Life After FOMC Meeting

Yes, there is life after the FOMC meeting. There is life for the bulls: USD bulls and stocks bulls. Until not long time ago I was in a big mess after the FOMC meetings because I didn't know how to trade better what the Fed said.

Although I was reading myself the statement and followed the press conferences, I mostly gave credit to the analysts from the big banks, hedge funds or financial publications.

For years the media is somehow "lying" small investors with their articles. Even the FOMC statement and Yellen's press conference made no exception. I've read around 20 articles and analysis in the last 24 hours, all regarding what the Fed said in their statement and how it will influence the markets in the following days, weeks, months.

Some players said that the Fed was dovish, some others are saying that the Fed was hawkish, some others are saying that the Fed is wrong and they suggest to buy gold as a safe haven to protect you from the incoming "bad days" and so on. Thank God that I read the statement myself and watched Yellen's press conference from the first second till the last.

What I have understood from the FOMC meeting does not mean that it is the right thing. I could be wrong but if I have to lose money because I took a trade on this, at least I loose money on my own view and not on anyone else's view. I strongly recommend you to do the same: trade what you see!

Now, my view after the Fed is this:

USD

in my opinion the FOMC statement was neutral but Yellen was hawkish in her press conference. The Fed does not seem to be worried on falling oil prices, on what's happening in Russia (actually Yellen said that USA has a very small exposure on Russian market and there will be no implications for US economy if the things gets worse in Russia) or what could happen in the Emerging Markets if they will raise rates.

The bottom line is that the Fed seems decided to deliver the first rate hike in 2015. This is extremely bullish for USD, mostly against EUR, GBP, JPY, NZD. So, based on this last FOMC meeting for 2014, I am very bullish on USD for 2015.

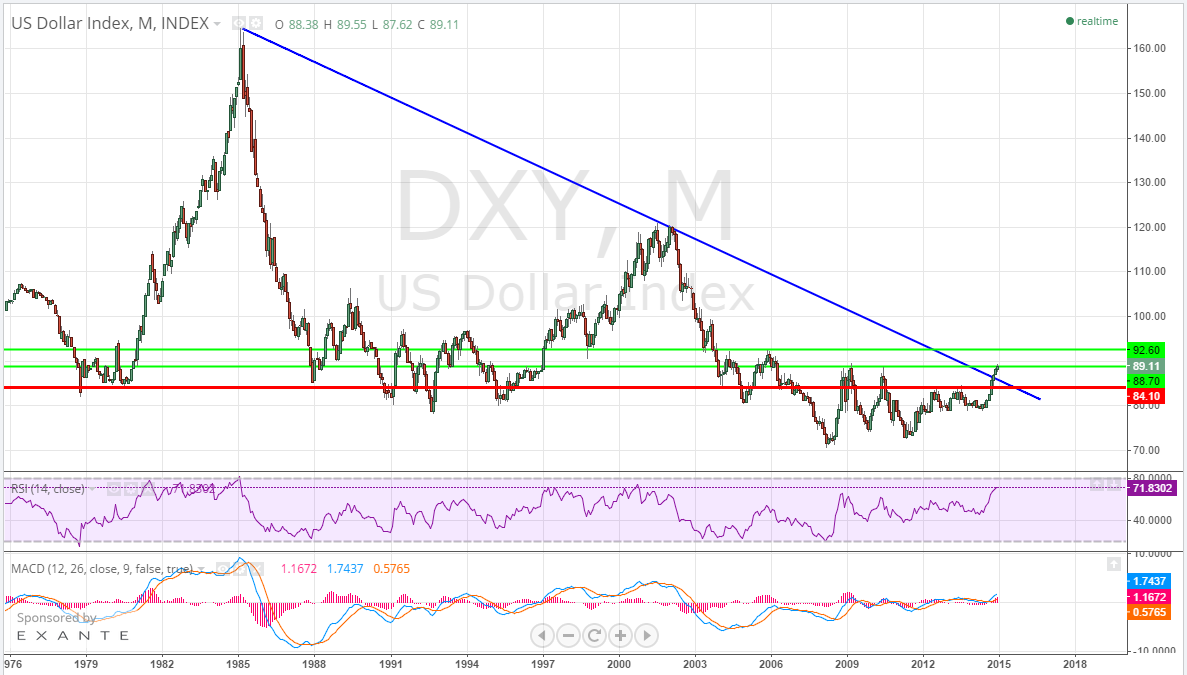

Have a look at the monthly chart for the Dollar Index: there is a 30 years old descending trend line that is finally broken. 90.00 will be the next resistance to watch but it is more like a psychological resistance than a technical one. The first real important resistance to look for is at 92.60 - 92.75 as there is also the 23.6% Fibonacci Retracement of the entire 30 years drop in USD.

In my opinion, by the end of 2015 we could see the 38.2% Fibonacci Retracement reached at 106.40. Do you know what this means for EUR/USD, USD/JPY or NZD/USD? At this moment, unthinkable levels. Please remember that the market is not moving in a straight line so we should see up and downs in USD crosses.

Stocks

Everyone is convinced that the stock market rally from the past few years was mostly driven by the low rates and QE. Most likely this is the truth.However, even if the Fed will raise the rates in mid 2015, they will not make a crazy hike (as for example Russia did a few days ago) but only a tiny 25bps increase. That is not and should not be a shock for the stock market. Besides this, we could see different drivers for a further rally in stocks: the Japan and European QE (I am sure ECB will do it) will still provide cheap money to invest in stocks.

Actually, the biggest pension fund in the world, GPIF already said that they will increase their allocations in stocks and also they will increase their allocations in buying foreign assets (stocks included).

A good reason to continue to buy US stocks is that the US economy is really recovering and this should also be a catalyst for better profits and better returns for the stock investors. Actually, if you look at the futures contract today, they all said "hello" to the FOMC statement and Yellen's press conference, by pushing higher after a few days of declines.

If stock market investors would have been scarred about a rate hike in 2015, the futures contracts today would have to be down not up. However, I would stay away from the European stocks as Europe has a huge exposure to the Russian market and if Russia is to default (I would not exclude it) then Europe will be also in big trouble.

I would also avoid Indexes like Dow Jones because there are many energy companies and I expect the Oil to continue to drop and this will drag a sell off in energy stocks.

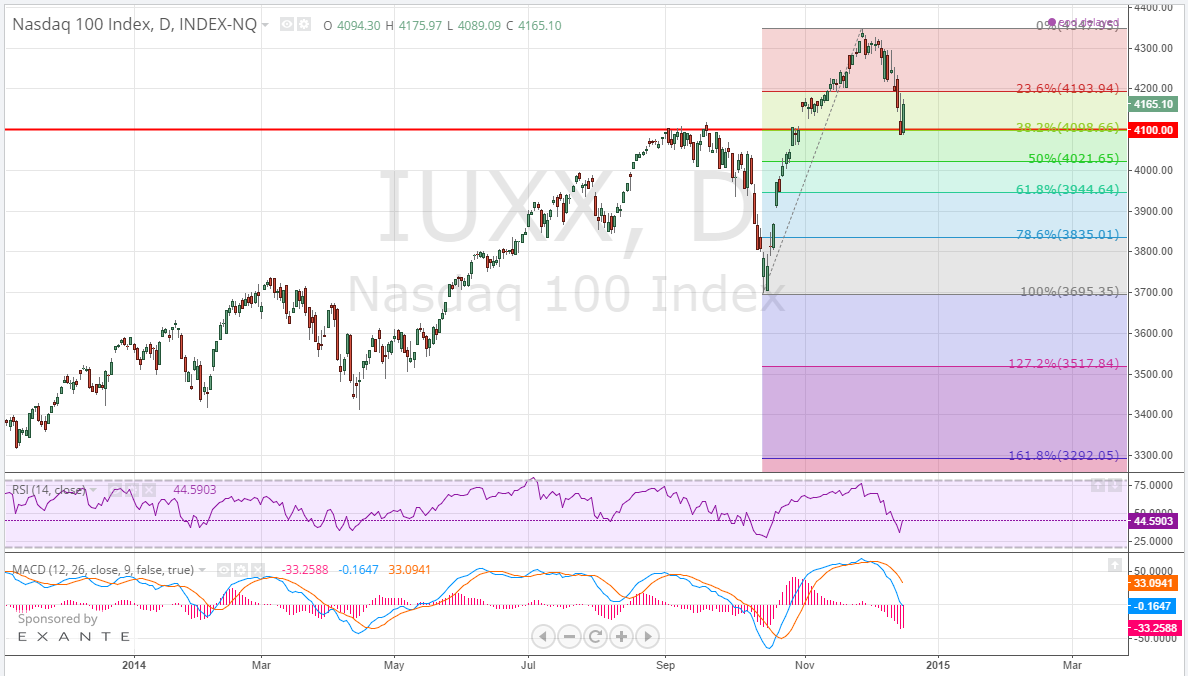

My favorite Index to go long is NASDAQ and in second place would be S&P 500. Have a look at the daily chart below: the line in the sand for Nasdaq was 4100, and also, in the same area is the 38.2% Fibonacci Retracement of the last rally.

That's the perfect level to retrace before attacking new highs and is exactly there where Nasdaq stopped. I am not excluding to see it going a little bit lower also due to global turmoils but I don't think it will fall much more than the 50% Fibonacci. And there is one more thing: on historical base, Nasdaq's peak is at 4800 so there is plenty of room for this index to grow.

If you think that stocks like Apple (NASDAQ:AAPL), Google (NASDAQ:GOOGL), Intel (NASDAQ:INTC), IBM (NYSE:IBM) and many others have more potential to grow than Exxon Mobil (NYSE:XOM), Chevron (NYSE:CVX) or any other energy/oil company, then you stay long Nasdaq for 2015.

Gold

if USD and stocks had the expected behavior after the FOMC, I have to admit that I am surprised by Gold. Going long stocks means that investors are still liking the risk and there is no reason to buy and hold safe havens like gold.

Strong USD should be negative for gold but both these things failed to push gold lower. Personally I don't understand why. Yes, we have a few big risks in the world which could spark a safe haven demand but we had other risks with more or less the same magnitude even in 2013 or 2014 and gold didn't care. Why now?

In my opinion Gold will be very choppy in 2015. Fundamentally, I see no reason why should an investor hold gold in his portfolio. If you want safe haven just buy US Treasuries, they are less volatile and that means less risks while gold can make important damages to your account if suddenly, out of nowhere drops with $30-$40. It happened before.

Anyway, looking at the weekly chart, we see that 1180 was the line in the sand for the yellow metal. This year gold broke that huge support but it failed to continue the drop. A lot of stops were triggered under 1180 and is now trading above 1200$.

The same weekly chart shows that Gold broken a descending trend line and technically is running for new highs. Maybe as long as we have Russia and the Oil crashing on our radar, it is not such a bad idea to buy the dips in gold. Investors like the risk but not a frenetic risk: they could continue to buy stocks and other risky assets but in the same time they want to hedge the risk with gold. 1330 and 1180 will be the lines in the sand in 2015 in my opinion.

If I like the idea to be long USD and Nasdaq for 2015, personally I would avoid to hold gold. I said it and I repeat myself: I think gold will be choppy and while buying it to hedge the risk I would not be surprised to see a $30-$40 crash in one single day.