flat on the day, though the inverted hammer played out largely below Tuesday's.gap-up red candle neatly filling the gap. With indicators now overbought, there's a hint of a move lower, though with the way the dollar has been getting yanked about lately, who can tell.

Euro: And the euro remains stuck in its trading range of 1.3525 - 1.3582 pretty much as I expected Monday night. And I still see no sign that the sideways movement is over just yet.

Transportation: The trans did even better than the Dow on Wednesday, closing at record highs just short of their upper BB at 6765. The indicators have just gone overbought and the stochastic has just formed a bearish crossover, so Thursday might be a topping day here though we remain in a rising RTC.

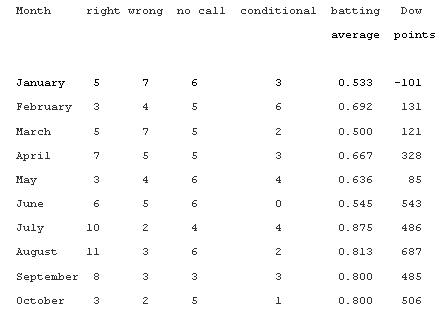

Accuracy (daily calls):

Hmm - while we ow have this messy debt ceiling business off the table for a while at least, we're also nearing the end of op-ex week. While the charts still look at least a little bullish, they're also closing in on some resistance points that make me think further upside is going to be limited. In fact, I'm thinking now that Thursday could be a doji day so I'm just going to have to call Thursday uncertain.