The Philly Fed's Aruoba-Diebold-Scotti Business Conditions Index (hereafter the ADS index) is a fascinating but relatively little known real-time indicator of business conditions for the U.S. economy, not just the Third Federal Reserve District, which covers eastern Pennsylvania, southern New Jersey, and Delaware. Thus it is comparable to the better-known Chicago Fed's National Activity Index (more about the comparison below).

Named for the three economists who devised it, the index, as described on its home page, "is designed to track real business conditions at high frequency."

The index is based on six underlying data series:

- Weekly initial jobless claims

- Monthly payroll employment

- Industrial production

- Personal income less transfer payments

- Manufacturing and trade sales

- Quarterly real GDP

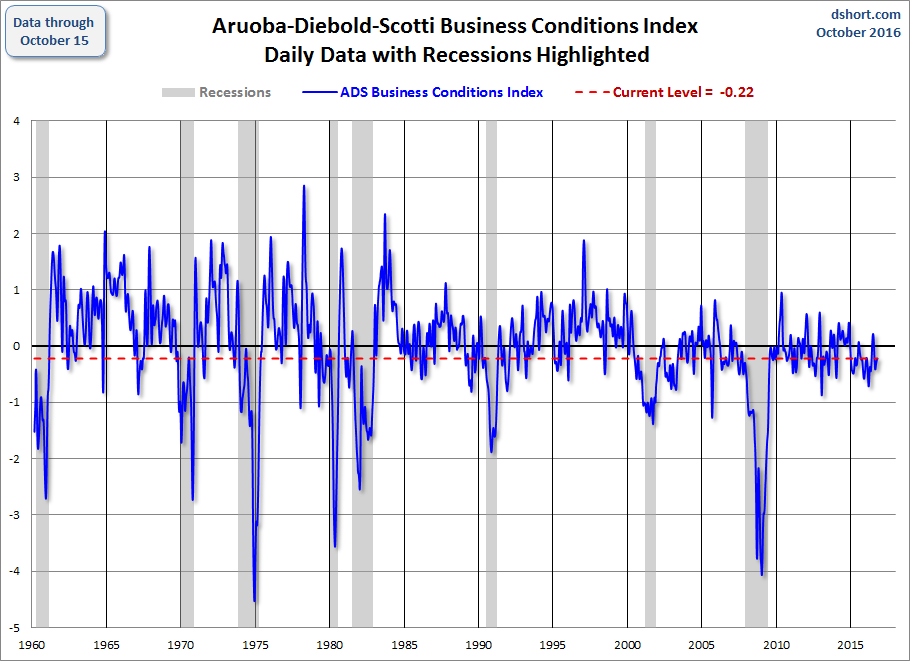

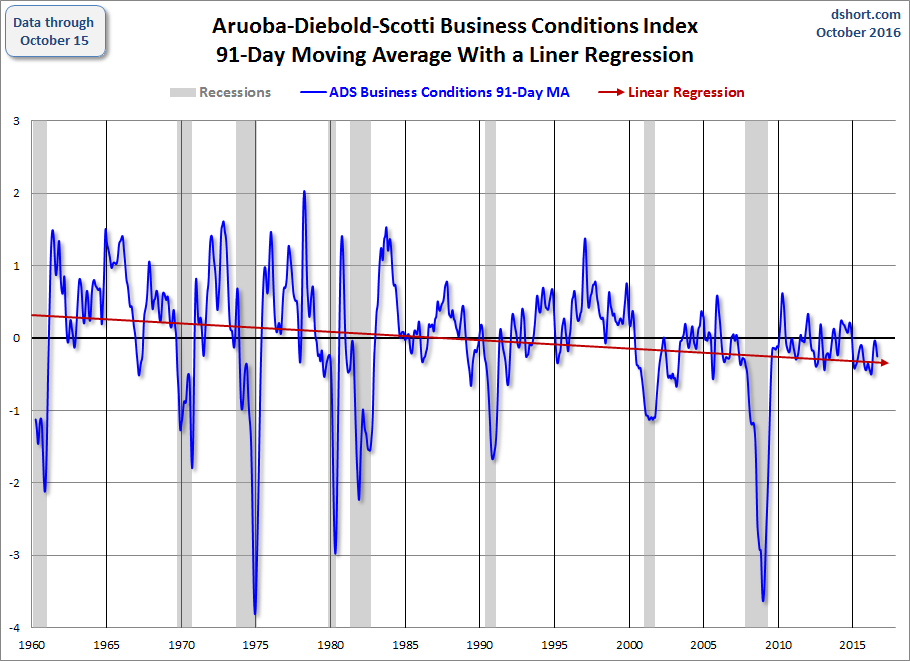

The accompanying commentary goes on to explain that "The average value of the ADS index is zero. Progressively bigger positive values indicate progressively better-than-average conditions, whereas progressively more negative values indicate progressively worse-than-average conditions."

The first chart shows the complete data series, which stretches back to 1960. We've highlighted recessions and the current level of this daily index through its latest data point.

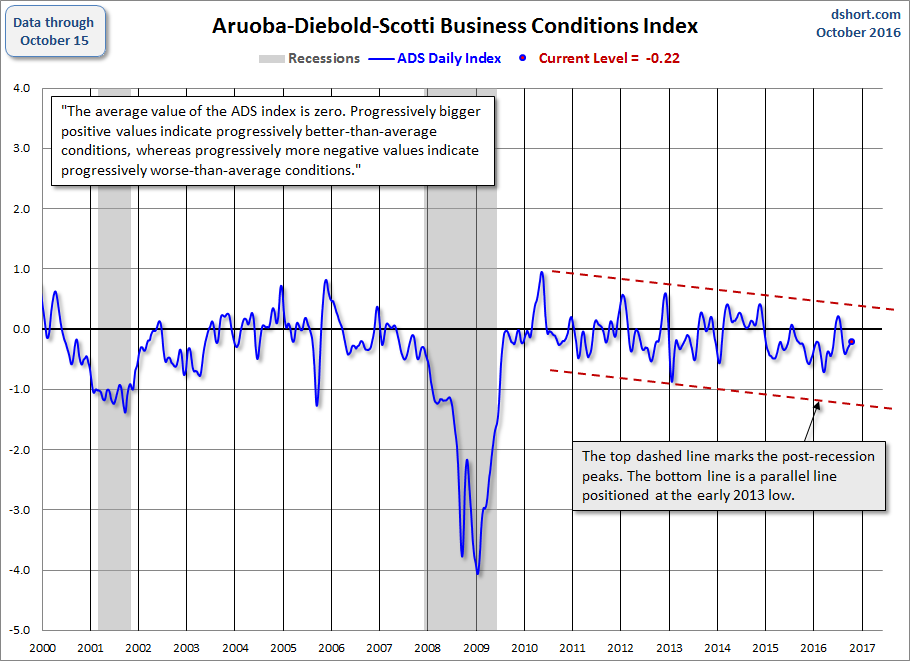

Now let's take a closer look at the 21st century daily index. We've added a pair of dashed parallel lines highlighting a high-low channel since 2010. Our purpose was to give a better sense of direction for the economy. The top dashed line marks the post-recession peaks. The bottom line is parallel to it and positioned at the early 2013 low. The latest data point is fractionally below the upward trend. It will be interesting to watch this indicator over the next few weeks to see if it breaks out of the six-year channel.

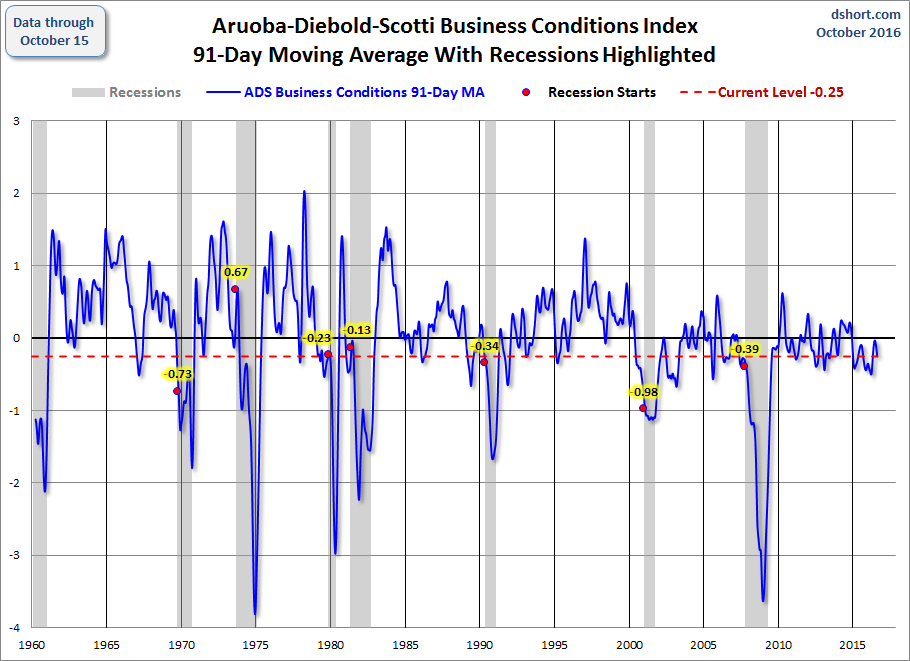

A Smoothed Look at the ADS Index and Recessions

The chart below features a 91-day moving average of this daily index. Why 91 days? The better know cousin index of the Philly Fed's ADS the Chicago Fed's National Activity Index. The CFNAI is updated monthly, but the metric that gets the most attention by the Chicago Fed economists is its three-month moving average. They've even coined an acronym for it, the CFNAI-MA3. Thus we've used 91 days as a comparable smoothing of the Philly Fed ADS index. In the ADS 91-day MMA chart below we've highlighted recessions and the value of the smoothed index at recession starts.

A Comparison with the Chicago Fed's National Activity Index

Now let's compare the Philly Fed's Business Conditions Index with the Chicago Fed's National Activity Index (CFNAI), which reaches back to March 1967. (See also our latest monthly update for the CFNAI here.) The CFNAI is based on 85 economic indicators from four categories:

- Production and income

- Employment, unemployment and hours worked

- Personal consumption and housing

- Sales, orders and inventories

For a close look at the four components, see this monthly update.

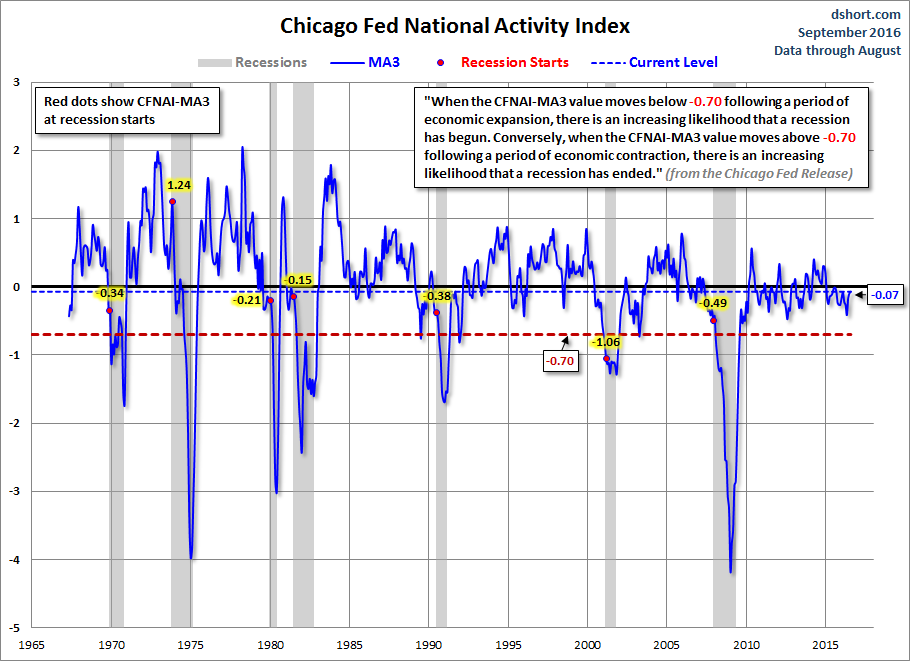

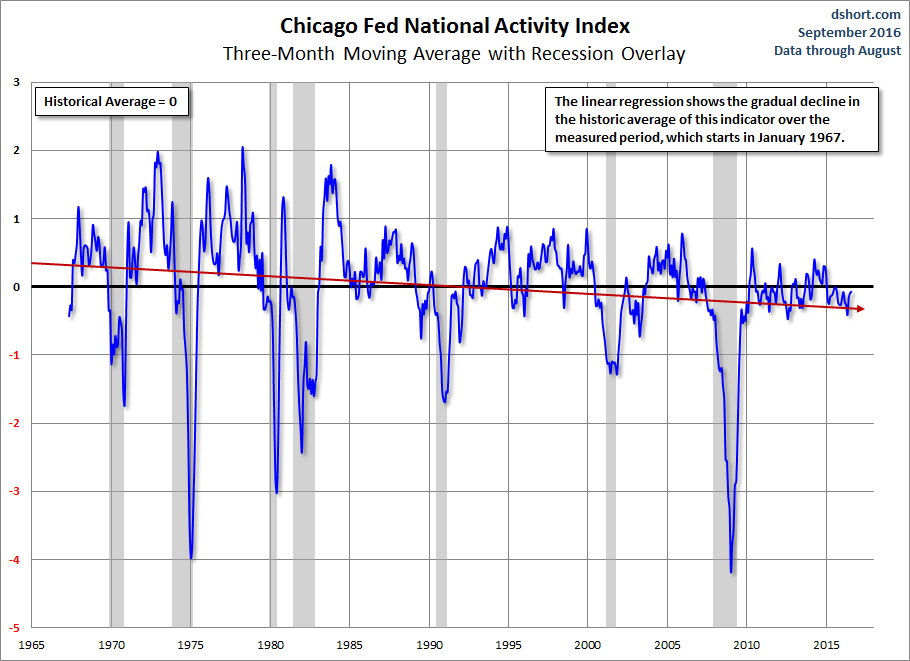

Here is the afore-mentioned CFNAI-MA3.

Even the most cursory examination shows the reasonably close correlation of these two indicators of the general economy. Moreover, the recession overlays for both also confirm their general accuracy in illustrating major economic downturns over the last few decades. Of course, these aren't real-time calls, because both are subject to rather extensive revisions.

The next chart reveals a trend in the ADS index — one that might not be obvious at first glance. Let's let Excel draw linear regressions through the data series.

Compare the slope of the regression with its counterpart in the CFNAI-MA3.

<

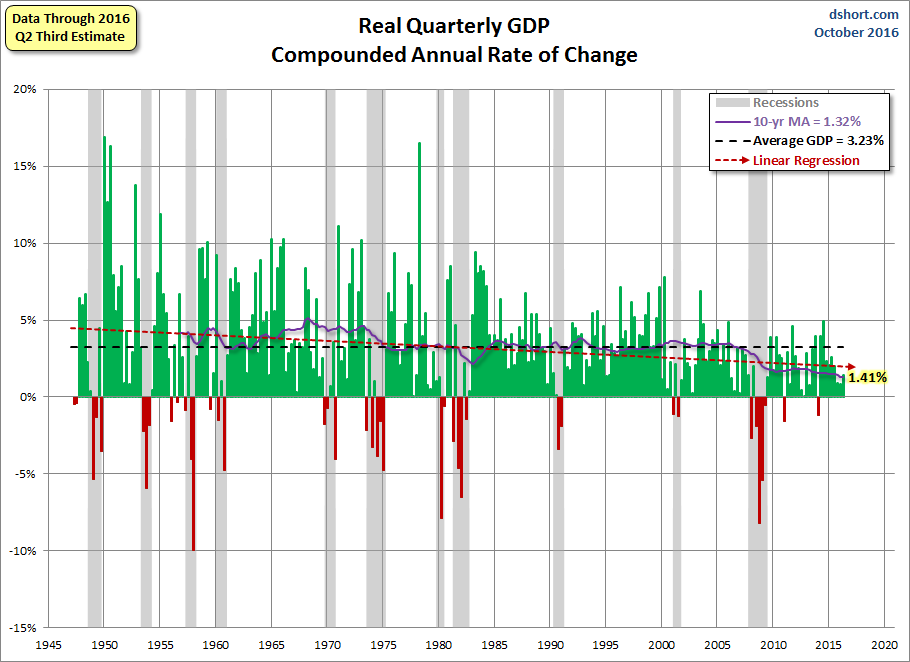

This chart duo indeed tells us something about the long-term trend toward slowing growth in post-industrial economy of the United States. In fact, we see a similar trend in real GDP as illustrated by both the moving average and linear regression in the chart below.