The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Thursday higher, low confidence.

- ES pivot 2001.17. Holding above is bullish.

- Friday bias uncertain technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader standing aside.

Recap

There was a nice little buying opportunity for the fleet of finger as the market dipped on Wednesday's Fed announcement and then Mr. Market decided maybe it wasn't so bad after all. And in the end, for all the ink and electrons spilled on trying to figure out what the Fed was going to do, the Dow closed higher by just 25 points. But taken along with Tuesday's action, there are some interesting developments here for Thursday so let's get right to them.

The technicals

The Dow: The Dow did its usual Fed day thing on Wednesday, creeping higher slowly before the announcement, then a quick dump followed by an equally quick reversal and some oscillation. Nice for the scalpers; I did not participate. One thing is clear - last week's downtrend is finito. In fact we now have a new rising RTC going and a nicely completed bullish stochastic crossover. The indicators are all rising before ever even having hit oversold, and that in itself is often a positive sign. But we touched the upper BB on Wednesday and then pulled back for a spinning top with another record close. The general look of this chart is bullish, particularly since there was no pullback after Tuesday's nice run.

The VIX: On Tuesday the VIX took a big dump slicing right back through its 200 day MA and it fell further, down another 0.63% on Wednesday but on a classic hammer. But the indicators are still nowhere near oversold so this chart is only a suggestion of a reversal. I'd not be surprised to see at least a bit lower on Thursday.

Market index futures: Tonight all three futures are slightly higher at 12:13 AM EDT with ES up 0.05%. Like the Dow, we now have a new rising RTC going and a nicely completed bullish stochastic crossover. The indicators are also like the Dow all rising before ever even having hit oversold,. On the other side, we touched the upper BB® on Wednesday and then also pulled back for a spinning top, unable to crack resistance at 2007. But we remain in a rising RTC, the indicators are not yet overbought, and I'd not be surprised to see ES take another look at the upper BB at 2008.

ES daily pivot: Tonight the ES daily pivot rises from 1993.50 to 2001.17. Even with that gain, ES is still above the new pivot so this indicator remains bullish, now for the second day in a row.

Dollar index: The US dollar of course was a big winner on Wednesday with a big bullish engulfing candle good for 0.32% to the upside. That leaves it right at resistance. And with the indicators just now off overbought, it's not clear if the dollar has the mojo required to push through that. I guess we'll find out Thursday.

Euro: The euro on Wednesday managed to short-circuit what was becoming a week-long rally with a bearish engulfing candle that dumped it right out of its latest rising RTC for a bearish setup and formed a bearish stochastic crossover. But that's not the worst of it. The worst is the Wednesday evening overnight, which gapped down an amazing 0.46% to 1.2863, just above strong 2013 support at 1.2826. In any event it remains in a week-long descending RTC. But I think it's going to be more influenced by the Scottish independence vote, hoot-mon, on Thursday than the technicals. And if I may say, I think they're all fools if they vote yes.

Transportation: Interestingly, the Trans outperformed the Dow in a big way on Wednesday, up almost a percent to exit a week of indecisive sideways motion. That sent all the indicators higher and gave us a bullish stochastic crossover. We also hit the upper BB but the trans has shown it can climb the upper BB so I'd have to guess there could still be more upside available here.

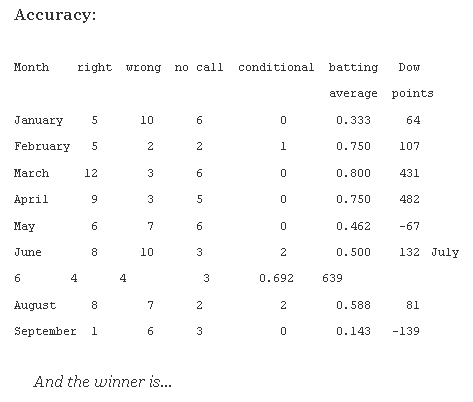

Tonight, there are some technical bullish signs in the charts so I'm going to call Thursday higher, though I haven't been having much luck with this all month so far. We'll see.

ES Fantasy Trader

Portfolio stats: the account remains $114,250 after eight trades in 2014, starting with $100,000. We are now 6 for 8 total, 4 for 4 long, 2 for 3 short, and one push. Tonight we stand aside.