You may have noticed that the market isn’t off to a great start in 2016.

Okay, that’s putting it lightly.

Year to date, the S&P 500 is down about 10%. And it’s on pace for its worst January in history.

But if you’ve been listening to what my colleague Matthew Carr has to say, this should come as no surprise. January has plagued investors for much of the past decade - even as far back as the start of the new millennium.

Which begs the question... is now a good time to invest?

Our answer is simple: It depends on the sector.

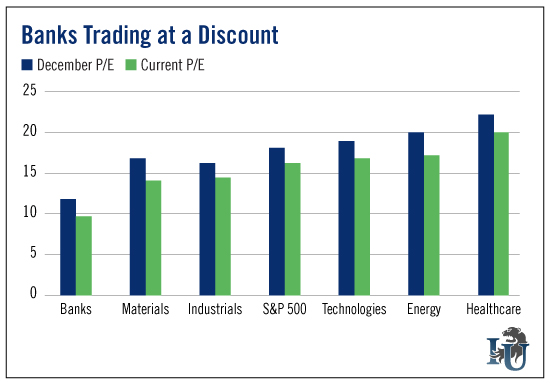

This week’s chart looks at the price-to-earnings ratios (P/Es) of six sectors. As you can see, one sticks out above (or I should say below) the rest...

Banks.

The S&P 500 Banks Index has a P/E of 9.74. That’s well below other major sectors and the broader market.

This means investors are willing to pay $9.74 for every $1 of current earnings.

In comparison, the S&P 500’s current P/E is 16.41.

So, at today’s prices, banks are trading at a 40.65% discount to the S&P 500.

But even beyond having a lower P/E, there’s another reason banks should be on your radar...

Simply put, the results don’t match the trend.

You see, banks recently reported stronger-than-expected revenues and much better profits for the fourth quarter of 2015.

For full-year 2015, JPMorgan Chase (NYSE: N:JPM) delivered record net income of $24.4 billion. Bank of America (NYSE: N:BAC) produced its best profit since before the financial crisis - $15.9 billion. And Citigroup (NYSE: N:C) brought in $17.1 billion of profit, its best result since 2006.

Banks seem to have finally broken away from their past legal issues and fines. Yet, even with these strong results, shareholders continue to dump their bank stocks.

It would seem that the banks have simply gotten caught up in the general market sell-off...

Which means bargain hunters can pick up shares at significantly discounted prices.

Of course, if you’re looking for a more diversified approach, you could always purchase the Financial Select Sector SPDR ETF (NYSE: N:XLF). This will give you exposure across the whole banking sector.

Just do it now, before the rest of the market figures out the true value of this industry.